Quantitative Easing 101 (part 4): Consumer Q&A, Timeline, Rate Chart

Quantitative Easing is one of the most used financial phrases of 2010 so homeowners and buyers need to know what it means. The core definition is simple: it’s when the Fed buys bonds to lower rates. More explanation is needed to understand rate and housing market implications, so below is a Q&A addressing this technical topic in simple terms. And here are previous installments of our Quantitative Easing 101 series:

What Is Quantitative Easing (QE)?

QE is when the Fed buys bonds to lower rates. It was introduced in the U.S. during the heat of the financial crisis in late-2008 as a way to stimulate a severely ailing economy.

Why does buying bonds lower rates?

A bond’s price and yield (or rate) move inversely, so when bond prices rise in a QE buying campaign, rates drop. It must also be noted that the reverse happens: when bond prices drop in a selloff, rates rise.

How does QE help mortgage rates?

The Fed engages in two kinds of QE: Treasury bond buying to lower overall rates in the economy, and mortgage bond buying to lower home mortgage rates. The Fed spent $1.25 trillion buying mortgage bonds from January 2009 through March 2010 which helped 30yr fixed rates to drop 1% during this period: 30yr fixed rates dropped from 6% to 5%.

Does QE disrupt normal rate market activity?

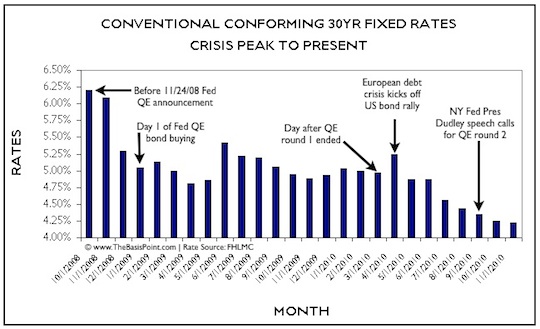

Yes. The aforementioned $1.25t mortgage bond buying campaign was announced by the Fed November 24, 2008. If you look at the accompanying chart, you’ll see November 1, 2008 rates were just above 6% before the Fed announcement. You’ll also see that rates were just above 5% by January 1, 2009, before the Fed spent one dime buying mortgage bonds. This entire 1% rate drop was from private investors buying mortgage bonds, not the Fed.

So QE did nothing to lower rates?

The mere announcement that the Fed would buy mortgage bonds caused the market to rally ahead of actual fed buying, and this brought rates down.

Why buy mortgage bonds before the Fed?

The goal of every investor is to buy a security that’ll appreciate so they can sell for a profit. When the Fed said they’d be bidding up mortgage bond prices in November 2008, big global investors put billions into mortgage bonds knowing the Fed would be a massive buyer behind them. The question for private mortgage bond investors was, and still is, when to sell.

Did rates drop more after the Fed started QE?

No. Rates were 5% rates as of the January 1, 2009 QE start date. On the chart, you’ll also see 5% rates as of March 1, 2010, the last month of QE. And you’ll see rates rose as of April 1, 2010 because many investors sold mortgage bonds (to take profits) when the Fed’s QE program ended.

Then why does the chart show rates dropping since May 2010?

Rates drop on bond rallies, and bonds have rallied since then for three reasons: (1) A European debt crisis caused global investors to sell European bonds and reinvest in U.S. mortgage and Treasury bonds, (2) the U.S. economy started stumbling again so investors have sought safety in bonds, (3) bond investors think the Fed will announce a second round of QE on November 3.

Would more QE bring rates down further?

Not likely. Markets have already bid up mortgage bonds in anticipation of QE round two following an October 1 Fed speech, and as we saw from the first round, the rate impact of anticipated QE was felt before the Fed spent one dime buying bonds. The same thing is happening again, and current rates most likely already reflect any future QE impacts.

So what is the rate outlook from here?

In the next 3-6 months, we think rates will rise or stay in their current range. Investor rationale for holding mortgage bonds is that there are no better alternatives in a globally unstable market—if they do hold, rates will stay in their current record low range. Investor rationale for selling mortgage bonds is that QE round two is the perfect opportunity to sell at a profit while the Fed again props up prices artificially—if investors do sell, rates would rise. And of course the Fed’s rationale for another round of QE is to help the economy improve. If it works (or if the Fed doesn’t do QE round two at all), that’s more rationale for investors to sell mortgage bonds at a profit and seek new returns elsewhere, which would also push rates up.