Goldman Sachs Consumer Finance & Housing 2019 Conference Liveblog

We’re live at the 2019 Goldman Sachs Housing and Consumer Finance Conference, and we’ll be posting quotes, stats and insights from experts in the consumer finance space all day. Refresh this page throughout the day as we keep posting.

+++

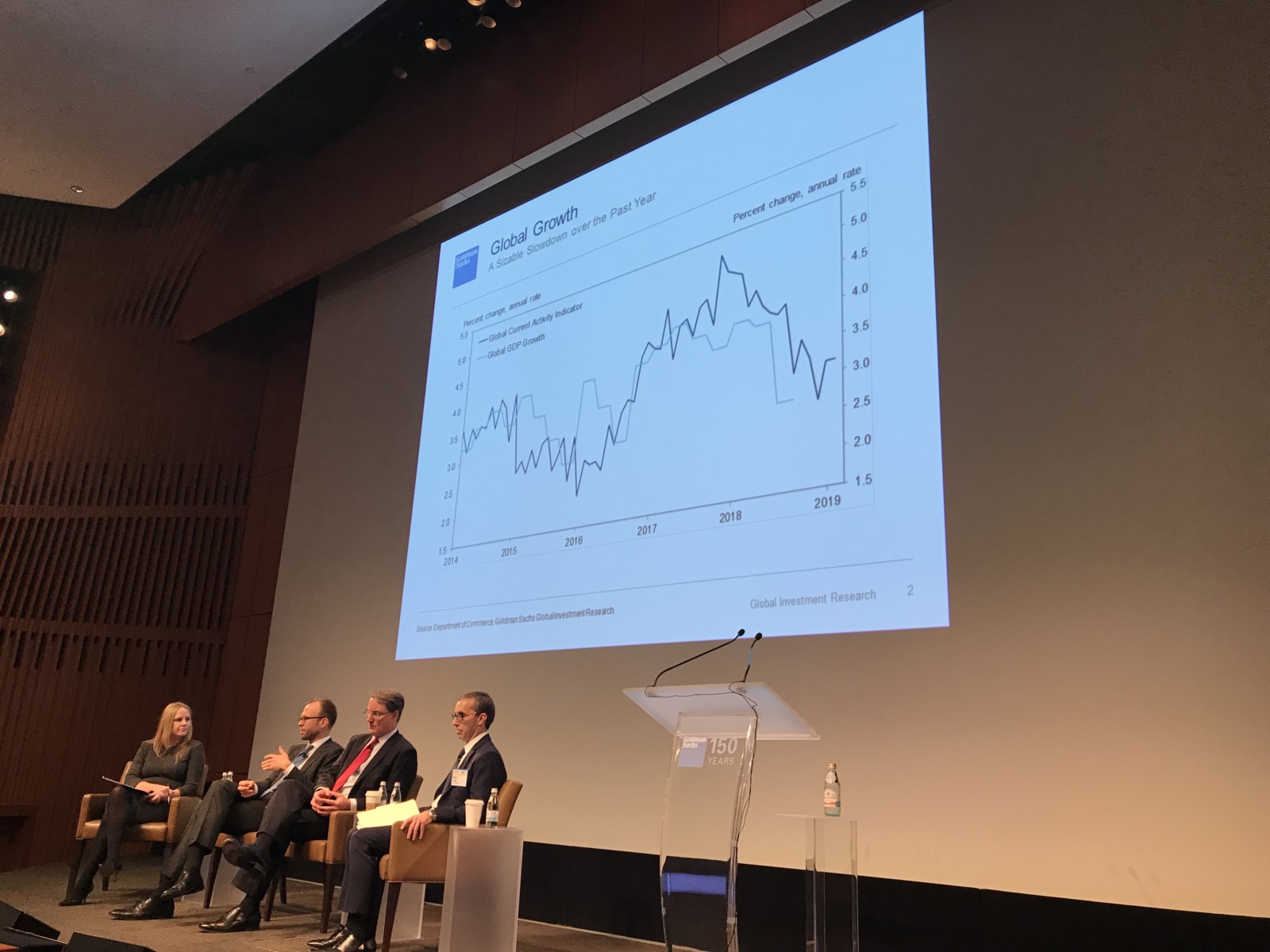

The day started with a group of Goldman Sachs economists discussing the state of the economy and U.S. housing market.

To kick things off, Jan Hatzius, Goldman’s chief economist, said that despite a slowdown in the U.S. and global economies, that he thinks there’s reason to believe we’re at a bottom in the market cycle and that GDP growth will accelerate in 2019 to 2 to 2.5%.

