Core PCE Unchanged January and 1.4% YOY, Inflation Subdued. Savings Rate Decreases to 3.3%.

Overall Personal Consumption Expenditures, the Fed’s favorite measure of consumer inflation, were 0.2% in January and 2.1% year-over-year through January. Excluding volatile oil and food costs from the readings, “Core” PCE price index for January was unchanged and 1.4% YOY through January. The Fed looks closely at Core PCE excluding food and energy prices because of the price volatility of these two items, and the Fed’s zone for reasonable inflation is 1-2% per year. At 1.4%, Core inflation is within their comfort zone, as confirmed by the Ben Bernanke’s remarks last week that inflation is likely to be subdued for some time, and the fact that PCE inflation has been stable since summer 2009.

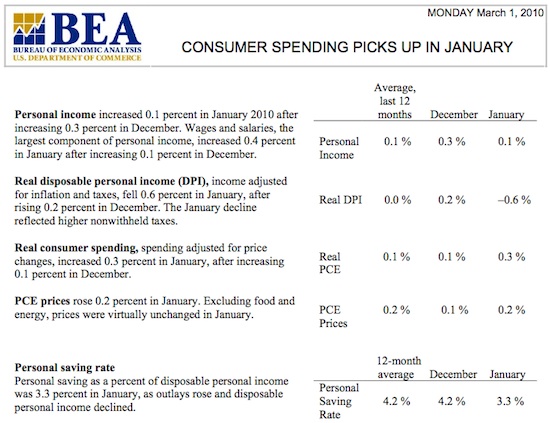

Personal income increased 0.1% percent in January, and wages were up 0.4% since December. The household savings rate dropped from 4.8% to 3.3% but not due solely to consumer spending. The larger reason for less savings is from a 0.6% decrease in disposable income (which is income adjusted for inflation and taxes). The 12 month average savings rate is 4.2% which is well below the May 2009 all-time record of 6.9%. Below are all key details from the Personal Income & Outlays report.