HousingWire Engage.Marketing 2019 Liveblog – Day 1

The Basis Point team is on the ground in Charlotte for HousingWire’s Engage.Marketing conference the next two days. We’re bringing you everything you need to know as top marketers in the consumer finance industry share how home buying, selling, and financing is being sold to you.

Want to be a savvy homebuyer or seller? Keep refreshing this liveblog to get the goods on what’s next in consumer finance and real estate marketing.

HousingWire CEO Clayton Collins set the tone for the show right away at his opening remarks.

“We’re going to focus on one thing and one thing only today,” said Collins. “Mortgage origination marketing.”

“We want to form a community of marketers in the mortgage industry. That will help everyone in this community become more impactful, and better at putting people in their homes,” Collins continued.

Collins introduced the keynote speaker, Brittany Hodak, a marketing entrepreneur who said she’s going to teach us how to turn borrowers into “superfans.”

Brittany Hodak got her start in mortgage marketing as an OG influencer—as a 17 year old marketing intern, it was her idea to start a blog for her company focused around her hanging out with celebrities that came to town. Her obsession with meeting celebs led her to study the idea of “superfans,” people who are all-in on a brand they identify with.

85% of people consider themselves superfans of something—“when people self-select to identify with a brand, they’ll do more, because your story is now part of their story.”

“The idea of ‘famous’ is so different for kids than it was for older generations. For kids right now, it’s who has the most followers on TikTok or subscribers on YouTube—the stuff that matters to them.”

That means marketers in the mortgage community don’t have to worry about being the biggest or best—they can focus on forming connections with the people they can be meaningful to.

“You don’t have to be The Best, but you have to be the best at what you do.”

LOL: Hodak quoted research saying 61% of people think they’re pop culture influencers. What?! If everyone’s an influencer, no one is an influencer, right?

But when you dig in, Hodak says, your words mean something to the people around you. 92% of people trust word of mouth recommendations more than other marketing—so maybe everyone IS an influencer.

“Advertisers’ biggest enemy is apathy,” Hodak said. “The people who know who you are but don’t care.”

One of the roots of apathy is poor customer service—2/3 of people are “serial switchers” who will change brands based on bad service, according to Microsoft research.

News of poor service travels fast—people love to complain on social media, and those negative recommendations have a lot of power over potential referrals. So marketers need to safeguard against people having a bad day.

“The best marketing doesn’t cost money. You can’t buy superfans. You can’t pay someone to love you.”

But simple gestures can turn people into superfans right away. Hodak’s husband is a huge University of Michigan football fan, so he and Brittany wrote a letter to Michigan football coach Jim Harbaugh to ask him if he would do their gender reveal party.

Harbaugh actually responded with a note jokingly offering a scholarship in 18 years, and Hodak said “now I’m a Jim Harbaugh superfan for life. He had a million things to do, but spent a minute writing back to me and now I’m all-in on my connection to Michigan football that I didn’t have before.”

Hodak’s method for creating superfans is called the WAVE.

-W is for Welcomed—potential clients need to feel a sense of belonging after being greeted in a sincere way. “Look for opportunities in your business when you’re accidentally making people feel unwelcome.”

-A is for Appreciated—a client knows you’re thankful for their business.

Hodak has an upgrade for the advice we all got as kindergarteners: instead of the golden rule (treat others the way you want to be treated), she uses the platinum rule (treat others the way they want to be treated).

-V is for Validated—a client knows their opinions matter to you. Hodak said the most important thing marketers can do is make their customers feel heard and understood.

-E is for Engaged—when a customer is actively participating in your processes and excited about what comes next.

When you hit all four points of the WAVE for your customers, your story becomes part of their story.

“In marketing, the why and who are more important than the how. There will always be a new how—new channels and methods to figure out.”

“It costs zero dollars more to talk to your customers in a brand voice versus being generic,” Hodak said.

HousingWire managing editor Sarah Wheeler introduced the next session, a panel on how originators can integrate social media feeds from OptimalBlue, a company that helps lenders market to you.

OptimalBlue exec Mike Zastoupil started off by running through common frustrations lenders have when marketing over social media—there are strict social media compliance regulations, it’s tough to build brands, and it’s hard to sell your unique value proposition without giving up too much of your secret sauce.