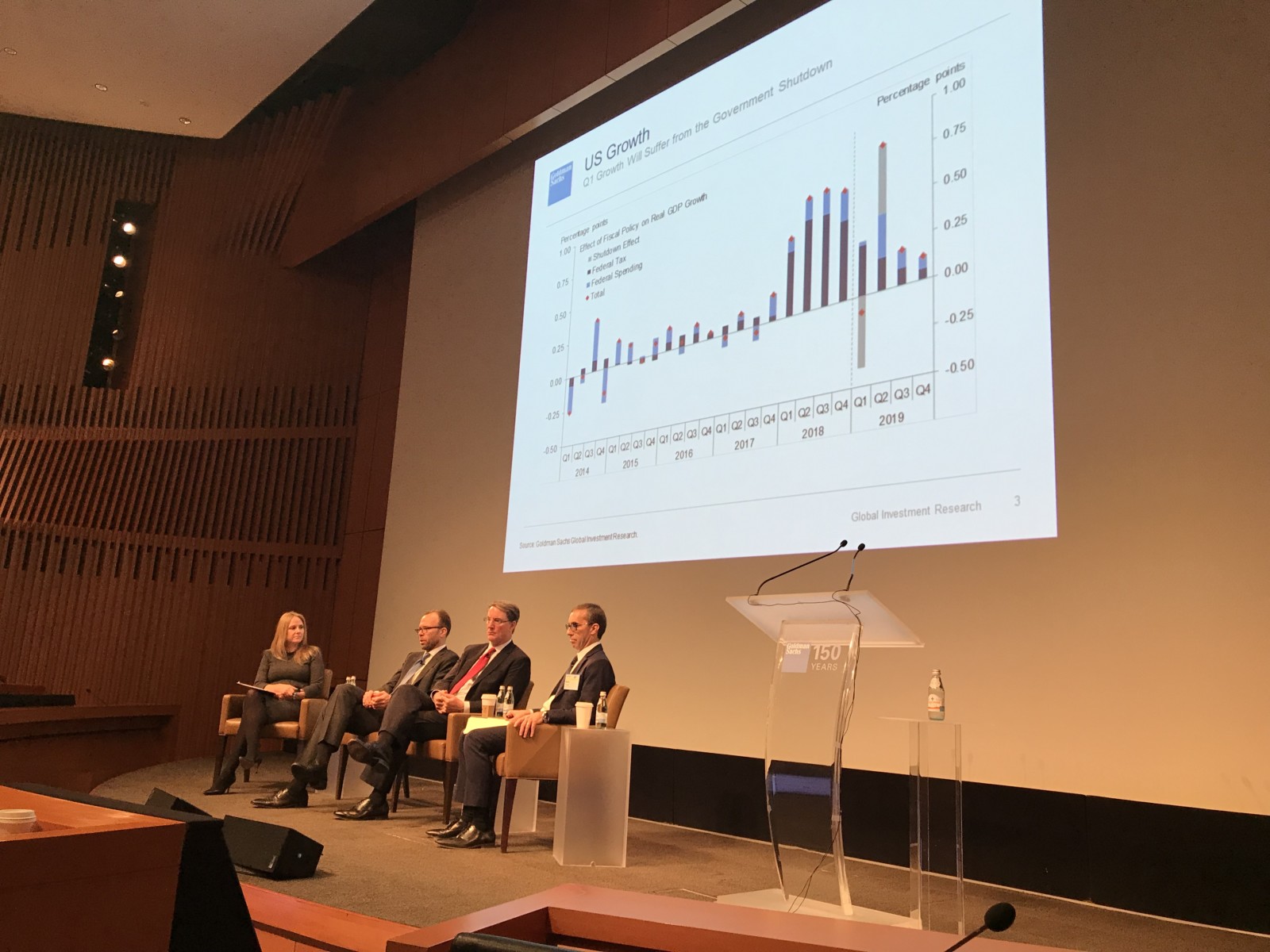

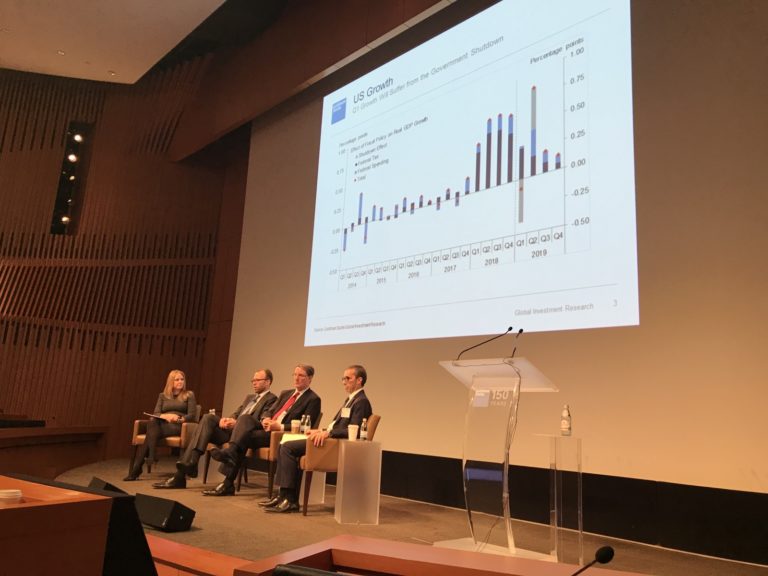

Hatzius also said the U.S. government shutdown shaved as many as 40 basis points off U.S. GDP growth in the first quarter, but that will return as growth comes back later in the year.

Hatzius expects new lows in the unemployment rate by late this year and an increase in inflation to over 2%, which would lead the Federal Reserve to increase interest rates. He said that would be a “run of the mill” increase. Hatzius doesn’t think the Fed is just reacting to the stock market, but it’s appropriate for it to respond to market weakness like we saw in late 2018.

Jan Hatzius, @GoldmanSachs Chief Economist at GS housing conf today:

Fed’s change from higher rate bias to neutral rate bias not purely stock reaction. But responding to market moves (like the major stock weakness late 2018) is appropriate.

— Julian Hebron (@TheBasisPoint) March 6, 2019

Next up was Charlie Himmelberg, Goldman’s chief markets economist. He criticized the stock market’s response to the Fed in late 2018, saying investors should have considered the Fed would be flexible in its analysis of the economy. He also said that we’re in a calm period as far as the Fed goes, and that the central bank won’t cause much disruption in markets.

Himmelberg said he wouldn’t bet on equity (aka stock) markets this year since “the growth narrative is choppy and equities like growth. Growth assets are stretched right now.” He said investors should look at emerging markets and credit markets for returns.

Then, Goldman’s senior mortgage analyst Marty Young took the mic. He said the increase in wage growth could fuel a 3% increase in home prices in the next year. He said that disappointing housing market data in the last year doesn’t have major implications for the economy, given that housing is more cyclical than the larger economy.

Young thinks mortgage rates will get up to 4.8% by the end of the year.

Goldman sees home prices growing 3% and mortgage rates about 4.58% by end of 2019. pic.twitter.com/Tm9HpLoUeU

