Rate Spike Last 2 Days: Here’s Why

Lots of red in this mortgage backed security (MBS) table from MortgageNewsDaily.

Lots of red in this mortgage backed security (MBS) table from MortgageNewsDaily.

Rates rise when bonds sell, and that’s what’s been happening the past two days.

Today was looking a lot worse for the Fannie 30yr 3.5 MBS coupon that serves as a benchmark for lenders to price consumer rates. It was down as much as 47 basis points, but as the table shows, we ended down only 16.

Combined with yesterday, that makes a loss of 53 basis points, which is has caused consumer mortgage rates to rise about .25%.

The reason is that the Greek bailout appears less bumpy, and there’s been enough positive U.S. economic data to encourage risk-on sentiment—aka bond selling.

That’s a big spike for 2 days, but the recovery today is critical because it took MBS back above the 50-day moving average and that’s a positive signal we may level off or improve.

There’s no data tomorrow, but there was lots today, summarized in simple bulles below.

Initial Jobless Claims

-351,000 for week ended February 24

-Down 2,000 from previous week’s 353,000

-4-week moving average 354,000, down 5,500

-Lowest level since March 2008

-But this report doesn’t count jobs added

-We’ll learn that with BLS jobs report Friday 2/9

Personal Income and Outlays (January 2012)

-Personal Income, Month/Month +0.3%

-Personal Income, Year/Year +3.6%

-Consumer Spending, Month/Month +0.2%

-Consumer Spending, Year/Year 3.8%

-In fact, real (inflation adjusted) income dropped and real spending has been flat for 3 months.

–BEA report here and chart below

Personal Consumption Expenditures Index: Consumer Inflation (January 2011)

-PCE All, Month/Month +0.2%

-PCE Core (excluding food & energy), Month/Month +0.2%

-PCE All, Year/Year +2.4%

-PCE Core (excluding food & energy), Year/Year +1.9%

-This is Fed’s preferred consumer inflation measure, and it continues to be flat

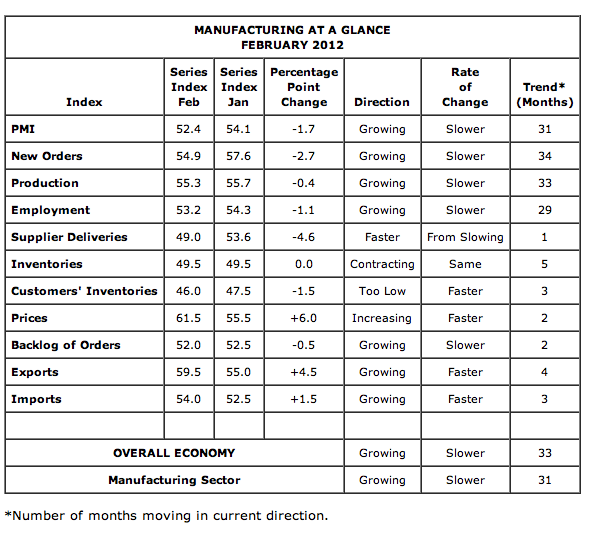

ISM Manufacturing Index (February 2012)

-ISM Manufacturing Index 52.4. Previous was 54.1.

This could indicate supply side slowing to adjust for weak demand in Dec & Jan

-50 is dividing line between expansion and contraction

-This is the 31st straight month of (albeit modest) expansion

-Here’s a summary of all ISM Manufacturing trends:

Construction Spending

-Construction Spending, Month/Month -0.1%

-Construction Spending, Year/Year 7.1%

___

Stay tuned on Twitter and Facebook.

WeeklyBasis rate market recap/outlook coming Saturday. Also watch daily Fundamentals.