Size of U.S. residential real estate market is $27 trillion in 2019

It’s Monday and we know you’re not working, so let’s wrap our heads around just how big the U.S. housing market is.

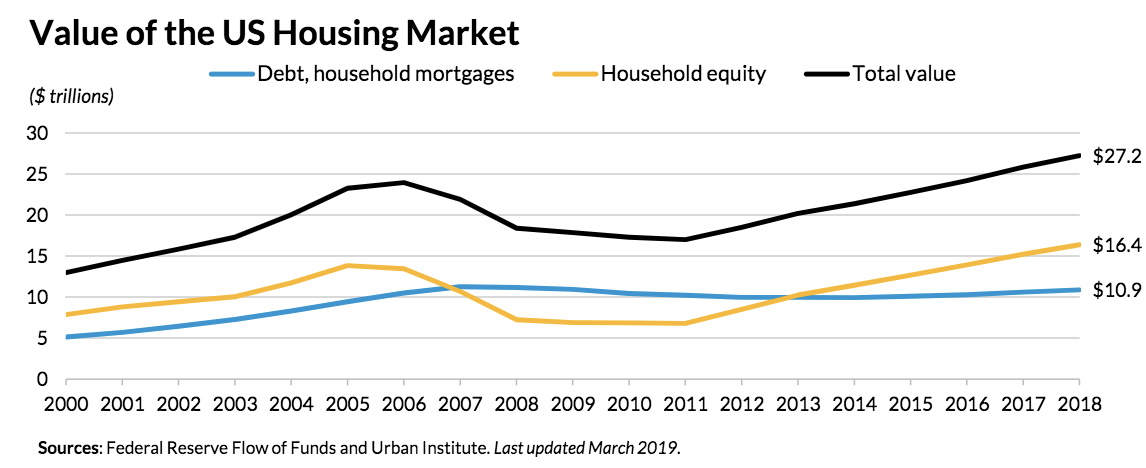

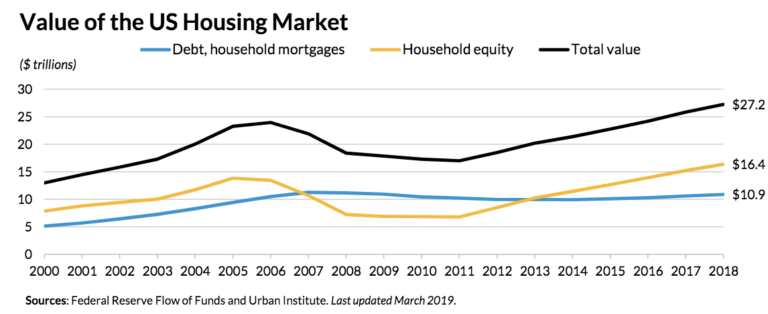

The total value of the U.S. real estate market is $27.2 trillion dollars.

Let’s do 3 comparisons to put this in perspective.

First, U.S. GDP—the total value of our economic output in 2018—was $21.5 trillion. Housing is $5.7 trillion bigger than that.

Second, it’s staggering that the America’s 3 biggest companies are worth $3 trillion and the U.S. stock market is worth over $30 trillion. But you start to realize how important housing is because it’s backed by hard assets.

Which brings us to the third and most important point:

How much of their homes do Americans actually own?

This is important because there are two critical quantitative measures lenders use to make people loans.

1. Loan To Value Ratio (LTV). This is loan amount divided by home value at the time you purchase a home. Most lenders will let you put down as little as 3% to buy a home, in which case your LTV is 97% and you own 3% of your home until the valuation eventually grows. If you’re a veteran, you can get 100% financing, which means your LTV is 100% and you own 0% of your home until the valuation eventually grows.

2. Debt To Income Ratio (DTI). This is your total monthly housing and non-housing bills divided by your total monthly income. Most lenders follow base guidelines that will allow your loan to be approved if your monthly debt 43% or less of your monthly income. But they mortgage system in America will allow exceptions to approve your loan even if your monthly debt goes up to 50% of your monthly income. One of the biggest ways these exceptions are made is if your LTV is really low.

Why is this important?

Because if people have more equity in their homes, there’s less risk in the system.

So let’s look at the LTV of the American housing market to see if the system is OK.

We know the total value of American homes is $27.2 trillion, and the total balance of mortgages outstanding is $10.9 trillion.

This means the national loan to value ratio of the American housing market is 40%.

Compared to the allowable loan standards noted above, this is extremely low.

It means Americans actually own 60% of their homes, which is near record highs. This is a positive note for the safety of the system. As is the loan quality of the past 10 years, and the fact that only 1.1% of mortgages are 90+ days delinquent.

___

Reference:

– Housing Finance At A Glance: A Monthly Chartbook, April 2019 (Urban Institute)