At least 27 major regs govern lender activity on social media, and force LOs to contort to certain standards. LOs have to market with their legal name, not nicknames—and Zastoupil said lenders often run into trouble with minor mistakes like that. These regs are part of why Facebook is going all-in on privacy.

OptimalBlue’s tech monitors LOs’ social media for lenders, and keeps an eye on keywords like “free X” that can sometimes get lenders into trouble. Even more importantly, OptimalBlue can monitor controversial keywords so LOs can delete racist or controversial comments that could put them in danger.

1 in 4 social media compliance violations are on Facebook, Zastoupil said. OptimalBlue audits let lenders review all their compliance findings on one platform.

But OptimalBlue isn’t all about keeping you out of trouble. They also help lenders roll out compliant social media campaigns, promote different pieces of content to different groups and regions, and cross-post content to different social media feeds.

Its collaboration tools are built to work with regulations, too—every post OptimalBlue makes with you is fed through an algorithm that tags potentially controversial words or phrases for you.

+++

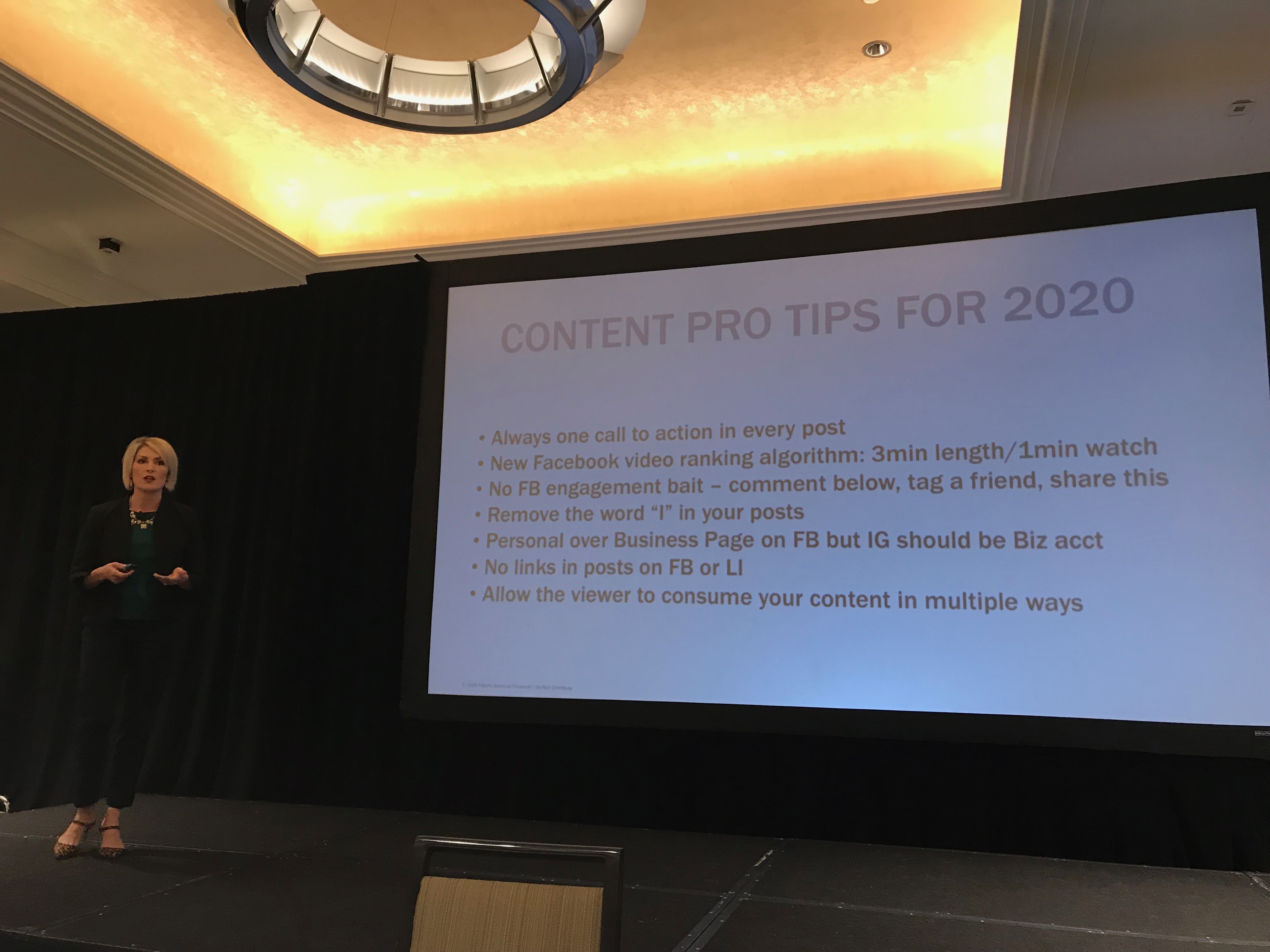

I caught the end of a presentation by Chelsea Peitz, head of social sales at Fidelity National Financial, and she broke down how quickly conventional wisdom on social media changes. The algorithm doesn’t care about what you were taught 5 years ago!

Here’s a quick overview:

A lot of this is news to me, a social media native millennial—no more telling people to tag a friend? It’s a brave new world out there.

A quick coffee break, and then we’re back with a superstar panel on personal branding.

+++

Next up is a panel on personal branding for loan officers with Chelsea Peitz from Fidelity National Financial, Kevin Peranio of PRMG, Adam Constantine of Pace Communications, and Kelsey Rauchut from Annie Mac.

Things that work for LOs right now on Facebook from each panelist:

Adam Constantine:

-creating shareable content people care about

-having a specific strategy for spreading that content with paid campaigns

Chelsea Peitz:

-FB is built on an algorithm—if you can game the algorithm, you’ll win. Algo favors comments right now—if you comment on 10-15 potential clients’ content, FB will think you’re friends and show them your stuff

-Ask questions in response to comments to increase engagement.

-FB live is still huge, even though we hate doing them. Videos that are 3+ minutes rank higher.

