Core PCE +0.1% August and +1.3% YOY, Inflation OK. Savings at +3% As Consumers Loosen Up Slightly.

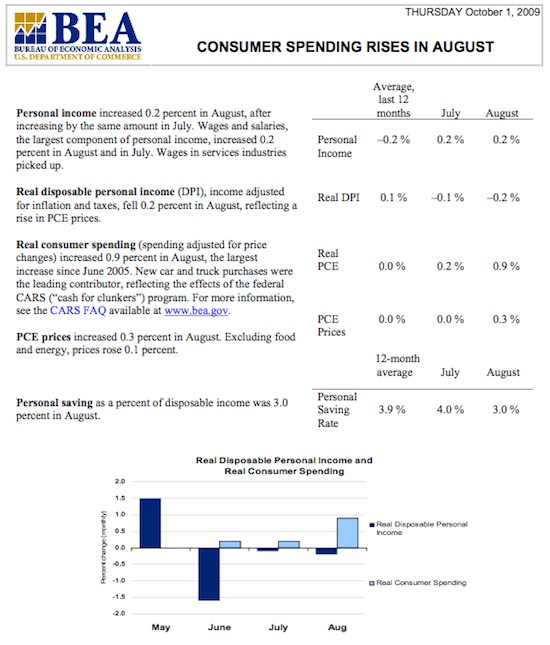

Overall Personal Consumption Expenditures, the Fed’s favorite measure of consumer inflation, were 0.3% in August and -0.5% year-over-year through August. Excluding volatile oil and food costs from the readings, “Core” PCE price index for August was +0.1% and +1.3% YOY through August. The Fed looks closely at Core PCE excluding food and energy prices because of the price volatility of these two items, and the Fed’s zone for reasonable inflation is 1-2% per year. At +1.3%, Core inflation is within their comfort zone, especially since Fed chairman Ben Bernanke confirmed tame inflation two months ago and since this month is the third straight month to show a drop. Personal income increased 0.2 percent in August, after increasing by the same amount in July and falling 1.1% in June. Households have stopped hoarding as much cash bringing the Personal Savings Rate to 3%. This is off from last month’s figure of 4.2% and May’s all-record savings rate of 6.9%. The average savings rate for the last 12 months is 3.9%. Below are all key details from the Personal Income & Outlays report.