— Julian Hebron (@TheBasisPoint) March 6, 2019

Of course, housing is local, and Young thinks the high-flying expensive markets will come down to earth such as Seattle and San Jose. “The booms in these cities are not the booms that led to the previous crisis,” Young said.

“A 760 credit score in 2019 isn’t as impressive as it was in 2012,” Young said. DTIs among borrowers are climbing, which he thinks reveals a loosening of underwriting standards.

50% of homes listed for sale are in the highest price tier. Young said.

Dallas home prices grew more in last 5yrs than in last 25 years. Goldman expects this and other high priced markets (see charts) to moderate which will partly to contribute to their 3% national home price appreciation target. pic.twitter.com/aVt3VdVrIW

— Julian Hebron (@TheBasisPoint) March 6, 2019

Hatzius then gave an outlook on the chance for a recession in the U.S. He feels the U.S. economy is much better guarded against recession than in the 2000s since there isn’t as much debt accumulation in the private sector. Spending is lower than income in total among households and businesses, so the economy isn’t running on a deficit. Hatzius says excess spending and debt led to the last two recessions.

Even better, he said, households and businesses aren’t “living beyond their means” in terms of debt and spending. That doesn’t mean a recession is impossible, but he’s “relaxed” about the relatively low chance of a recession.

Himmelberg said consumers have improved their financial habits in the past ten years by de-leveraging, and that the next recession won’t necessarily hurt as bad as the last one. Corporates are earning tons of money, which means they’re less likely to take on debt, which doesn’t set the economy up for a debt collapse like we saw in 2008.

Young then said the commercial real estate market has gotten really expensive, even compared to expensive residential real estate. It’s not a red flag, he says, but it’s something to watch. Commercial banks have a lot of commercial real estate debt on their books, which could be a problem.

