Rates up to 5% on higher November data: Business Inflation +.8%, Retail Sales +.8%

Hotter than expected November business inflation and retail sales are causing a massive 70 basis point mortgage bond selloff this morning, and rates rise when bond prices drop in a selloff. If this selloff holds, 30yr fixed rates will settle at 5%. We’ll get the Fed’s latest views on economic growth, inflation and rate policy at 11:15 PT today. If they change their language to one of more economic optimism, this rate spike will hold.

Hotter than expected November business inflation and retail sales are causing a massive 70 basis point mortgage bond selloff this morning, and rates rise when bond prices drop in a selloff. If this selloff holds, 30yr fixed rates will settle at 5%. We’ll get the Fed’s latest views on economic growth, inflation and rate policy at 11:15 PT today. If they change their language to one of more economic optimism, this rate spike will hold.

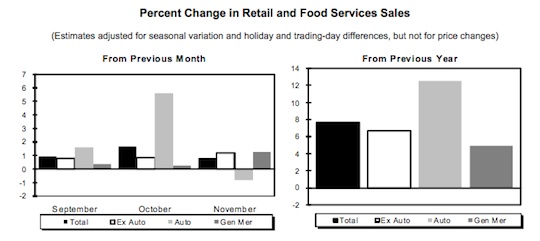

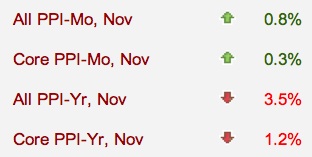

November producer prices, which measure business and manufacturing inflation, were up .8% versus October and 3.5% higher than November 2009. Excluding volatile oil and food costs, “Core” PPI for November was up 0.3% versus October and 1.2% higher than November 2009. While the year-over-year numbers are down, the monthly number of .8% was double September and October figures, and the highest since 1Q2010. Bond markets are wary of this and China’s blistering inflation report Sunday because inflation erodes future bond returns. November Retail Sales were $378.7 billion, an increase of .8% versus October and 7.7% higher than November 2009. These numbers reflect improved figures for Black Friday and Cyber Monday holiday shopping.