Originations: HARP Underwater Refi Qualifying Checklist & Advice

Today’s Originations linkfest is dedicated to the Home Affordable Refinance Program (HARP) that enables underwater homeowners to refinance. HARP was set to expire at the end of this year and has now been expanded to run through the end of 2015. Pay particular attention to links by fellow mortgage banker Dan Green who writes TheMortgageReports blog—he’s all over the latest HARP happenings. Also below are the 5 Key Questions To Ask Your Loan Officer About HARP Refis, a piece sent to me by another fellow mortgage banker Craig Reynolds.

HARP NEWS UPDATES

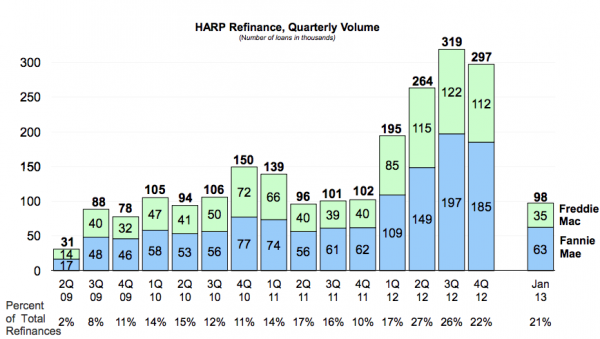

– Latest Stats on HARP Refi Volume (Christina Mlynski, HousingWire)

– Fannie Mae Regulator Extends HARP Refi Program Through 2015 (Clea Benson, Bloomberg)

HARP QUALIFYING GUIDELINES

– HARP Qualifying Checklist – Quick Reference Version (TheBasisPoint)

– The Complete HARP Eligibility Requirements AS OF 4/11/13 (Dan Green, TheMortgageReports)

– HARP 3: Proposed HARP Upgrades & Who May Qualify (Dan Green, TheMortgageReports)

+++++++

HARP REFINANCING: 5 KEY QUESTIONS TO ASK YOUR LOAN OFFICER

by Craig Reynolds

Are you thinking about HARP refinancing, but are not sure if you are eligible for this mortgage program? Have you tried to qualify for the HARP program without success? If your answer is “yes” to either of these questions, it is important that you not only educate yourself about the Home Affordable Refinance Program (HARP) qualification guidelines, but that you find a loan officer (LO) who has a complete understanding of these guidelines.

HARP was created for homeowners who have managed to stay on top of their mortgage payments, but who are underwater with a mortgage debt that is greater than what their home is currently worth. Depending on the situation, the HARP mortgage program may be the refinance option that will help save these homeowners – homeowners like you – from drowning.

That said, to take advantage of a HARP loan, you need to qualify. To determine your eligibility and to make certain that you have the right loan officer for the job, you need to ask your LO these 5 very important HARP refinancing questions:

(1) Does HARP refinancing apply to condos or rental property?

Yes, it can be used to refinance either a condo or rental property. Find a lender or a participating bank within the country that can make this happen. Do not settle for a lender who cannot or will not refinance these properties.

(2) Will you accept mortgage insurance transfers?

Your loan officer should accept mortgage insurance transfers, regardless of whether or not you have lender paid mortgage insurance (LPMI) or private mortgage insurance (PMI). If these are not accepted, find a LO who will accept mortgage insurance transfers.

(3) Do you have loan-to-value lending restrictions?

Some lenders follow old rules and implement a loan-to-value ratio (LTV) restriction of 105%. However, the LTV regulations for the HARP program have changed. There are only LTV restrictions on loans that are longer than a 30 year term and on adjustable rate mortgages. Other than that, as long as you have a new fixed rate mortgage loan that is less than or no longer than a 30 year term, you are not subject to limitations. Therefore, if your LTV is in excess of 105%, choose a lender who as access to higher LTVs.

(4) Does my current mortgage make me an eligible candidate for HARP refinancing?

To determine the answer to this question, your loan officer should know that in order to qualify, you are required to meet the following criteria:

– Your mortgage must be guaranteed or owned by Fannie Mae or Freddie Mac.

– You must be current on your mortgage payments for the last full year (12 months).

– You must not have previously refinanced under the Home Affordable Refinance Program, unless it was a HARP loan that occurred between March and May of 2009 and was refinanced by Fannie Mae.

– At present, your mortgage must have a LTV that exceeds 80%

– Your mortgage must have been sold to Freddie Mac or Fannie Mae on or prior to May 31, 2009.

(5) Is an appraisal needed?

An appraisal may not be necessary because you may be eligible for an appraisal waiver. Choose an LO who understands the proper procedure for entering your details using the Freddie Mac or Fannie Mae automated underwriting systems. This process will determine if you qualify for an appraisal waiver and it is something that your LO should do.

Keep the above five questions in mind when you head to a loan officer to determine your HARP refinancing eligibility. Not all lenders have the proper understanding of HARP qualification guidelines. In fact, there have been cases where lenders have created underwriting overlays that caused the homeowner to be denied, when in actuality the homeowner met the program’s guidelines.

Thus, by being armed with the right information, you can find a professional who has the necessary HARP program knowledge and experience and will be able to act in your best interests.

Craig Reynolds is a seasoned mortgage industry veteran with over 15 years experience in managing and loan consulting. More info here.

___

Follow The Authors:

@mortgagereports, @cleabenson, @housingwire, @ChristinaMlynsk, @AlliedMtgDirect