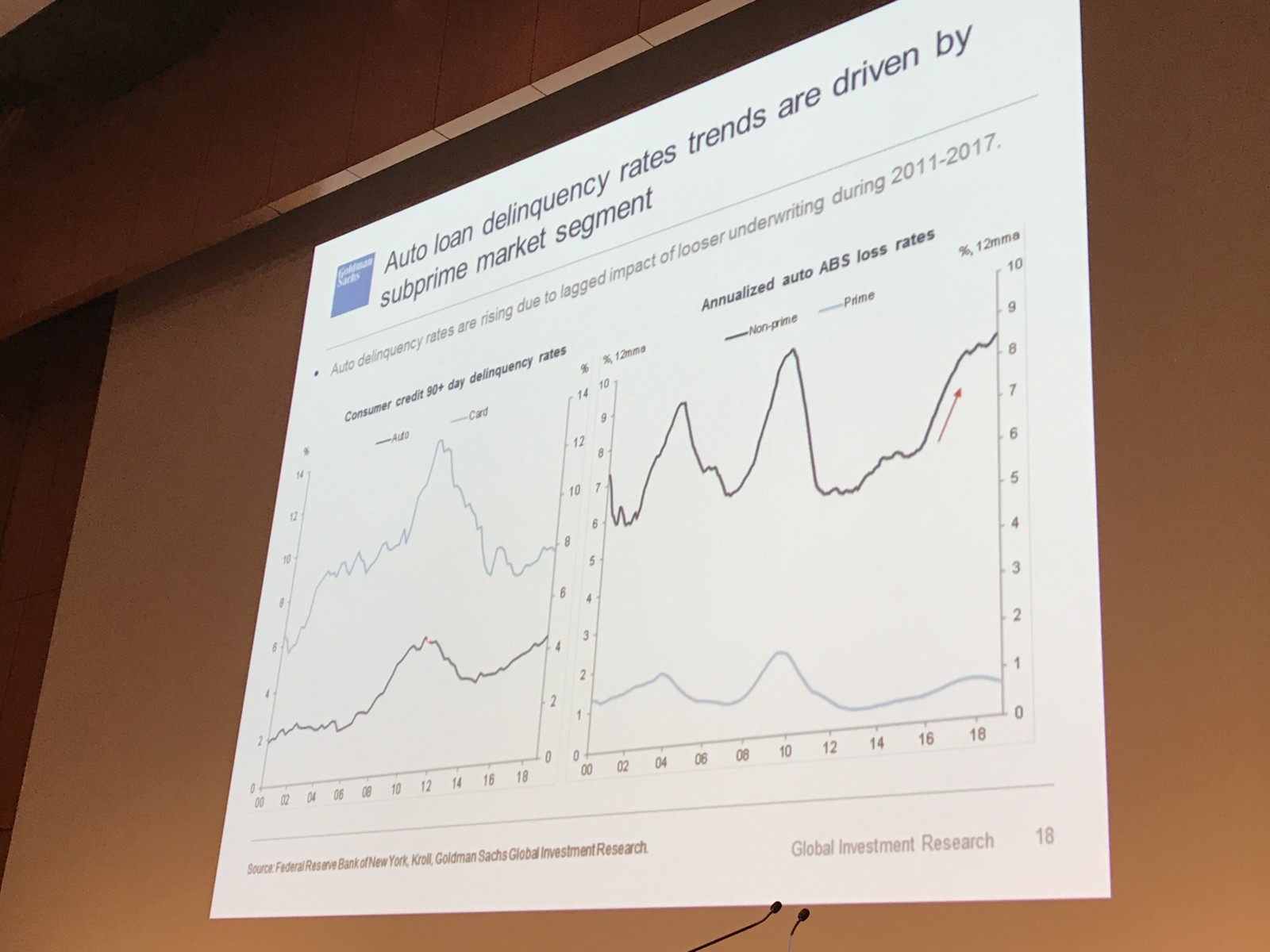

Young also discussed auto loan delinquencies and said it’s not really a sign of weaker macro weakness—he said it’s a sector weakness.

Late car payments a bit alarming, near 2010 levels. Rising due to lagged impact of looser underwriting during 2011-2017. Accordingly larger loss rates in subprime auto loans w much higher rates. This is a sector story and not as much of a systemic risk. – @GoldmanSachs pic.twitter.com/oMv0veTWMf

— Julian Hebron (@TheBasisPoint) March 6, 2019

More people are delinquent on their credit cards than their cars since people will pay their auto loans before they pay their credit cards.

The size of the auto market is also much smaller than housing, so auto delinquencies aren’t as big a sign of macro weakness as we might think. What auto delinquencies do show, though, is that underwriting standards have weakened.

Young said that since more people have been renting since the last recession, consumers are holding less debt that poses systemic risk.

