Rates Steady As U.S. Jobs & Greece Balance Out: Report/Charts

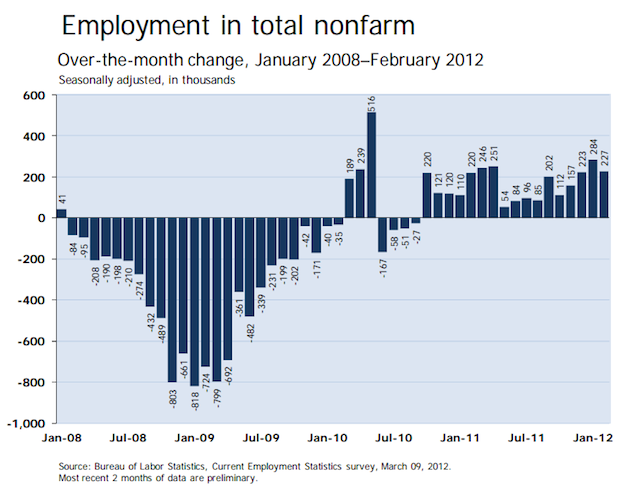

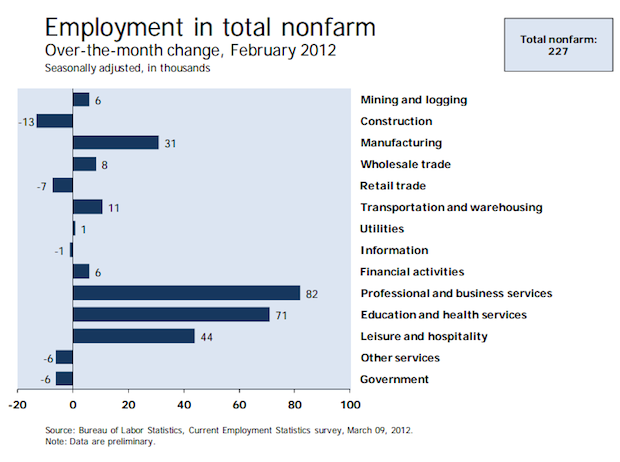

This morning’s BLS report showed the U.S. economy added 227k non-farm payrolls in February, topping most expectations of around 210k. Also January was revised from 243k to 284k new jobs created and December was revised from 203k to 223k. In total, this shows 61k more jobs created than previously reported.

Over the last two years, non-farm payrolls have added 3.5m jobs. Of the 8.8m net jobs lost between the official recession start date of January 2008 and February 2010, 40% have been recovered.

This non-farm payrolls figure doesn’t count actual people, it counts how many companies opened or closed, then uses that data to estimate the number of jobs gained or lost.

Unemployment held at 8.3% according to a different part of the jobs report called the ‘Household Survey’ which counts people. This is the lowest since February 2009.

Rate Reaction & The Greece Factor

Rates rise when mortgage bonds (MBS) sell, and MBS initially sold after the news but have recovered and are about even on the day.

The 3.5% Fannie Mae coupon—a key benchmark lenders use to price consumer rates—is hovering around +5 basis points which translates into flat rates if this position holds.

The reason MBS aren’t selling on the better U.S. jobs report is because Greece also reached a debt deal with their private investors … if you can call it that.

The deal required that most private investors agree to take massive losses on a bond swap deal that’s a pre-condition of Greece receiving bailout fundes needed by March 20.

About 86% of private investors agreed voluntarily but they need more. So Greece is forcing the holdouts to get to around 96%. Doing so is likely to trigger payments on credit insurance—aka credit default swaps or CDS—that investors receive in the event of a default.

The body that decides if the CDS will be triggered is expected to do so later today.

The total payments are expected to be around $3b, which is considered small, but it’s uncertainty. And uncertainty keeps safe haven assets like MBS in favor, which keeps rates from spiking.

I’ll also reiterate what I said last night: Even with a better jobs report rates are unlikely to spike because…

… uncertainty about Greece’s machinations ahead of March 20 will keep a lid on selling safe haven assets like MBS—that and longer-term facts like: this doesn’t solve Greece’s root issues, and even larger debt trouble looms for other Eurozone nations.

[UPDATE 2:55pm ET: It’s official, CDS will be triggered. As noted above, the payouts on Greek CDS are not considered to be massive. But it’s a validation that Eurozone debt trouble is long-term and no single deal will solve the problem—so the trade after this news is to seek safety: MBS have moved up from +5 basis points to about +16 basis points on the day, not a big rally, but it’s possible some lenders may improve rates before the end of today if the rally holds.]

___

Further Reference:

–BLS January Jobs Report

–FT: Greek Deal Allows Bailout: Athens To Squeeze Dissenters, Trigger Credit Event

-Next week’s rate outlook in WeeklyBasis tomorrow, and deeper dive on jobs report shortly.