Will Mortgage Brokers Survive, Or Only Bankers?

The ceaseless debate among mortgage originators for the past 18 months has been about which origination model will survive. There are three channels to originate: (1) retail, which is a consumer going to a traditional bank to get a mortgage, (2) correspondent, which is a consumer going to a mortgage bank to get a mortgage, and (3) wholesale, which is a consumer going to a mortgage broker to get a mortgage.

All three channels are related because a big bank like Wells Fargo for example, is involved in all three. Consumers can walk in the front door, or they can work through a mortgage bank that will close the loan and sell it to Wells, or the consumer can go through a broker that places their loan with Wells.

Retail means reliable underwriting but lack of product and price flexibility. Correspondent also has reliable in-house underwriting and brings the consumer a one-stop shop for multiple products and pricing. Wholesale gives the broker no underwriting control but does give the consumer the one-stop shop.

Just about everyone but wholesale originators think that wholesale won’t make it through this crisis. The argument goes: you can’t control fraud and loan quality with a broker sales force, and brokers have no loyalty to their wholesale banks because with the market shifting all the time, brokers will just abandon loan locks with one bank and go to another. This might help a consumer if a rate drops during a lock period, but if a bank can’t rely on their lock pipelines, they just offer higher pricing to brokers.

For example, Wells Fargo retail and correspondent rates are often lower than wholesale rates because they don’t lose as much money on dead locks like they do with wholesale. The reason is because they have controlled sales forces. Retail originators have softer lock renegotiation policies if rates drop on locked loans. Correspondent originators have renegotiation policies and also have the ability to hedge locks among multiple lenders under one roof.

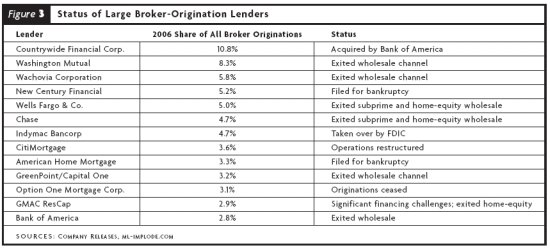

A Mortgage Banking Magazine from October 2008 said that Wholesale won’t die but will just evolve. Yet look at this chart from the piece, showing that 63.4% of the largest wholesalers are mostly gone or exiting from wholesale:

This debate will never die, and as one major Bay Area brokerage firm owner told us a few months ago: people have been saying wholesale will die for the past 20 years, yet it’s still here.

A good point by a good salesman. But it’s in a market and regulatory environment that’s going through changes we haven’t seen in 75 years.