Americans are wrong about 2019 being a bad time to buy a home. Or is the media wrong?

Mortgage giant Fannie Mae tracks how people feel about the housing market, and while this dataset is important and useful, their January 2019 update (from a December consumer survey) leads people to think housing market confidence is worse than it is. This was their headline in this week’s release:

– Housing Confidence Down as More Americans Believe It’s a Bad Time to Buy a Home

Fannie is the backbone of the U.S. housing market, so it’s not surprising the media didn’t stray far from this headline. Here are some samples, and I’m not citing sources to protect the guilty:

– More Americans think it’s a bad time to buy a home

– Homebuying sentiment falls to national survey low

– Rising prices drop consumers’ view of housing to 2018 low

These are all from friends in the media but they’re guilty on this one nonetheless.

Why? Because when you dive into the data, those headlines are wrong about sentiment. Let’s break it down.

+++

Here are the numbers that caused even Fannie to lead with this headline:

In a single month, the percent of people who said it’s a good time to buy dropped from 57% to 52% and the percent who said it’s a bad time to buy rose from 34% to 41%. It’s a sharp monthly drop indeed.

In addition, the percent of people who think the economy is on the right track dropped from 53% to 50% and the percent who think economy is on the wrong track rose from 37 to 40%. Not as sharp of a monthly change, but combined with the good time vs. bad time to buy stats, it’s something to watch.

+++

As for home price and mortgage rate sentiment, they barely changed in the month: 45% of people think home prices will go up next 12 months vs. 14% of people who think they’ll go down, and 61% of people think mortgage rates will rise next 12 months vs. 5% who think they’ll go down.

In the homebuyer trenches (as opposed to a survey), when people think home prices and rates will go up, that skews them toward buying.

+++

The dynamic between rent and buy perception is most interesting: 58% of people think rental prices will rise next 12 months, 33% think they’ll stay the same, and 3% think they’ll go down.

