Rare moment: buyers market and 1-year mortgage rate lows

We’re in a rare moment: rates hovering near one-year lows of 4.5%, and homebuyers aren’t having terms dictated to them by sellers for the first time in years.

Low inventory and years of home prices climbing back from the crash made most markets so tight that buyer bidding wars prevailed, but now way fewer homes sell over asking price and bidding wars have nearly vanished.

And again: rates are ridiculously low. Not as absurdly low as 3.5% range we had in mid-2016, but 4.5% is still ridiculously cheap money.

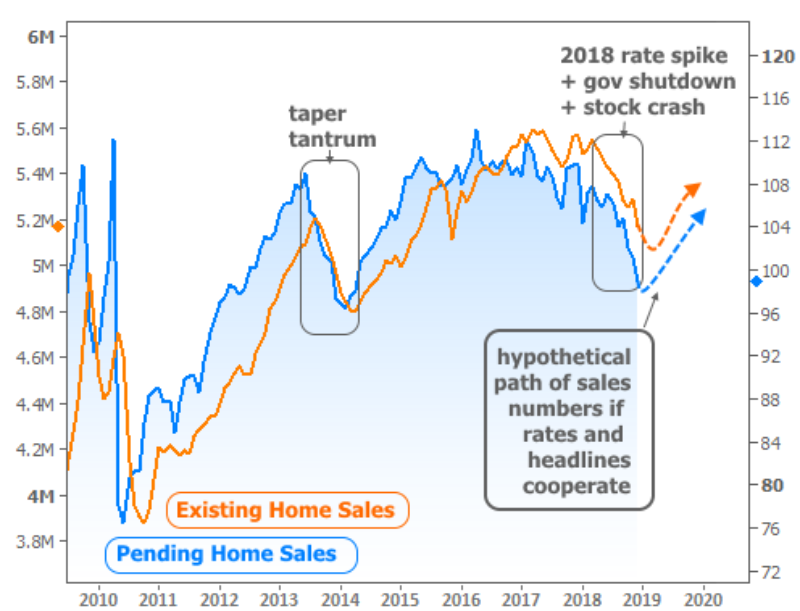

As we look forward from here, I point you to Matt Graham at Mortgage News Daily as I do every week, because he’s all over this stuff, and Friday he shared the most interesting chart in weeks. It shows the reaction of NAR’s Existing Home Sales (where home sales have been) and Pending Home Sales (where home sales might go) to two big rate shocks.

The first rate shock was back in 2013, when rates spiked because the Fed repositioned how it was buying bonds to help rate markets. As you can see, Existing and Pending Home Sales dropped sharply, but then recovered as markets shook off the initial shock.

The second rate shock was in October/November when rates hit seven year highs plus we had a massive stock selloff followed by government shutdown. You can see how home sales dropped off during this period as well, you can also see his hypothetical recovery path if rates and other macro factors cooperate.

And for now, it’s a buyers market with super low rates.

___

Reference:

– Why 2019 Could Be Great For Housing & Mortgage Markets (Mortgage News Daily)

– Mortgage Rates In A Holding Pattern (Mortgage News Daily)