Fundamentals 6/17: Consumer Spending’s GDP Impact

Leading Economic Indicators were +0.8%. I do not believe that LEI has been an accurate gauge of GDP as of late. It assumes that money supply increase and low interest rates will give GDP a boost. This has not been happening. Money supply and low rates are the dog’s head, but the tail (consumer spending) has not been following. The reason is no mystery: the Fed is paying interest on excess reserves and there is $1.609845 trillion in excess reserves parked at the Fed. Excess reserves have increased by $573 billion since the start of this year, as you can see here in Fed Report H.3.

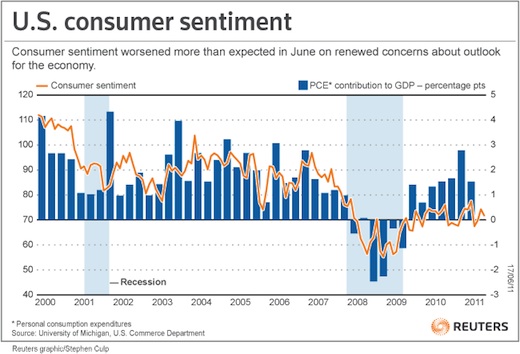

Consumer Sentiment dropped to 71.8 for the first half of June. This is measures predisposition to spend. Below is a consumer sentiment chart that also shows percentage consumer spending (Personal Consumption Expenditures or PCE) contributes to GDP.