GDP Goes Negative. Jobs Better. Rates Up.

Rates up again after this morning’s data summarized below. And rates may rise more.

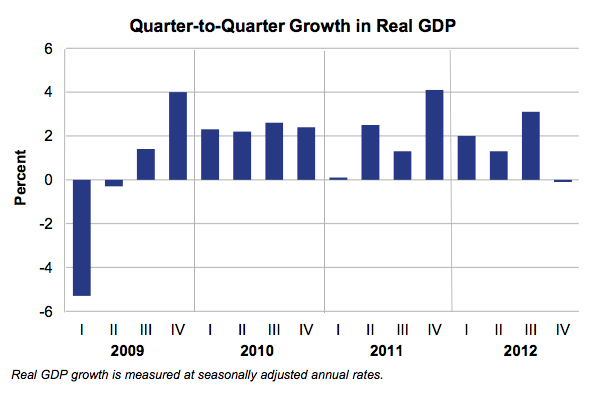

GDP (4Q2012)

First of three 4Q2012 GDP readings was -0.1%. This is Seasonally Adjusted and Annualized.

While surprising to many but well forecast by Consumer Metrics Institute which saw a sharp drop in consumer spending right after Thanksgiving.

Final Sales of Domestic Goods was +1.3% annualized. Government Spending was -6.6% presumably because, anticipating the fiscal cliff, many purchases were pushed into the 3Q2012.

While somewhat confusing this report is weak. What is more impressive is that the equity and fixed income markers are not reacting to this. People are buying equities as if all is fine and there is no flight to quality buying of Treasuries. Perception is everything.

Full report here and chart of recent GDP history below.

ADP Private Jobs (January 2013)

– +192,000. Previous revised down from +215,000 to +185,000.

– Full report/charts here and chart of recent ADP jobs history below.

– This is a precursor to Friday’s official January BLS jobs report. Estimates call for 160k new nonfarm jobs added vs. 155k added in December.

MBA Mortgage Applications (week ended 1/25/2013)

– Purchase Index – Week/Week -2.0%

– Refinance Index – Week/Week -10.0%

– Composite Index – Week/Week -8.1%

– All data has been volatile week to week but soft lately. We can count on the refi index getting worse as rate spike continues.