Kevin Peranio:

-FB algorithm ranks content placed in groups very highly

-More cars are sold on FB marketplace than anywhere else right now, so use it!

Kelsey Rauchut:

-position yourself as subject matter expert, but be authentic

-Give other people the stage. Highlighting others’ success takes people on a journey.

Chelsea Peitz: LinkedIn’s algorithm has a “points” system—videos give you more points, having more than 3 lines of content in a post gives you more points, likes and comments give you points. Leave long comments—you want people to have to click “see more” on comments.

“LinkedIn is an amplification platform. You use your network and profile to amplify your message.”

“When you think of LinkedIn, you think of old, stodgy, white bankers. So if you’re authentic, and bring a bit of jackassery, you can really stand out and win.”

Peitz has a background in brain science, and she said research shows when people watch videos of people they follow on social media, the same neurons fire as if they were sitting next to them listening to them speak. Making videos is a proven way to build connections with people—the science proves it!

Peranio: #2 search engine in the world is YouTube, so use it. Don’t use more than 10 tags on YouTube videos. People love seeing our flaws and seeing that you’re a real person. If you’re afraid of making videos, just do it and lean into the fear.

Constantine: One way I built my brand was showing off my shoe collection—it brought haters and fans together to engage.

Peitz: 3 T’s for producing content: tips, tricks and takeaways. Once you start producing content around that, it’s hard to stop.

Rauchut: Documenting your thoughts seems like a huge elephant you have to take on—but it can be broken down. Create a social media roadmap to plan out how you can grow.

Constantine: Four C’s of creating a culture of social media content marketing in an organization: curate, create, coach, copy. Gather material that you can easily turn into shareable content. Curation fuels creation of original content. Then you can use content to coach LOs on how to curate and create more content. Then you copy, meaning you do what worked well over and over.

Peitz: Don’t use big hashtags on Instagram. You’ll get lost in the feed. #realestate has 33 million posts. You aren’t going to stand out against the flood.

Put yourself in homebuyers’ shoes. People who are looking for homes aren’t searching #mortgage—they’re searching #homedecor, #hgtv, etc. Don’t think within the industry, think in buyer’s perspective.