Hatzius told investors to watch private sector deficits more than government deficits. Private sector deficits cause investment in the economy to dry up, which doesn’t happen to the federal government. A large government deficit won’t cause a crisis, but could make recession stimulus more difficult to fund, he said.

+++

The next panel focused on residential real estate investors. Wall Street is increasingly buying up homes and asset managers are now some of the biggest landlords in the U.S., so it’s important to understand why they’re getting into this market.

Dash Robinson, president of investment firm Redwood Trust, said that since there’s a big shortage of affordable housing inventory since builders haven’t figured out how to make money building it, and lots of people have to rent right now instead of buy, investing in single-family homes can be a big source of cash.

“It’s proven to be a business, which has created a whole new cohort of investors in single-family real estate that didn’t exist ten years ago,” Robinson said.

The single-family home investment market doesn’t have many big players in it, Robinson said—it’s mostly mom-and-pop investors renting to friends and families or professional investors who aren’t large enough to get accredited by Fannie and Freddie. That leaves the space wide open for large asset managers with huge capital war chests.

Redwood decided to buy 20% of 5 Arches, a mortgage investor, to break into the single-family market.

Nancy De Liban, EVP at Athene Asset Management, has also been financing single-family rentals.

David Finkelstein, CIO of Annaly Capital Management, said the strong home equity market led the firm to invest in residential real estate. Remember there’s record equity out there!

“If people have equity, they won’t default on their loans,” he said. Basically, lenders feel comfortable and don’t see major risk in housing.

Finkelstein also said he thinks it’d be a tough fight for Congress to legislate Fannie Mae and Freddie Mac into going private, but the Federal Housing Finance Authority can make it happen through administrative means. FHFA can change loan level price adjustments and how much they charge lenders to package loans into securities to price the secondary market more effectively and reduce the role of Fannie and Freddie.

Finkelstein said there’s a lot for investors to like about bringing private investors in as mortgage guarantors as proposed by Senator Mike Crapo.

However, private players might not be able to provide as much liquidity as Fannie and Freddie do today, and new entrants in the market might need government backing since a lot of the risks Fannie and Freddie take today are only possible because of gov’t backing.

Robinson said the most interesting residential real estate investment is jumbo choice loans. Finkelstein likes the alternative document mortgage space. De Liban likes MSRs and non-QM loans.

+++

The next panel focused on a group of online lenders discussing the state of personal loans.

Marlette CEO Jeffrey Maier said the company’s had 7 profitable quarters in a row.

Ray Quinlan, CEO of student loan servicer Sallie Mae, said the company focuses on new college graduates and their credit needs in the first 5 years after graduation: auto loans, credit cards, mortgages and credit cards. The company introduced personal loans about a year ago, but didn’t want to build its own credit card since the industry is too crowded. He said the credit card space is hampered by legacy tech, which is why the company invested in and partnered with Gen Z-focused credit card startup Deserve.

Since mortgage and auto are a little more complicated, Sallie Mae refers that business to other partners.

Al Goldstein, CEO of personal online lender Avant, also makes technology that lets smaller banks offer digital personal loans. The company counts HSBC and TD Bank as customers as well as regional banks.

Goldstein said “banks have borne the cost of prior mistakes heavily,” which is why it’s hard for them to quickly update technology. Banks have to worry about security in a way tech startups don’t.

David Neaves, CFO of Lendmark, said tech upgrades for lenders are always way more complicated than most expect. The company has opened around 100 branches in the past year.

GS moderator Akhil Garg asked each lender what they’d do in case of a recession. Goldstein said he focuses on non-prime consumer credit, typically a big predictor of recession, and he thinks that market is stable. He doesn’t predict a recession in the next 12 months.

Maier said that the yield curve and Treasury bond spread points to a recession in 2020. He also cited a Moody’s prediction that said mid-2020.

Neaves said his customer base is working-class, so he keeps close tabs on corporate layoffs. Lendmark pays close attention to unemployment claims.

On the other hand, Sallie Mae is the “caboose” of the recession train since college graduates have lower unemployment rates. However, college-educated households are affected by ripple effects, Quinlan said.

“I think there’s some credence to the idea that a personal loan has less value to a customer than a relationship,” Goldstein said. He said customers use revolving credit products like credit cards are used more by consumers and meet their immediate needs better than personal loans.

“I think credit card, banking, and personal financial management products should be an essential part of the personal loan relationship,” Goldstein said. He encouraged lenders to offer other products to enhance customer relationships.

Quinlan said customers can’t just go to the Sallie Mae website and get a personal loan—you have to be invited. That helps with customer acquisition cost since more people entering their funnel are already interested instead of coming in cold.

