Rates Up Slightly. EU problems Disguise Domestic Problems.

Apart from 2Q2011, the entire recovery has been very weak.

Concern about Greece in particular and the broader eurozone has sent the euro to a two year low v. the US dollar. The sad thing is that consequently the US is not seeing the cost of its massive deficits because Treasury borrowing costs are so low. Some day, two or three years from now buyers of US Treasury debt are going to demand higher yields. We may be seeing a debasement of fiat currencies in general. At present the US dollar simply isn’t as debased as the euro.

And as for today’s U.S. data, here’s a rundown. Treasuries and mortgage bonds (MBS) selling off slightly, pushing rates up a bit.

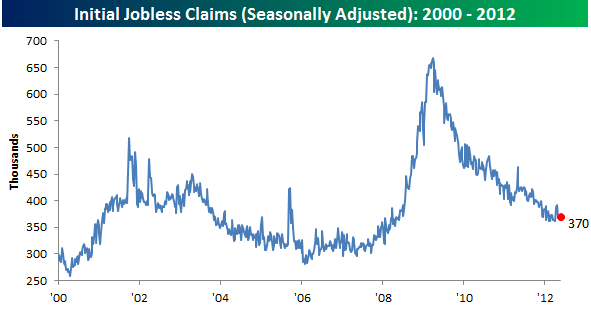

Jobless Claims (week ended 5/19/2012)

– Initial Claims were 370,000.

– Previous was 372,000 revised up from 370,000

– 4-week Moving Average was 370,000 down from 375,000, lowest since April 6

– Job market isn’t as bad as it was but still not healthy

– Massive deficits and accomodative-to-the max-monetary policy have done little

– Here’s full report and below is a chart from Bespoke:

Durable Gods Orders (April 2012)

– New Orders, Month/Month 0.2%

– New Orders, Year/Year 6.9%

– Ex-transportation (core), Month/Month -0.6%

– Ex-transportation (core), Year/Year 6.3%

– DGO is a bouncy piece of data thus difficult to parse but the core Month/Month is another sign that recovery is weak.