Constantine: you need to connect with local businesses and figures that have a lifestyle mindset. Turn on post notifications for at least 5 of them so you can immediately engage with their posts. If you can comment first, you’ll get noticed.

The next portion of the panel features our friends Dustin Brohm, who runs the Massive Agent Podcast, and Phil Treadwell of Mortgage Marketing Expert Podcast, talking about how LOs and real estate pros can start podcast. They’re also co-founders of the Industry Syndicate, a network of slick podcasts and content creators in the mortgage industry.

“Don’t overthink this. My first few podcasts were terrible. But you can do this,” Brohm said. Brohm is a top realtor in Salt Lake City and Treadwell is a manager at Mason-McDuffie Mortgage.

Podcasts are a killer way to get and keep peoples’ attention, Brohm said. People watch online videos for an average of 2 minutes, but the average time people spend listening to a podcast is 50 minutes. That’s a lot of time to explain complicated concepts and to build connections with listeners.

“Effective marketing is a balance of trust and attention,” Treadwell said. Podcasts give you audience’s attention and the space to build trust.

If you want to check out Dustin and Phil’s presentation, hit it up here.

The session wrapped with a massive Q&A sesh with all the speakers.

“Marketing should take the shape of your audience’s behavior,” said Adam Constantine. So stay hyper-local and stand out in your local area.

Other social media sites you need to be on, per Kevin Peranio: Reddit is the 5th largest website in the world—use it to tap into local markets. Quora can help you become a trusted expert on real estate and consumer finance topics.

OMG of course someone talked about video games—Ginger Bell said eSports sponsorships drive huge engagement.

+++

While I’m scarfing down lunch, I’m covering the lunch panel: a session on top mortgage originators with our friend Jake Fehling, VP of marketing at Movement Mortgage, his colleague Lindsey Goins at Movement, Daniel McCoy of MVB Mortgage, and Ramon Walker of Mount Diablo Mortgage.

This panel’s about how LOs market themselves from a frontline perspective.

Goins got into the lending biz in 2012, at the housing market bottom and when everyone hated LOs for their association with the financial crisis. She navigated the populism by centering her personal brand about always staying true to her word.

McCoy said building an LO brand is all about being a consistent source of good financial advice. “If you have to tell a client they’re better off not buying a house, you better tell them that.”

Walker said his brand is all about combining good rates and good service. “I want to give everyone the deal I would give to my mother if she was buying a home.”

“In the mortgage business, you can’t just have one job. You have to wear multiple hats,” McCoy said.

The panel took a question from the audience on whether print marketing is still relevant, and surprisingly, they agreed there’s still a use for print marketing. Goins loves having physical material to hand out to folks when meeting with new realtors or when touring neighborhoods.

Another old-school question: is direct mail still a thing? Not really for these LOs. It’s expensive, and Walker said it’s “out of place.” He does love sending people postcards since it’s cheap, though.

Direct mail can be a good customer retention strategy, though—McCoy sends people notes on life events. His clients say they like feeling that McCoy knows them.

+++

The next panel is about how to build the tech backbone of a marketing machine with Kevin Peranio of PRMG, Courtney Keating Chakarun of Roostify, Brittany Whitmire of FGMC, and Brian Faux of Morty.

“This panel is basically about what vendors to go with,” said Peranio.

“Building a good tech stack takes a lot of integrity. You need to have a vision and a mission and commit to them,” said Roostify. “Strategy first, technology comes second.”

This panel is focused on industry wonks, but for you readers who live and breathe consumer finance technology, there’s some gold here about SaaS sales in the mortgage biz:

-find champions at your target clients who understand your value add and will communicate that internally

-be persistent—this sales cycle can take years

Morty is a marketplace for homebuyers to find mortgages at a bunch of different lenders. It disrupts the mortgage broker model in the same way Expedia disrupted travel agents.

“Our ethos is to say no and say no often, which is weird, but it works for us,” Faux said. “I’ve worked at the largest organizations in the world, Wells Fargo, the federal government, and it takes years to integrate things. These orgs have the money, but they also have fatigue.”