Neaves says Lendmark’s branch model builds relationships with its customers, making them more likely to prioritize paying down personal loans as opposed to their other credit products.

“We view the personal loan as a credit card with guard rails. We can look at customers’ income every time they ask for more funds and can ensure they’re able to keep paying,” Neaves said.

Garg asked the panel who they compete with, and if the lenders are competing with themselves by offering different credit products.

“I don’t think so,” Goldstein said. “People don’t get a credit card when they need a $15,000 personal loan because their car broke down.”

Neaves agreed, saying consumers “bucket” their borrowing and use different credit products for different reasons.

Quinlan said Sallie Mae competes in the $11 billion yearly student loan market, with Discover, Wells Fargo, and other big names. 94% of its originations occur completely digitally.

Maier said that the opportunity for lenders isn’t specializing in products any more—it’s “using tech and customer data to make sure non borrower is left behind. Credit products are commodities. It’s not a product game, but a customer need game.”

The panel unanimously expects 1 Fed rate hike this year.

+++

The next panel was titled “Innovations In Housing Finance and Servicing,” and featured Mike Fierman, the CEO of Angel Oak, Willie Newman, the CEO of Home Point Financial, Sameh Elamawy, the CEO of Scratch, and David Spector, the CEO of PennyMac.

Fierman said Angel Oak originated $2.2 billion in non-QM loans and expects to double that this year.

Home Point is a residential mortgage originator and also services loans. The company sources customers of both sides of the business through brokers and correspondent lenders.

Scratch is an end-to-end student loan servicer that services everything from mortgages to loans backed by cryptocurrencies. It’s a consumer-focused payment platform.

“A lot of innovation has gone into originating loans, which is great, but the lifecycle of the loan has not seen as much innovation and we want to change that,” Elamawy said.

Second-lien products are becoming more popular, Newman said.

PennyMac just launched a HELOC product, one of few nonbank lenders to do so. Despite tons of tappable equity, homeowners are using personal loans, credit cards, or cashout refis. Spector said lenders shouldn’t refi borrowers who have sweet interest rates from earlier in credit cycle and should point them towards HELOCs. HELOCs can also help home sellers bridge cash gap while selling.

HELOC product allows PennyMac to capture servicing from those loans and securitize them.

“One of the big problems for a mortgage banker is asking yourself ‘how will I exit the product?’ We think we’ve solved that for HELOC,” Spector said.

PennyMac is a big servicer of Ginnie Mae loans.

Scratch’s platform is all about teaching consumers—making them aware when payments are due via text, email, etc. Approaching loan servicing from an “event” perspective. If customer is late on a payment, do they know they’re late? How can you let them dispute an how?

Elamawy said Scratch made “Wes Anderson-style” videos explaining how to dispute with servicers.

Angel Oak just finished the largest non-QM securitization since the financial crisis. “We’re working on building trust with investors and rating agencies,” Fierman said.

Newman of Home Point Financial said they’re working on creating faster HELOC approval process.

Elamawy said lenders should automate busywork to let human pros do the things they’re good at—empathy and advice. “We view human pros more as loan guidance counselors,” he said. “The worst thing you can do is replace them with a chatbot.”

Spector said Fannie and Freddie offer tools that can drive down cost of making loans, which is important to lenders because they pass those costs onto borrowers which weakens their experience.

Newman said “we think the distributed retail model of origination is under stress.”

Spector agreed and said that’s why PennyMac got into the broker business itself. He said LOs will move to become brokers themselves.

“As non-QM grows, LOs will seek to become brokers because the number of products they can offer increases,” he said. “Large banks have gotten out of mortgage banking as we know it and are more focused on providing their customers mortgages as a product.”

Elamawy said there are 4 pillars to successful loan servicing customer service: visibility, control, flexibility, and guidance. Borrowers will experience many life changes across the life cycle of a loan and they need to be able to easily contact their servicer, who won’t view ups and downs in our financial lives as exceptions, but rather expected complications.

+++

The lunchtime session was a fireside chat interview with Jacqueline Reses, the head of Square’s lending business. Square’s lending arm helps small businesses get loans and also helps consumers make purchases on layaway.

On the merchant side, Square Capital provides loans, but also performs functions like payroll.

“The words ‘economic empowerment’ are on the wall at Square. That’s the purpose we’re rooted in,” Reses said.

Square Capital underwrites its business customers from data it has on the financial behavior of the customer and data from the payments the business uses Square to accept. The real-time data Square takes in lets it understand when business borrowers are better able to repay loans—if a seller has a high sales volume day, Square can let them pay back more of their debt. If they go on vacation, Square will wait to collect payments till they return.

