Hey lenders, the worst thing you can do is call a millennial on the phone

Take it from me as a millennial: the worst thing you can do is call someone on the phone.

Especially if you’re hunting for a mortgage—you don’t want to talk to some stranger at a bank or lender … until you do.

But even chatbots can be annoying when your lender uses them poorly. It’s all about timing, and there are times when you actually need and want to text your bank and to talk to a human. It’s just a matter of when.

Let’s take mortgage loans for example, since stats show most of us want to talk to both robots AND people when we’re financing a house. There’s a company called Botsplash that’s training your lender on how to talk and text with you the way you want.

Here’s how it works.

When we start mortgage shopping, most of us prefer messaging to keep our distance. We want to keep things digital and do as much as we can online.

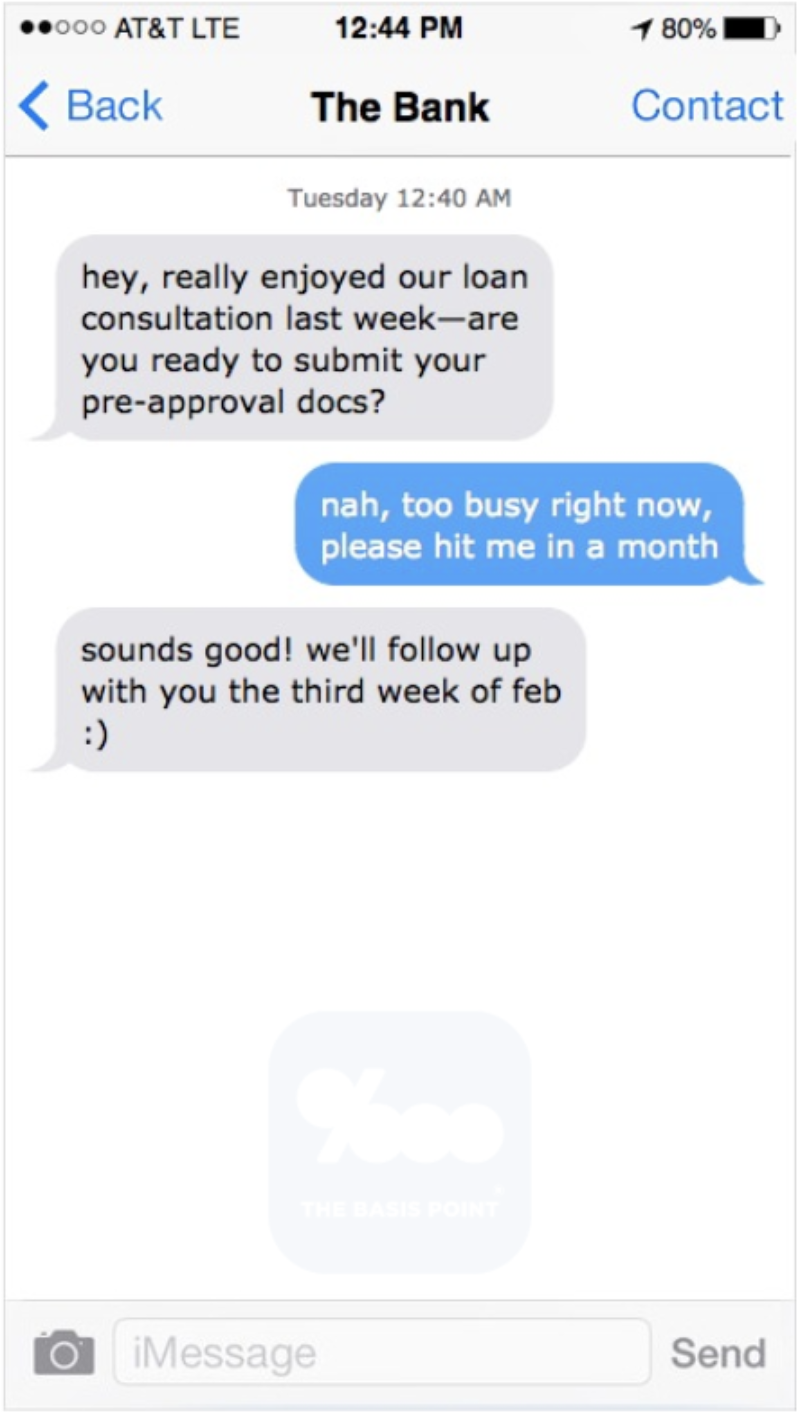

Botsplash makes tech that lets lenders talk to you on your terms. Don’t want to get cold calls from loan officers and would rather get text updates on your options? Botsplash does that.

Once you’ve gotten your feet wet in the mortgage hunt, you can start to chat up multiple lenders using a tool like LendingTree or Zillow. Botsplash helps you do this without any phone calls.

From there, you don’t even have to call, email or even fill out an online form to start the mortgage process. You can start by sending your bank a Facebook DM and even apply for the mortgage within the Facebook app, says Botsplash CEO and co-founder Aru Anavekar.

If anything shows you millennials like me have taken over, it’s that Botsplash lets lenders use other apps like Facebook Messenger to let you start the mortgage process, so you can share your income statements by sending photos to your lender while you scroll past your friends’ baby pictures.

“Imagine completing an online form and instead of getting called, you get a text,” said Anavekar. “Text rates have much higher response rate due to convenience—you can hide and respond to a text later, unlike an intrusive phone call.”

If you don’t want to sit through annoying phone calls, or you don’t want to have to scan documents when you could just take pictures of them, tell your lender you want features like this.

And Anavekar has a message for lenders who want to stay with the times:

“Be where your customers are, and give them the control. If your customers want to text, text them. If they want to talk, call them.”

But all you lenders out there, just remember what I said about calling a millennial.