Notes on U.S. and global monetary policy

Here are some notes from the Economist on American and global monetary policy I’m excerpting for some research I’m doing. Sharing for others who need to keep up on these things. Links to full pieces below the excerpts.

Economist on American Monetary Policy 6/10/17

It is possible that more inflation is coming. An economy that is stimulated will eventually overheat. The central bank may believe that low unemployment is about to cause inflation. But the truth is that nobody is sure how far unemployment can fall before prices and wages soar. Not many years ago some rate-setters put this “natural” rate of unemployment at over 6%; the median rate-setter’s estimate is now 4.7%.

The only way to find the labour market’s limits is to feel them out. Falling inflation and middling wage growth both suggest that these limits are some way off, for two possible reasons. First, higher wage growth could yet tempt more of the jobless to seek work (those who are not actively job-hunting do not count as unemployed). The proportion of 25- to 54-year-olds in employment is lower than before the recession, by an amount representing almost 2.4m people. By this measure, which fell in May, joblessness is worse in America than in France, where the overall unemployment rate stands at 9.5%. Second, even the moderate pickup in wage growth to date might encourage firms to invest more, lifting productivity out of the doldrums and dampening inflationary pressure.

…Inflation has been below 2% for 59 of the 63 months since the target was announced in January 2012. Continuing to undershoot the goal would cast more doubt on the central bank’s commitment to it than modest overshoots would.

For too long, hawks have made excuses for the persistence of low inflation. The latest is to blame new contracts offering unlimited amounts of mobile data, as if cheaper telecommunications somehow should not count. The Fed should keep its promise to base its decisions on the data, and leave interest rates exactly where they are.

Economist on Global Monetary Policy 6/3/17

The ECB’s meeting on June 7th and 8th was not long ago eyed as pivotal. The bank’s staff would produce new, upbeat economic forecasts. Many ECB-watchers (and maybe some of its governing council) reckoned it might signal the “tapering” of QE. That now looks unlikely. Figures this week showed that underlying inflation fell to 0.9% in April, well short of the ECB’s target of below-but-close-to 2%. On May 29th Mario Draghi, the ECB’s boss (pictured), told the European Parliament that the bank was “firmly convinced” that an “extraordinary amount” of monetary support was still needed.

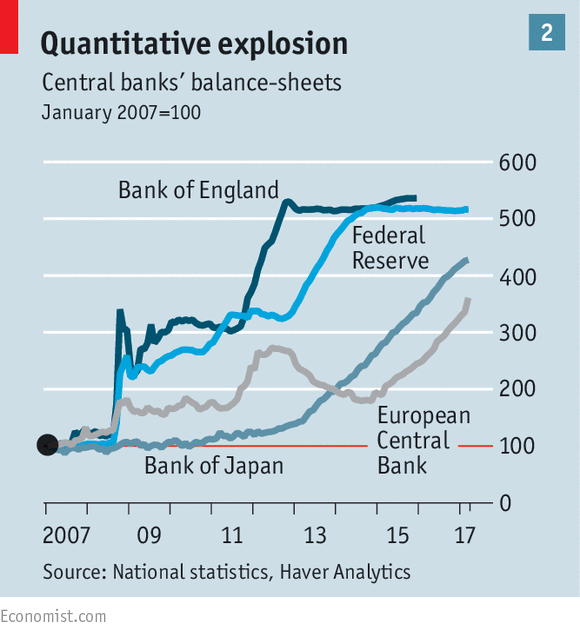

…Elsewhere, too, things are not going entirely to plan. The Fed raised interest rates in March and is widely expected to do so again in June. But thereafter markets have priced in little in the way of further increases. And few other central banks are following its lead. Indeed several have cut rates. Mr Draghi’s ECB is not alone in its taper caution. The pace of the Bank of Japan’s purchases has not fallen much. The balance-sheets of these three central banks, in aggregate, are still expanding. They are unlikely to start shrinking until 2019.

…Central banks are treading carefully in part because of low inflation. Headline rates of inflation have risen this year, but largely because of higher oil prices. Price indices that exclude volatile food and energy costs tell a different story. The underlying rate on the index preferred by the Fed fell to 1.5% in April, for instance. But monetary policy also reflects the specific risks to financial stability in America, Europe and China.

…Yet the main risk highlighted in the ECB’s recent Financial Stability Review is a sudden rise in bond yields. A hasty withdrawal of QE could plausibly set off such a change, especially in countries such as Italy with large public-debt burdens. That is one more reason for the ECB to go slow.

