Fed Rate Stimulus Ends March 31. Impact On Mortgage Shoppers.

As most know from our weekly coverage over the last 64 weeks, the Fed has been using a $1.25 trillion budget to buy mortgage bonds since January 1, 2009 in order to elevate mortgage bond prices and push rates down. Rates are 1.125% lower than they were when the program was announced, and the Fed will use up it’s final $3b next week, then the program is over. Below is more information on what this means going forward.

Rates rose about .2% last week, so any quote a mortgage shopper received before March 23 will be higher now. This rise came from overall bond market panic about the ability of governments to meet future bond repayments. This started with worries about Greece and Portugal, then spread further in Europe and there’s been ongoing rumors about whether ratings agencies will downgrade America’s AAA credit ratings. Mortgage bonds sold off and rates rose on this sentiment as well as paltry performance on new Treasury auctions. We’re now about .375% above all-time record lows and could move higher.

Will Rates Spike Now That The Fed Is Done Helping?

The record rate low set on November 25, 2009 is very likely to remain the record low. Below is an excerpt from a February post that answers the question of where rates may go by summer and why:

Rates on loans up to $417,000 are about 5% as of mid-February, and rates could rise as much as .5% by summer for three macro reasons: (1) The Fed will end it’s $1.25t mortgage bond buying program March 31, and then we’ll likely see profit taking on mortgage bonds as private investors sell, which pushes prices down and yields, or rates, up; (2) An improving economy and resulting inflationary fear will cause mortgage bonds to sell off because inflation eats up bond returns, so this would also push bond prices down and rates up; and (3) Inflation will cause the Fed to start hiking short rates from current near-zero levels. Global investors currently borrow on these short-term rates to buy long-term securities with higher returns. When short rates rise, it will erode the benefit of this interest rate trade and force selling of long-term securities—including mortgage bonds—to repay short-term loans. That selling will also push rates higher.

Also the last section of this piece addresses why mortgage rates are going to continue to be very volatile.

What’s The Bottom Line For Consumers Seeking Mortgages

If you’re waiting to refinance, your window is closing. If you’re looking to buy a home, rates are important, but a good home price is more important. So buyers shouldn’t let the rate market dictate their strategy—the price and quality of the home should be the driving factor.

Visit this link for more on how to lock a rate in a volatile trading environment.

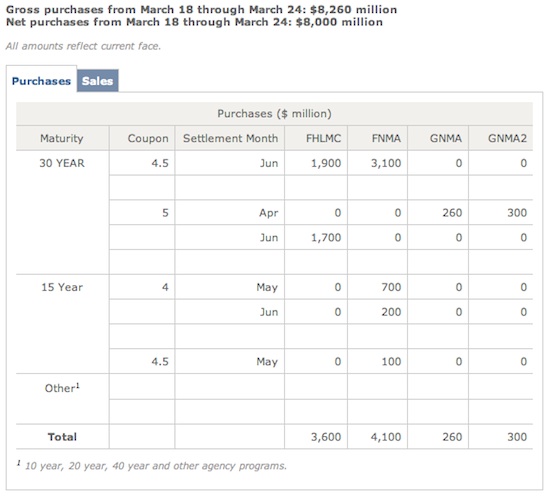

Tally Of Mortgage Bonds Bought By Fed

The Fed, according to their own reporting, has bought $1.247t net of mortgage bonds, which is 99.76% of their allotted $1.25t target by March 31, 2010, so we’ve got about $3b left for the Fed to buy next week, and the official Fed report will be released Thursday, April 1. This count isn’t an official number, it is a close tally The Basis Point has kept of weekly net MBS purchases since the Fed began buying in January 2009. Here’s the current and detailed report of the Fed’s MBS holdings.

Conflicting Factors Create Big Rate Volatility

Most estimates call for 40-50% less loan originations in 2010 vs. 2009 so even with the Fed stopping it’s mortgage rate support next week, there may be less to buy. So this may prevent rates from spiking too much, but the real question is whether private market participants will reengage in mortgage bond markets.

The Fed mortgage bond buying program was designed to help MBS markets thaw and create confidence in the market. This is absolutely critical For housing and the overall economy to generate self-sustaining recovery, and there must be a private MBS market that’s not reliant on the government as a core participant.

Lots of fear comes from whether the underlying loans will perform well, and even though the underwriting standards for those loans are strict, markets are still jittery and there’s also concern about whether home prices will hold and keep consumers interested in paying their mortgages.

As markets sort through these inputs, rate volatility will continue. Last week proved that point once again. Mortgage bonds traded in a wide range of about 150 during the week and closed the week net down 65bps. This translates into rates that are about .2% higher on the week.