Should Homeowners Use Derivatives To Hedge Home Price Risk?

In June 2009, publicly available housing derivatives were launched by Robert Shiller and Karl Case, the economists who run the most widely followed U.S. home price indicator: the S&P Case Shiller Index. The products are called MacroShares, and are essentially options any investor can use to make bets about whether home prices will rise or fall. The theory is that these options could serve as home equity insurance to protect homeowners from market fluctuations.

Of course, many don’t want to hear talk of housing derivatives so soon after reckless lending and (unregulated) derivatives caused a global financial crisis, but like Shiller said in his (worth reading) 2008 book, The Subprime Solution:

The current financial crisis is often viewed as a reason to sound retreat, to return to yesterday’s simpler methods of financial dealing. This would be a mistake. Options are widely thought of by the public as financial gimmicks for reckless investors, when in fact they are effective devices for spreading and canceling risks.

Protecting Home Equity Without Moral Hazard

The reason you’d have this ‘home equity insurance’ in the form of a securitized option rather than a simple insurance contract on your individual home is to avoid moral hazard. Shiller rightly argues that if people had home equity insurance directly on the selling price of their own home, the homeowner could easily lose incentive to maintain the home or negotiate the best price when selling because any loss would be incurred by the insurance company.

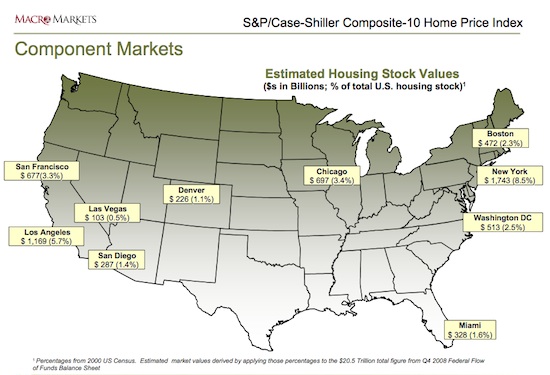

This is why MacroShares were created. They implement the concept of home equity insurance using the aggregate value of homes in a city—currently defined by the Case Shiller 10-City Composite—so that the moral hazard of an individual policy is avoided. The 10 “Cities,” as we note in our monthly Case Shiller coverage, are actually 10 broad metropolitan areas including: New York, San Diego, San Francisco, Washington, D.C., Boston, Chicago, Denver, Las Vegas, Los Angeles, and Miami. Below is a map showing national percentage values of each region.

How MacroShares Work, Safety Measures

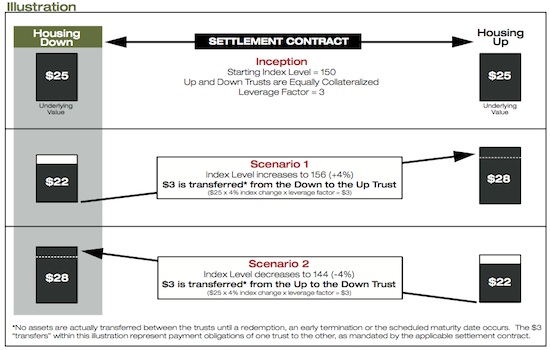

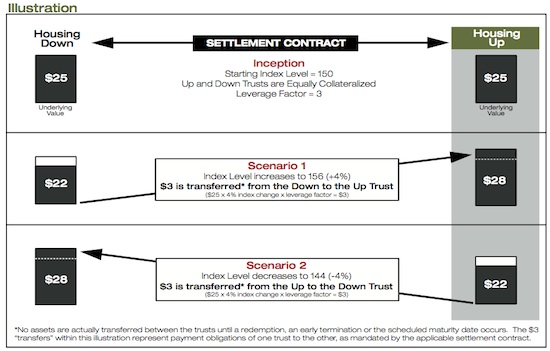

One of the big selling points of MacroShares is that they’re exchange traded so they have daily liquidity unlike home prices. As for risk management, they’re unlike many other derivatives because investors pay for their position up front so there’s no counterparty risk (like there was with the CDS debacle at the core of the crisis). And MacroShares are issued in pairs, one for the rising price bet and one for the falling price bet, so every bet has an offsetting investment. Below are two examples of how the shares work for betting on a down or up market. They’re from the down and up MacroShares fact sheets.

Housing Derivatives: Betting on Price Decreases

Housing Derivatives: Betting on Price Increases

Mainstream Adoption Slow…So Far

The MacroShares concept hasn’t captured mainstream attention yet, but it’s not something that’s going away because it’s a responsible implementation of homeowner risk management. The trick for mainstream adoption is clarity on how it works, and that clarity will only come if people learn about it in the right context.

This piece is a simple introduction to the concept but until a product like this can be wrapped into the home sales and financing process, it’s just not going to have enough relevant context for a homeowner to get on board. In order to do that, Case Shiller and company will probably need to roll out more specific location-based shares. Then mortgage banks will also need to integrate a product like this into the traditional loan offering—and perhaps offer lower rates for those who choose this hedging add-on to their mortgage because the hedging would reduce risk for everyone involved.