Rate Reaction To September Jobs Report (CHARTS)

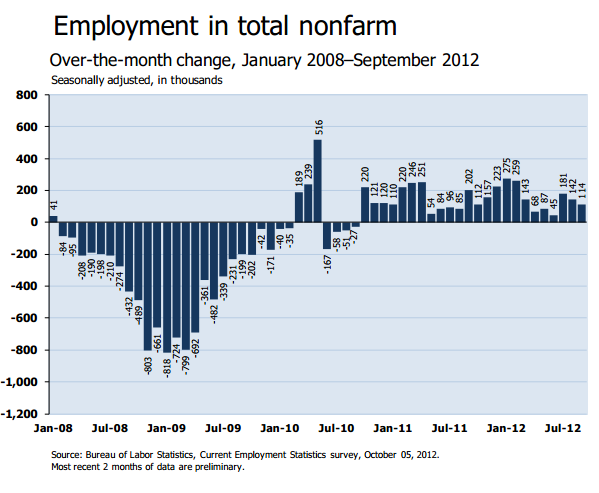

Rates are about even today after a BLS report showed the U.S. economy added 114k nonfarm payrolls in September. This is a rather weak number, but August was revised up from 96k to 142k,

and July was revised up from 141k to 181k.

These revisions make the last six months in the chart above look a lot less bad.

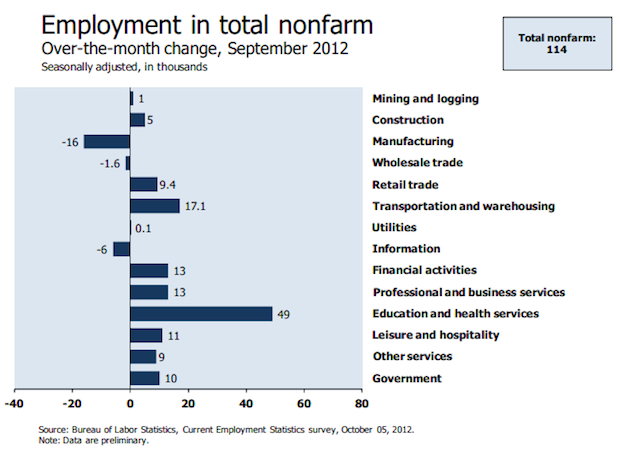

This non-farm payrolls figure is from the ‘Establishment Survey’ component of the jobs report which doesn’t count actual people, but rather counts how many companies opened or closed, then uses that data to estimate the number of jobs gained or lost.

Unemployment dropped from 8.1% to 7.8%, the lowest level since January 2009, according to a different component of the jobs report called the ‘Household Survey’ which counts people. There are 12.1 million people unemployed, down 456k in September.

RATE REACTION

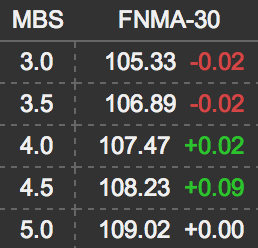

Rates rise when mortgage bond (MBS) prices drop on a selloff, and this is what happened the last two days and even this morning as an initial reaction to the jobs report.

Rates rise when mortgage bond (MBS) prices drop on a selloff, and this is what happened the last two days and even this morning as an initial reaction to the jobs report.

But now MBS are back to even. This table* shows that we’re pretty close to par on the day for all key Fannie Mae 30yr MBS coupons that lenders use to price consumer rate sheets.

Still, the MBS selloff from Wednesday and Thursday puts rates about .125% higher for the week.

Here’s a deeper dive on September jobs report, and more good links below.

___

Reference:

– BLS September Jobs Report

– Great Jobs Report Summary From CalculatedRisk

– $MBB, $TLT, $ZN_F, $TNX, $MACRO

*Table used with permission from MortgageNewsDaily