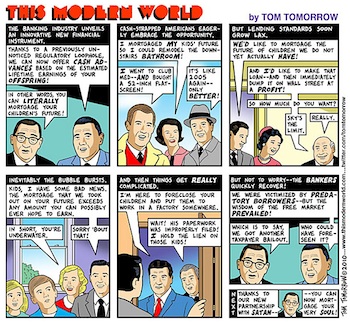

Rates Down But Extremely Volatile. No Equity To Refi? Just Mortgage Your Kid! (CARTOON)

Rates Better But Extremely Volatile

Rates are better by about .125% today vs. Friday. This morning’s home price report showed a big decline and this plus ongoing worries that Portugal and Spain will soon be next to need a rescue package following Ireland and Greece have caused mortgage bonds to rally (which brings rates down)—but it’s hard to say how long mortgage bonds will benefit from bad news in Europe. Most believe that mortgage rates will chop around at these levels for some time, but it won’t come without some gut-wrenching volatility for consumers who choose watch the market instead of locking in rates.

Mortgage Your Kid!

Mortgage Your Kid!

It’s been a tough few years for home prices and the days of refinancing endlessly to get more and more cash are over. But why not borrow against your children?! Here’s a good comic from Salon on the topic.

Mortgage Employment Down 54%

Mortgage industry employment fell 54% in the third quarter of the year, the first downturn in nearly a year. Total mortgage industry employment was estimated at 246,000, less than half the 535,400 government figures reported at the industry’s peak in October 2005.

Banks Holding Line on Buying Loans Back

What if Freddie or Fannie wanted you to buy back a loan, and you didn’t? I guess we’ll see. So far banks are resisting buyback requests from Fannie and Freddie.

Wells Fargo Letter On Who Should Retain Loan Risk

A reader wrote in about the 5% risk retention proposals. “Wells Fargo is are pushing to have any loan with an LTV that’s greater than 70% to be considered not eligible for exclusion from the risk retention rule. The letter also suggested other provisions, including warranties on early payment defaults and a 5% vertical slice for risk retention that be held in trust. The company realizes that this would favor those with capital and ‘hose’ those without – Wells has capital.” Here is a copy of the letter.