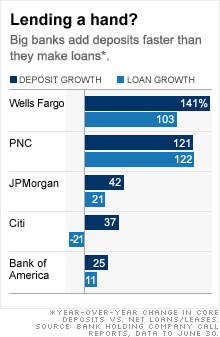

Big Bank Deposits Outpace Loan Growth (graphs). What Does ‘Too Big To Fail’ Mean?

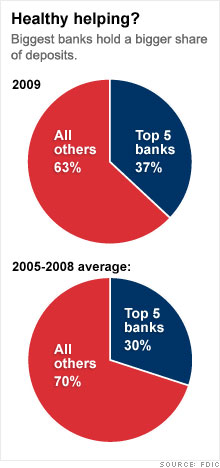

Fortune reports that big bank deposits have outpaced loans in the year ended June 30, 2009. These two graphs from the story show loan/deposit stats among top banks and market share of deposits for big vs. rest of banks—also below are key stats from the story. This isn’t to say it’s all Evil Banker Greed, and this story eventually acknowledges that loans typically drop off during a recession and we also know that Personal Savings has risen significantly during the recession.

Fortune reports that big bank deposits have outpaced loans in the year ended June 30, 2009. These two graphs from the story show loan/deposit stats among top banks and market share of deposits for big vs. rest of banks—also below are key stats from the story. This isn’t to say it’s all Evil Banker Greed, and this story eventually acknowledges that loans typically drop off during a recession and we also know that Personal Savings has risen significantly during the recession.

But it’s certainly concerning that the concentration of deposits among large banks is larger now than in the years leading up to their TARP-worthy “too big to fail” designation by government. We can’t forget that the two big investment banks that didn’t fail in Fall 2008 were also granted commercial bank status. The reason at the time was to give them access to TARP, the Discount Window and other government assistance, but now they are trading firms that could take deposits if they wanted to. Now all big commercial and investment banks have trading and investment banking operations—the repeal of Glass Steagall in 1999 is what allowed traditional banking and investment banking activities to happen under one roof.

So the big question is whether this mix is what makes a bank too big to fail. The ‘counterparty risk’ inherent in global trading of all types of securities—especially more arcane securities like credit insurance or those tied to subprime mortgages—is what drove the too-big-to-fail designation in the heat of crisis. The logic was that if one firm failed, all the other firms tied to that firm’s positions would potentially fail too. Regulating derivatives like credit default swaps is a good start so at least everyone knows the CDS positions of other firms (this $60t market was privately traded and unregulated from 2000 on). But the other part will have to be considering the breakup of commercial and investment banking operations.

So the big question is whether this mix is what makes a bank too big to fail. The ‘counterparty risk’ inherent in global trading of all types of securities—especially more arcane securities like credit insurance or those tied to subprime mortgages—is what drove the too-big-to-fail designation in the heat of crisis. The logic was that if one firm failed, all the other firms tied to that firm’s positions would potentially fail too. Regulating derivatives like credit default swaps is a good start so at least everyone knows the CDS positions of other firms (this $60t market was privately traded and unregulated from 2000 on). But the other part will have to be considering the breakup of commercial and investment banking operations.

Deposits at the top five bank holding companies soared 29 percent in the year ended June 30, according to the Federal Deposit Insurance Corp. Yet only one of those banks — PNC (PNC) of Pittsburgh — boosted its lending by the same magnitude, according to midyear data from regulatory filings.

…All told, the five biggest deposit-taking banks added $852 billion in core deposits over the past year — essentially checking and savings accounts of less than $100,000. Over the same period, their loan portfolios rose by just $564 billion. This is noteworthy because these five banks received more than $100 billion in direct taxpayer assistance via the Troubled Asset Relief Program (TARP) — a program that was set up to replenish the depleted capital levels of banks and allow them to boost lending to consumers and small businesses.