…Though most market participants expect the Fed to increase the target range on its main interest rate on June 16th by another quarter-point to 1-1.25%, the markets are pricing in very little beyond that. Investors are betting that the federal-funds rate will be just 1.5% at the end of 2018. If the Fed lives up to the median forecast of its rate-setting committee, the rate by then should be 2.25%. But sluggish inflation may well force a rethink. In any event, the Fed has prepared the ground for a reduction in its balance-sheet, to begin soon. As things stand, the Fed reinvests the proceeds of maturing bonds, but the plan is to allow a fixed amount of those to run off. Initially the cap would be set at a low level (as little as $12bn a month on one reckoning) and would gradually increase every quarter. Economists at JPMorgan Chase reckon that shrinking the Fed’s balance-sheet by $1.5trn would eventually push up ten-year yields by 0.25%. But the Fed is likely to move so slowly that the effect will be barely perceptible. Since the plans were outlined, the yield on ten-year Treasuries continued to fall, reaching 2.2%, down from a recent peak of 2.6% in March.

In large part, falling bond yields reflect a growing conviction that short-term interest rates are unlikely to rise quickly or soon. Central banks are fearful of cutting short the synchronised global economic upswing and, with inflation quiescent, see no real need to take the risk. They are buying lots of assets: the ECB and Bank of Japan are acquiring more; the Fed is still reinvesting. In short, little is afoot to upset the bull-market mood: “They’ve still got your back”, is the message that investors are taking from central banks, says David Riley, of BlueBay Asset Management.

Economist on History of Central Banks

…central banks have been widely slated for propping up the financial sector, and denting savers’ incomes, in the wake of the financial crisis of 2007-08.

…Governments have asked central banks to pursue several goals at once: stabilising currencies; fighting inflation; safeguarding the financial system; co-ordinating policy with other countries; and reviving economies.

These goals are complex and not always complementary; it makes sense to put experts in charge. That said, the actions needed to attain them have political consequences, dragging central banks into the democratic debate.

Alexander Hamilton, America’s first treasury secretary, admired Britain’s financial system. Finances were chaotic in the aftermath of independence: America’s first currency, the Continental, was afflicted by hyperinflation. Hamilton believed that a reformed financial structure, including a central bank, would create a stable currency and a lower cost of debt, making it easier for the economy to flourish.

…Central banking was one of the great controversies of the new republic’s first half-century. Hamilton’s bank lasted 20 years, until its charter was allowed to lapse in 1811. A second bank was set up in 1816, but it too was resented by many. Andrew Jackson, a populist president, vetoed the renewal of its charter in 1836.

A suspicion that central banks were likely to favour creditors over debtors was not foolish. Britain had moved onto the gold standard, by accident, after the Royal Mint set the value of gold, relative to silver, higher than it was abroad at around the turn of the 18th century, and silver flowed overseas. Since Bank of England notes could be exchanged on demand for gold, the bank was in effect committed to maintaining the value of its notes relative to the metal.

By extension, this meant the bank was committed to the stability of sterling as a currency. In turn, the real value of creditors’ assets (bonds and loans) was maintained; on the other side, borrowers had no prospect of seeing debts inflated away.

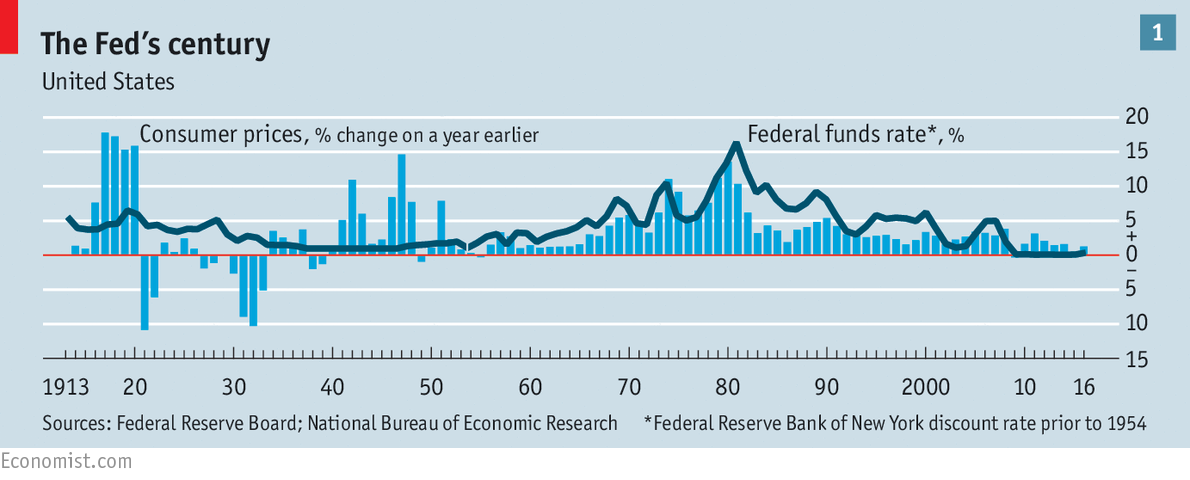

…If central banks struggled to cope in the 1920s, they did even worse in the 1930s. Fixated on exchange rates and inflation, they allowed the money supply to contract sharply. Between 1929 and 1933, 11,000 of America’s 25,000 banks disappeared, taking with them customers’ deposits and a source of lending for farms and firms. The Fed also tightened policy prematurely in 1937, creating another recession.