Since Square already owns all its customers through its payments business, its low marketing costs let it underwrite loans as low as $500. That’s what sets it apart from other lenders, Reses said. Still a relatively small lender—issued $1.6 billion in loans last year (34% growth from previous year).

Square also launched a consumer credit product called Square Installments, which lets you pay for big purchases over time at merchants that use Square. Reses said you can apply for and get financing in 2 minutes using Square Installments without signing any physical paperwork.

+++

The next panel focused on consumer lending and student loans featuring Rob Habgood, CEO of Fair Square, David Klein, CEO of CommonBond, Jack Remondi, CEO of Navient, and Usama Ashraf, CFO of Prosper.

Navient owns $100b in student loans and services $300b in loans. CommonBond is a student loan lender that also sells student loan relief products to employers of college grads.

Online loan marketplace Prosper launching home equity lending product today.

“Not many companies have a vehicle to acquire millennial companies at low cost, and not many have a student loan,” Klein said. “The student loan is the tip of the spear for the rest of the financial products someone will need for the rest of their lives. We’re the only pure play in that space that connects meaningfully with other financial institutions.”

Prosper started as a peer-to-peer lender, but that’s less than 10% of the company’s funding today. The rest of the company’s funding is institutional money investing in loans made on the company’s platform, said Ashraf. Now, the company originates personal loans in the prime and superprime markets. Will expand product suite in consumer lending space past addition of HELOC.

Remondi said there’s a huge balance of student loans eligible for refinancing. There will be at least $20 billion in new student loan originations this year, he said.

Navient markets refis to customers who can afford to pay down their debt instead of deferring student loan payments. Company lets customer decide monthly payment for refi and then creates loan term around that and plans to add that process to in-school loans as well.

Ashraf: current home equity loan process is very manual and takes 5-7 weeks. Even “digital” process is “push a button online and someone calls you in 3 days. “Prosper’s goal is to take 5-7 week process and fit it into a week,” he said.

“It’s important for people in personal loan business to focus on underwriting<" Ashraf said. "We don't know when the recession will be, but we're a year closer to it than we were a year ago."

Klein said 10 basis points of defaults in CommonBond's entire portfolio. Company is a AAA bond issuer.

Navient CEO Remondi says 40 years of student loan data the company has shows graduates have lower unemployment rates and incomes. 2/3 of borrowers who defaulted did so on less than $10,000. Less than 10% of defaults have more than $40,000 in debt. 43 million people with student debt.

Habgood of Fair Square, a startup credit card, said the trick to building brand loyalty with a credit card is an easy-to-use mobile app. Consistent good experiences build customer trust, which can lead to sales of other products.

"Being easy gives you the right to offer more to the customer," he said.

+++

The afternoon continued with a panel on innovation in auto loans with Scott Painter, CEO of Fair, Craig Hewitt, CEO of CarFinance (wonder what they do) and Daniel Mason, VP of strategy at Spring Labs.

Fair is a subscription service for used cars. You apply for a car via an app on your phone and you see a marketplace of cars with monthly payments listed. The company also offers roadside assistance and month-to-month auto insurance. The company partners with Uber for shared car ownership in the U.S. If you download Uber and sign up to drive and don’t own a car, the app directs you to Fair to get a car.

“The entire experience happens on a phone,” Painter said. “There’s no physical paperwork. We’re not lending customers money, we’re buying a car and then entering a digital agreement with customers for them to use the car. 100% of our customers are on autopay instead of a credit decisioning product.”

Fair lets you get cars worth up to $100k as long as your credit checks out. Fair also partners with dealers—if you go to a dealership and get turned down, partnered dealers can send you to Fair to see if you qualify. If Fair holds onto a car for more than 30 days without it being rented, the company sells it wholesale.

Big Auto companies and Softbank have backed Fair with about half a billion dollars. The company has served 30,000 drivers so far.

Spring Labs is basically a credit bureau that uses blockchain. Mason described it as a “peer to peer credit system to detect fraud.” The company sells tech to lenders and banks that lets them securely hold credit data themselves instead of relying on the traditional credit data.

CarFinance is an auto lender that also focuses on refinancing.

“How consumers get auto loans and how lenders find customers hasn’t changed in 30 years,” Hewitt said. “Consumers want to migrate for a digital transaction, but no one is creating a wholly digital transaction.”

Hewitt said the company is unveiling a digital carbuying experience this summer.

