Mortgage Interest Deduction Not As Important As People Think

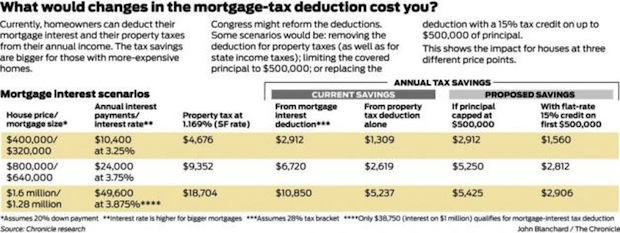

Carolyn Said of the San Francisco Chronicle wrote a good piece on the fate of the mortgage interest deduction as budget talks slog on in Washington. Of particular note is the table (see above) that lays out each possible way the mortgage interest deduction could play out for different home prices and loan amounts.

Here’s a quick description on how the math in the table works: U.S. taxpayers are currently allowed to deduct mortgage interest and property taxes paid. The way a deduction works is that anything you’re allowed to deduct is subtracted from your Adjusted Gross Income and you pay tax at your rate on that new lower amount. So to get a quick estimate of annual tax savings, you can multiply your tax rate by the amount of your deductions. Tax rates vary based on income levels, so it’s best to use a lower tax rate when estimating your annual tax savings so you’re not over-estimating it. The SF Chronicle table uses a 28% tax rate which is the middle of the road for the Bay Area region.*

The fate of the mortgage interest deduction is obviously a hot topic and, as always, @csaid does a good job of capturing consumer and professional perspectives. I’m quoted on my current position in my local market where, in a majority of client scenarios, rent vs. buy math works in favor of buying even without the deduction:

But Julian Hebron, vice president of RPM Mortgage in San Francisco, said lenders don’t consider the deduction when deciding what size mortgage a buyer can afford.

“Lenders approve loans by calculating what percentage of a borrower’s income is going toward housing cost and other debt,” he said. “This calculation is made using total housing costs before tax benefits. And as San Francisco rents have risen sharply in the past 12 months, more than half of my client scenarios work out where the total cost to own a home before any homeowner tax deductions is cheaper than renting.”

And my colleague @diannecrosby in a different part of the Bay Area offers an opposing view. Go check out the full SF Chronicle story. It’s a good one…

Mortgage Interest Deduction In Jeopardy? (Carolyn Said, SF Chronicle)

___

*If you want to do more specific estimates for yourself, here’s a good tax rate calculator.