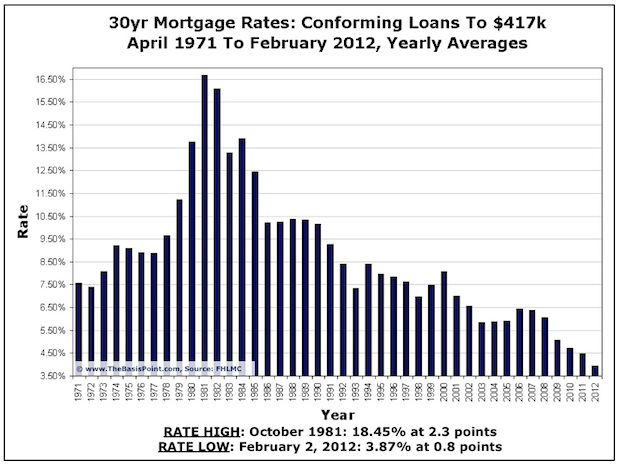

Mortgage Rate Chart: 1971 to Present

This chart is the latest on rates. The 2012 bar is yearly average through today, which is 3.9% with 0.8 average points. Points are fees as a percentage of loan amount used to “buy the rate down.” Points are on top of normal closing costs associated with a loan transaction.

Rates have traded lower than this 2012 average at very brief intervals in the past two weeks, but are creeping up for now.

These rates are for loans to $417k on owner-occupied single family homes with at least 20% equity and perfect credit. Here’s a weekly snapshot with more disclosures.