STAT FIGHT! Student debt not a systemic problem, just a whiny millennial problem

Parents, are you sick of your kids complaining about their student loans?

Millennials, is the system preventing your graduation from student debt to mortgage debt?

Well, get ready to cry “fake news” at each other, because we’re about to have a STAT FIGHT!

Millennials followed the go-to-school-to-get-a-better-job routine, but school got way more expensive for our gen, so we pushed U.S. student debt to a record $1.46 trillion and landed in the work 25/8 economy.

With so little career stability, we live in fear our student debt could take us out after a few bad months. So employers need to offer more pay instead of weird benefits or the system will collapse, right?

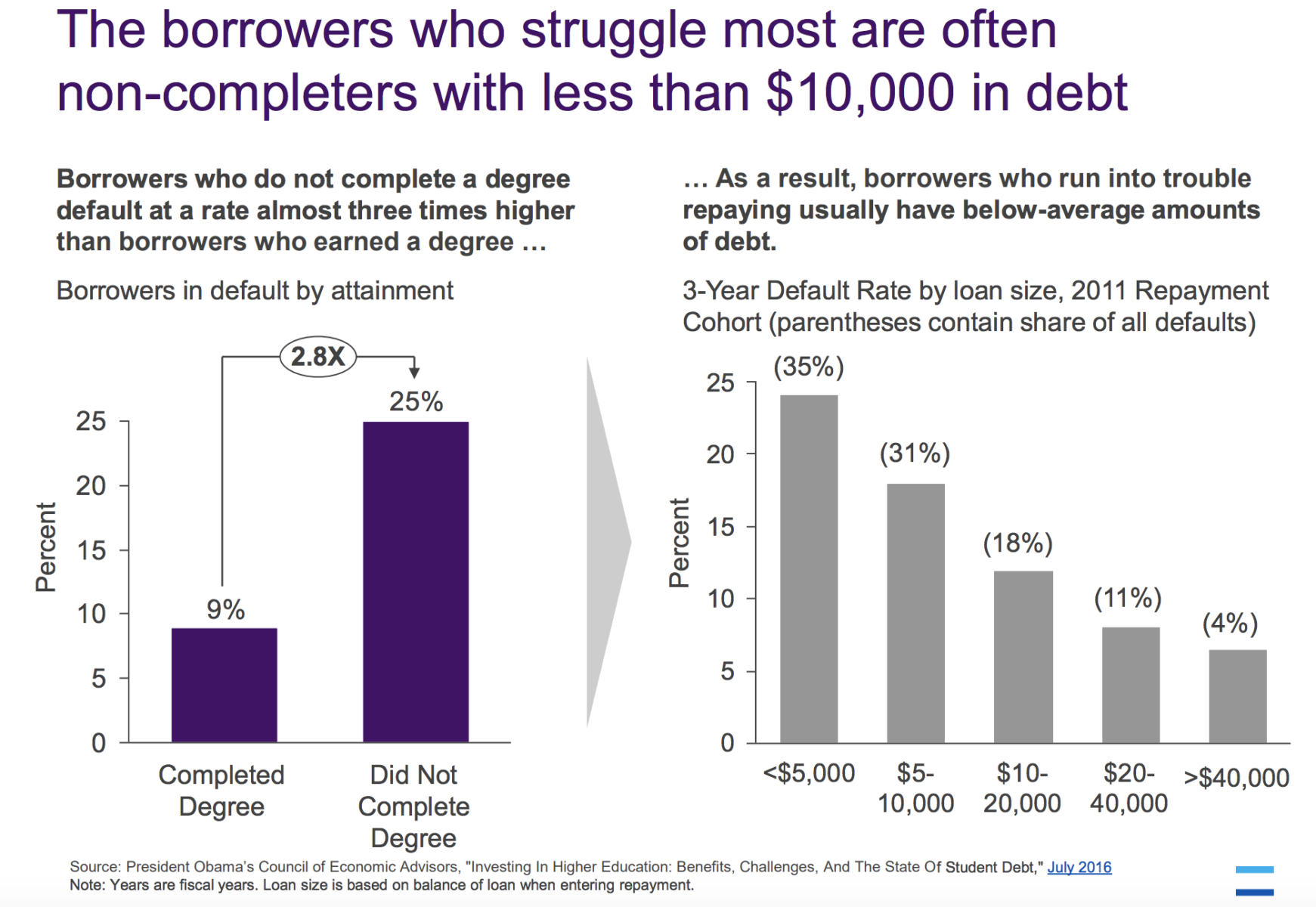

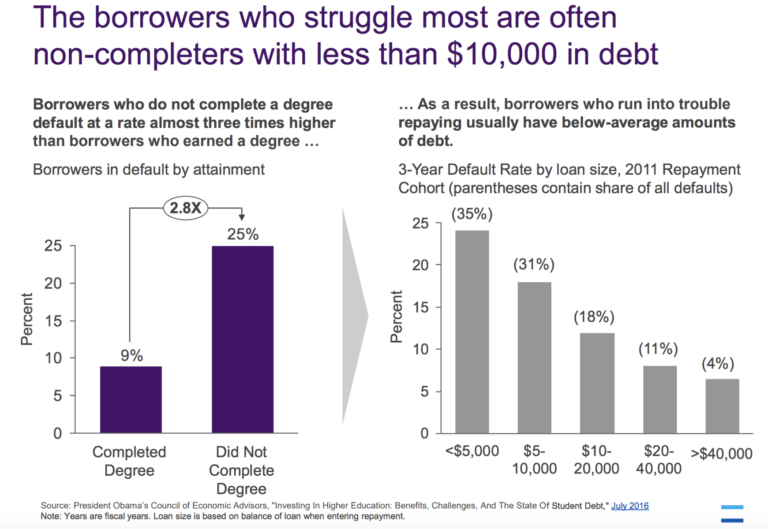

“Grow up,” say our parents as they roll their eyes to the chart above from huge student lender Navient.

It shows student loan defaulters generally didn’t finish school, and don’t have a ton of debt to begin with. Only 4% of people who default have more than $40k in debt, and 66% of people who default had less than $10k in debt.

So we don’t have a systemic problem here, just a whiny millennial problem.

And that’s where we hand it off to you—study up on these charts and come strapped for a STAT FIGHT at dinner tonight.

___

Reference:

– Full Year Earnings Report (Navient)