Could U.S. Government Qualify For A Mortgage?

Yesterday was the one year anniversary of QE1 ending. QE1 was a $1.25 trillion Fed mortgage bond buying campaign that began January 2009. Then QE2, a $600b Fed Treasury bond buying campaign began November 2010 and will end June 30. Last month, bond king Bill Gross asked who would buy these securities when the government stopped. This month Gross is questioning whether anyone should buy them.

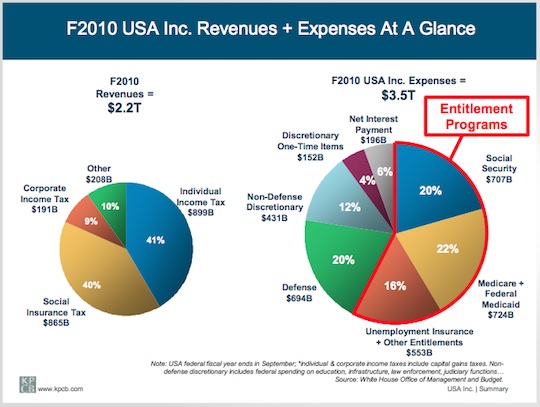

He cited a report from former Morgan Stanley analyst Mary Meeker (now at Kleiner Perkins) showing just how dire U.S. government finances are. Below is a chart from the report that shows the government’s debt-to-income ratio for 2010 was 159%. For perspective, government-controlled Fannie & Freddie set the max debt-to-income ratio for a consumer mortgage borrower at 45%.