Linkage: 5 PART HOUSING SERIES – Ritholtz

Today’s Originations linkfest is solely focused on a 5 part housing series written by money manager Barry Ritholtz a couple weeks ago. Required reading for mortgage and housing watchers.

–PART 1: Debunking The Housing Recovery Story

–PART 2: Home Affordability Reality Check

–PART 3: The Problem With Home Prices

–PART 4: Foreclosures: A Decade Long Overhang

–PART 5: Fear of Buying: The Psychology of Renting

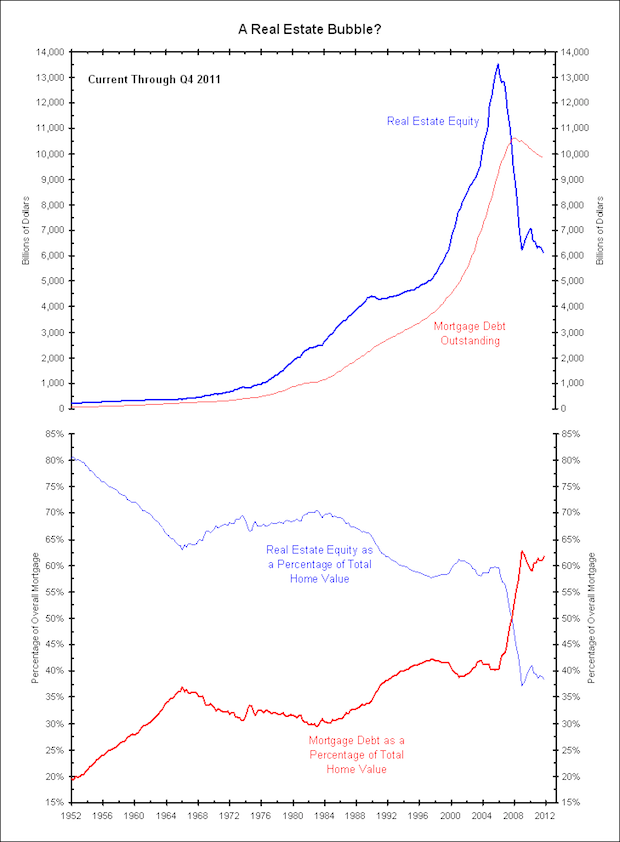

And as a bonus, Barry also posted a Bianco Research piece during the housing series on why foreclosures could still drive home prices lower. Here’s an excerpt and chart from the piece:

A 5% drop in home prices from current levels would likely push all the near-negative equity homes into the negative equity camp. In other words, a 5% decline in housing would mean at least 27% of homes would be underwater. A 10% decline, as predicted in the story above, would probably put one third of all mortgages underwater.

___

Follow The Author:

@Ritholtz: Twitter | Stocktwits

$XHB, $ITB, $DHI, $RYL, $LEN, $HD, $LOW