“There’s a sprint in the auto industry for a digital transaction,” Painter said. “The problem with the current transaction isn’t that it’s not what the customer wants, it’s that there’s a different process in 50 different states. That’s why we went with a different model to offer a different experience and took a risk on buying the vehicle. However, we’re not trying to disrupt the dealership model. We feed them money in the form of service costs that we funnel to them through the warranties we sell for them.”

Painter said ideas of ownership are changing among Gen Z. They don’t own music, they stream it. Painter’s 16 year old son used Fair to get his car and considers it his, but he doesn’t have to worry about selling it when he goes to college, it just makes sense that he has it while he uses it.

Hewitt said a rising interest environment would slow down refinances, so lowered rates in a recession would help CarFinance’s refi business.

1.5 billion cars on Earth with $5 trillion in revolving debt on them.

+++

The day’s final panel focused on disruption in mortgage with Vishal Garg, CEO of Better Mortgage, Paul Gu, co-founder of Upstart, and Tim Mayopoulous, president of Blend and former CEO of Fannie Mae.

Blend powers 25% of the mortgage market with its technology and enables lenders to offer digital mortgage and home equity loan experiences. It also plans to expand to auto loans and other verticals, Mayopolous said.

“Nobody had created great software for lending in financial institutions for 30 years,” Mayopolous said. “But the challenge of becoming part of the core systems of banking is you have to go through a rigorous sales and vendor management cycle. But once you’re there, you can offer a range of products to those entities.”

Mayopolous then said that Blend’s technology is also open to partners who want to use it to build other products. The company’s technology is moving towards a tipping point where borrowers are approved instantly and stay approved because all their data is collected.

“When that happens, it’ll change all of consumer finance,” he said. We agree, because mortgage is the gold standard of difficulty for customer experience and that will impact the rest of the industry.

Garg of Better Mortgage said the company made a product for the consumer end user—he said it’s cheaper for a customer to get a Chase or Citi loan on the company’s website than directly through those banks, even if the user is already a customer of Chase or Citi. 4% of American home shoppers get pre-approved on Better’s site.

Garg said Better has the same trust problem as Amazon in 1997. Most people don’t know the company. But by partnering with big brands that people trust, he can deliver the Better experience at scale. Garg compares that to the AWS model.

Gu of Upstart pushed Garg on whether loyalty was really the problem, asking if customers still fail to convert even if Better had better rates because they don’t trust the brand. Garg replied that Better has best rates on all of its products in all U.S. markets, but 80% of buyers go somewhere else because they trust their realtor or local lender more. But this won’t happen if Better can become Amazon Prime of mortgage.

Garg said Better will facilitate $4 billion in mortgages this year.

Upstart is a personal lender that uses alternative underwriting standards to get loans to people outside the traditional credit spectrum.

“You can underwrite better using more data than less, and better using a machine learning model than the classical model,” Gu said. “The Upstart model gives you 6 times the accuracy of the FICO model in some instances. For similar FICO scores, our borrower customers default at half the rate.”

While regulators are worried about the increasing speed of mortgages, the panelists think the technology used to make loan decisions makes them faster and safer at the same time.

“Technology is going to de-risk the mortgage business,” Mayopolous said. “If you can see what a borrower is getting every two weeks in their paycheck and get that data, it can take a kind of conservatism out of the credit system.”

Next, the panel briefly touched on the home trade-in model of homebuying.

“All the different homebuying models will be tested, but it’s very complicated to break into this business,” Mayopolous said. “After 10 years in mortgage, I’m not sure who want to be in this business!”

“Optimism isn’t a good thing in lending,” Gu said. “It means you either explicitly or implicitly believe losses will be less than they could be.”

Mayopolous said the tipping point for the mortgage industry to focus on technology was the 2016 Rocket Mortgage Super Bowl ad.

“That ad was when the industry started to take technology seriously,” he said.

Garg said Better Mortgage is growing at 400% this year. Since many banks are getting out of mortgage, it gives Better more room to grow.

Mayopolous gave some insight on why mortgage giants are slow to move: Fannie had a $3 trillion balance sheet, 7500 employees, and had to operate under Congressional oversight. “Decisions had to be made a lot more deliberately.”

Conversely, Mayopolous’ current company Blend serves 25% of the mortgage industry after just 6 years and that gives it opportunities and challenges of who to partner with that will still offer value to customers and end user consumers.

+++

That’s all, folks! Check out our roundup from last year below while we digest all we learned today. Look out for deeper thoughts from the conference soon and let us know if we should cover anything else in depth.

also here's are notes from last year's conference to see how things have evolved compared to this year's live blog notes https://t.co/wnJi0cNVX2

— Julian Hebron (@TheBasisPoint) March 6, 2019