Coming up: a breakout session led by our friend Joe Welu, CEO of mortgage marketing automation experts Total Expert. TE helps your lender communicate to you in a way that doesn’t suck and make you offers that actually matter to you.

Joe interviewed Jim Anderson, the CMO of Stearns Lending.

Joe defines the customer experience as “the sum of all touchpoints a customer has with your brand from first touch to customer for life.”

“I have a golden retriever who’s been dead for 6 years that still gets mail from Bank of America,” Anderson said. “You need to make messaging relevant to your actual customer.”

“Organizations crave mass customer acquisition, but the most lifetime value a customer adds is AFTER the initial transaction. My grandmother has had the same checking account since 1942. Think of that lifetime value add,” said Welu.

“Never skip the dating process” when courting a customer, said Welu. Customers are willing to pay more for better customer service. Offering value builds trust and respect, which leads to a lifetime relationship.

“Millennial homebuyers are looking for education. There are so many acronyms in this industry,” Anderson said. “You need to have the educational material. The top search terms are how much home you can afford and how a home fits into financial plans.”

“If you want to be the tip of the spear, before a borrower even has a realtor, you have to have that education,” Anderson said.

But how do you offer that personalized education to borrowers with different experiences? You need data to fuel relevant conversations, said Anderson. You don’t talk to someone who’s 25 the same way you talk to someone who’s 65.

What’s the line between stalking and being personalized? Marketers must ask themselves if they would be creeped out receiving a piece of personalized content.

What’s the difference between younger and older borrowers? Do millennials expect more personalization?

Not necessarily, but they do have specific needs. “Boomers want friends, and millennials want education,” Anderson said.

“The end goal of personalization is to anticipate customers’ needs based on life events,” said Welu.

+++

Next up is a panel of The Basis Point friends and top mortgage marketers: Christine Beckwith, president of 2020 Vision for Success Coaching, Jason Frazier, director of business development for Shred Media, Adam O’Daniel, director of marketing at Movement Mortgage, Josh Pitts, founder of Shred Media, and Sarah Wheeler, managing editor of HousingWire.

“‘I see your stuff everywhere’ is the best compliment you can give a marketer,” Frazier said. “Don’t look at likes or the vanity metrics—it’s all about reach.”

“We overthink content, we strategize, but we don’t do it. This is content!” Pitts said, and then whipped out his phone and took a quick selfie video of himself hyping up the crowd.

“Use the same method when talking to consumers as B2B,” Wheeler said. “Make an emotional connection.”

“No one likes the way you look on video, but guess what? That’s the way you look in your office, too,” Frazier said. “It’s easy to get tripped up because you see everyone’s perfect life on Instagram, but people identify with imperfection.”

“Be yourself, even as a brand. People want to see who you are as a company, even if it’s bad news.” said O’Daniel.

“Everyone should spend at least $2 a day on Facebook ads. Promote a vertical video telling a story. At least 60 to 90 seconds. Every loan you make is a story—every borrower is a consumer like your next borrower,” Frazier said.

Quick social media don’ts:

“Don’t try to manipulate the system,” O’Daniel said.

“Don’t watch any of your own videos, you’ll get too in your head,” said Pitts.

+++

Last panel of the day: how to connect with homebuyers not traditionally served by financial services featuring Leora Ruzin, VP of secondary marketing at Guaranteed Rate, Keosha Burns, VP of PR at Chase Mortgage, Patricia Korth-McDonnell, CMO of Better Mortgage, and Riffat Lakhani, VP of marketing at Guidance Residential.

Some people are “system gamers,” and they love Better Mortgage because they see it as an opportunity to game the system, says Korth-McDonell. They like having as high a credit score as possible.

Burns saw the worst of the housing industry working in PR for Fannie Mae during the financial crisis and said it turned her off home ownership. After a few years, though, she got curious about the process and ended up buying a condo and writing about the experience. That gave her a unique insight on how millennial borrowers approach homebuying.

“Single women are buying homes like crazy, but if all your marketing is a husband and wife and golden retriever buying homes, that’s not connecting with that audience,” Burns said.

+++

And that’s it for day 1 of Engage.Marketing! Check back tomorrow for the best of day 2.