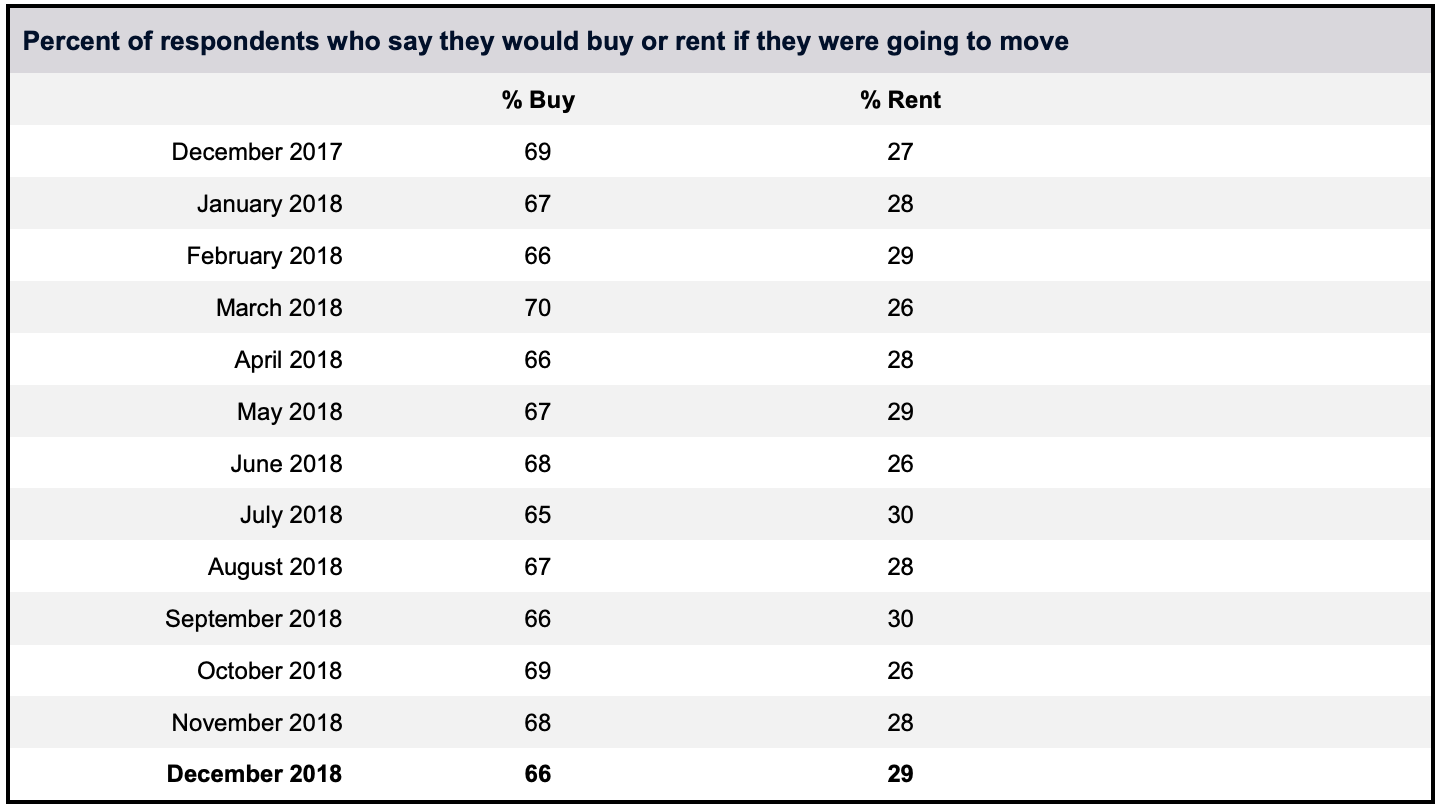

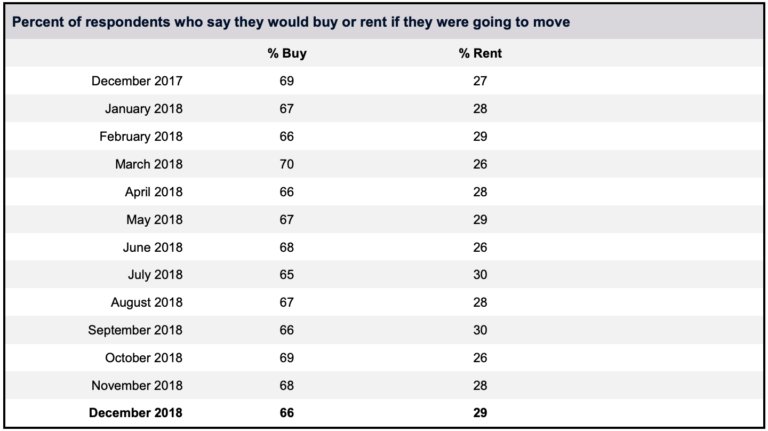

And if they were going to move, 66% said they’d buy a home, and 29% said they’d rent. Hard to argue against this being a strong display confidence in home buying.

+++

Barely changed for the month (and the change was for the better) is people’s strong confidence in their job situation, with 89% not concerned about losing their job and 10% concerned.

Also only 12% think their personal financial situation will get worse next 12 months, while 48% think it’ll get better (down from a majority 51%) and 38% think their financial situation will stay the same.

+++

So Let’s Recap:

– There was a big monthly increase in people who think 2019 is a bad time to buy a home, but there’s still a majority (albeit slight) who thinks 2019 is a good time to buy a home.

– The rest of the stats are steady on how people what people think about 2019: home prices will rise, their job is safe (despite feeling slightly less confident about the economy), and their financial situation will be the same or better.

– If they were going to move, a strong majority said they’d buy instead of rent a home.

As For The Rate & Home Price Outlook:

– Rates are actually more likely to go down as we move into recession territory late-2019.

– And home prices will probably in fact rise, just at a slower pace. But this is all localized and you have to talk to your local real estate agents to get precise market information to make good decisions here.

– One thing is certain: when home price appreciation and home sales slow, sellers get nervous, and buyers get their way in negotiations.

– So your property search is your driving force, not rates. You can control how you select your dream home, you can’t control what rate markets will do day to day. And it’s simple to refinance if rates drop after you close. Ask your lender to brief you on how this works.

The Line Between Home Buying Headlines & Actual Home Buying:

There’s an ocean of data and headlines about sentiment and economic activity to get lost in every day, week, and month. But there are still six million homes sold in the U.S. each year (about 90% existing homes and 10% new homes), and this activity happens regardless of headlines.

That’s why, for more than a decade, we’ve chosen to speak to (and highlight relevant data for) these people who are trying to make buy and sell decisions on the ground, not gaze at headlines and ponder macro-economics. This year, we’re doubling down on this approach, and hope you continue to check back—see follow options bottom of site.