OH MY GOD, RECORD RATES!!!! (Everything You Must Know)

Another Thursday, another wave of “NEW RECORD LOW” rate headlines. And another round of stories that mostly exclude critical fine print on how these rates are derived. Below I run down this fine print so you can determine if you AND your property qualify for the rates you’re reading about.

The rates in the press are from a Freddie Mac survey published every Thursday, and here are the key points to screen your profile against. If you and your property meet all these parameters, then you’ll qualify for rate levels you’re seeing in the media. If not, rates will be a bit higher:

– PMMS rates are national averages based on survey responses from 125 lenders—Freddie Mac surveys 25 lenders in each of their 5 regions.

– PMMS rates are for the week leading up to (and not including) Thursday. Mortgage rates are tied to mortgage bond trading, and as such, rates change all day everyday. So Thursday PMMS rates are long expired before they ever hit the media. Maybe the market has held by the time the press covers it, maybe not. The only way to know is with a quote from your lender based specifically on you AND your property.

– PMMS rates are on Conforming loans up to $417,000. Super-Conforming loans up to $625,500 and Jumbo loans above $625,500 are excluded. Rates are higher for these loan tiers above $417,000.

– PMMS rates are on Conventional loans, and exclude FHA loans.

– PMMS rates are for single family homes, and exclude other property types like condos and duplexes. Rates are higher for these other property types.

– PMMS rates are for borrowers with at least 20% equity in their homes.

– PMMS rates are for owner-occupied homes only. Rates are higher for rental properties and (some) second homes.

– PMMS rates always include “points” to buy down the rates. Points are fees calculated as a percentage of loan amount, and these fees are on top of a normal set of closing costs. Many press reports leave out this critical fact—it’s critical because rates with zero points are higher. And also rates are higher for zero-cost loans.

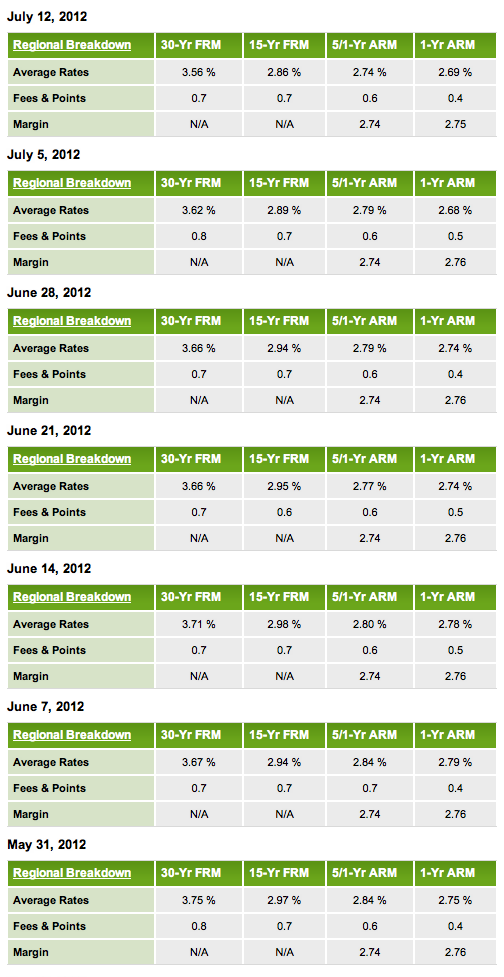

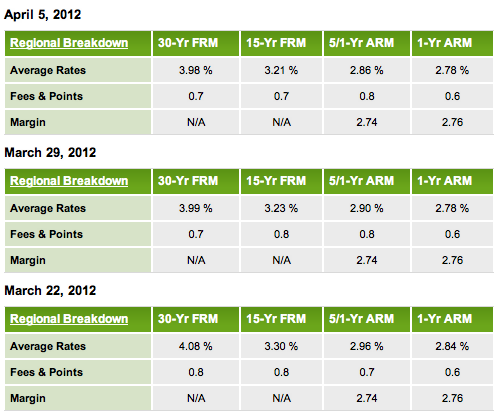

Below are tables showing Freddie Mac PMMS rates and points (on single family home loans to $417,000) for the past 4 months. To understand points, look at the July 12 points for the 30yr fixed: 0.7% x loan amount = fees on top of normal closing costs. So if you had a $400,000 loan at 0.7% points, you’d pay $2800 in points plus normal closing costs which are $2500-$4000 depending on your region.

The tables above include the rate low and high for 2012:

2012 Rate Low, reported July 12 (for week up to July 12): 3.56% with 0.7 points

2012 Rate High, reported March 22 (for week up to March 22): 4.08% with 0.8 points

This is a spread of .52%, which is certainly enough to check and see if you need to refinance. You need to account for two key things when reviewing options with your lender:

(1) How long will it take for savings from a new lower rate to repay closing costs on a refinance? Or can you just refinance with a zero-cost loan (which will have a slightly higher rate) and still end up with a lower rate?

(2) Is it better to wait because rates might drop further from here? Nobody knows the outlook. But the dire state of Europe and a questionable U.S. economic recovery will continue to drive global investors into U.S. mortgage bonds, which could push our rates lower as 2012 moves on. So a common play right now is to do a no-cost refinance, which enables you to refinance again near-term if rates drop, and do so without losing on fees. But each client profile and time horizon is different, so you need to run it down with your lender.

If you like to do the up-front math and analysis yourself before talking to your lender, I highly recommend The Economics of Refinancing report by bond veteran and PhD Andrew Kalotay (thanks to Reuters mortgage bond guru Adam Quinones for sharing this with me).

In his report, Kalotay explains how consumers can evaluate refi options using the same techniques bond investors use to make their decisions.

Sound intimidating? It’s not because it’s done in plain English starting at page 21 of the report.

Then once you’ve read the primer, you can use Kalotay’s ‘Should I Refinance?’ calculator.

And since you’re reading this online, you’re also potentially viewing some online rate quote sites like Zillow. There’s a whole different set of parameters for understanding whether those quotes are legit. I spoke to Zillow’s mortgage operations head Erin Lantz this morning, and I’ve got that segment of the rate shopping process down too.

But I’ll save that for next time.

Stay tuned: Twitter | Stocktwits | Facebook

___

Reference:

– Freddie Mac Weekly Rate Survey (THIS IS SOURCE MEDIA USES)

– How To Shop For A Mortgage (MortgageNewsDaily)

– The Economics Of Refinancing (scroll to page 21)