During the second world war central banks resumed their role from the first: keeping interest rates low and ensuring that governments could borrow to finance military spending. After the war, it became clear that politicians had no desire to see monetary policy tighten again. The result in America was a running battle between presidents and Fed chairmen. Harry Truman pressed William McChesney Martin, who ran the Fed from 1951 to 1970, to keep rates low despite the inflationary consequences of the Korean war. Martin refused. After Truman left office in 1953, he passed Martin in the street and uttered just one word: “Traitor.”

Lyndon Johnson was more forceful. He summoned Martin to his Texas ranch and bellowed: “Boys are dying in Vietnam and Bill Martin doesn’t care.” Typically, Richard Nixon took the bullying furthest, leaking a false story that Arthur Burns, Martin’s successor, was demanding a 50% pay rise. Attacked by the press, Burns retreated from his desire to raise interest rates.

In many other countries, finance ministries played the dominant role in deciding on interest rates, leaving central banks responsible for financial stability and maintaining exchange rates, which were fixed under the Bretton Woods regime. But like the gold standard, the system depended on governments’ willingness to subordinate domestic priorities to the exchange rate. By 1971 Nixon was unwilling to bear this cost and the Bretton Woods system collapsed. Currencies floated, inflation took off and worse still, many countries suffered high unemployment at the same time.

This crisis gave central banks the chance to develop the powers they hold today. Politicians had shown they could not be trusted with monetary discipline: they worried that tightening policy to head off inflation would alienate voters. Milton Friedman, a Chicago economist and Nobel laureate, led an intellectual shift in favour of free markets and controlling the growth of the money supply to keep inflation low. This “monetarist” approach was pursued by Paul Volcker, appointed to head the Fed in 1979. He raised interest rates so steeply that he prompted a recession and doomed Jimmy Carter’s presidential re-election bid in 1980. Farmers protested outside the Fed in Washington, DC; car dealers sent coffins containing the keys of unsold cars. But by the mid-1980s the inflationary spiral seemed to have been broken.

In the wake of Mr Volcker’s success, other countries moved towards making central banks more independent, starting with New Zealand in 1989. Britain and Japan followed suit. The European Central Bank (ECB) was independent from its birth in the 1990s, following the example of Germany’s Bundesbank. Many central bankers were asked to target inflation, and left to get on with the job. For a long while, this approach seemed to work perfectly. The period of low inflation and stable economies in the 1990s and early 2000s were known as the “Great Moderation”. Alan Greenspan, Mr Volcker’s successor, was dubbed the “maestro”. Rather than bully him, presidents sought his approbation for their policies.

…When the credit bubble finally burst in 2007 and 2008, central banks were forced to take extraordinary measures: pushing rates down to zero (or even below) and creating money to buy bonds and crush long-term yields (quantitative easing, or QE). As governments tightened fiscal policy from 2010 onwards, it sometimes seemed that central banks were left to revive the global economy alone.

Their response to the crisis has called forth old criticisms. In an echo of Jefferson and Jackson, QE has been attacked for bailing out the banks rather than the heartland economy, for favouring Wall Street rather than Main Street. Some Republicans want the Fed to make policy by following set rules: they deem QE a form of printing money. The ECB has been criticised both for favouring northern European creditors over southern European debtors and for cosseting southern spendthrifts.

And central banks are still left struggling to cope with their many responsibilities. As watchdogs of financial stability, they want banks to have more capital. As guardians of the economy, many would like to see more lending. The two roles are not always easily reconciled.

Perhaps the most cutting criticism they face is that, despite their technocratic expertise, central banks have been repeatedly surprised. They failed to anticipate the collapse of 2007-08 or the euro zone’s debt crisis. The Bank of England’s forecasts of the economic impact of Brexit have so far been wrong. It is hard to justify handing power to unelected technocrats if they fall down on the job.

All of which leaves the future of central banks uncertain.

___

Source:

–American Monetary Policy: Why The Fed Shouldn’t Change Rates

–Global Monetary Policy is not tightening as expected