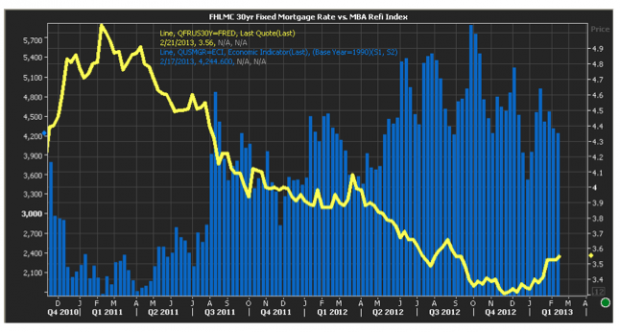

End Of Refi Boom Is Near. This Chart Explains.

Here’s good chart from the Reuters IFR Markets team comparing Freddie Mac 30yr fixed rates and the MBA weekly refi index. As I’ve been saying in my daily rate commentary on MortgageNewsDaily: rate fence sitters beware.

Also see my “Rate Spike Isn’t Over Yet” post 10 days ago. Premise there still holds: upward rate pressure exists on a technical level. But this week, macro issues are helping offset some technically-driven MBS selling that’s driven rates higher this year. In fact, the Italian elections (briefing), the U.S. sequestration—aka mandatory budget cuts—(briefing), and Bernanke reiterating QE support (briefing) helped rates briefly touch their best levels since mid-January on MBS rallies Tuesday and today. By best levels, I mean about .25% above record lows (as opposed to .375% to .5% above record lows that we’ve tracked at since mid-January). Remains to be seen whether we definitively establish higher technical support for key MBS coupons (Fannie 3s and 3.5s), which would keep rates at this lower level. But for now, trading is very jittery. So I’ll say it again: rate fence sitters beware.