TARP Update: Which Banks Have and Haven’t Repaid. IMF Urges More Europe Support.

TARP Update

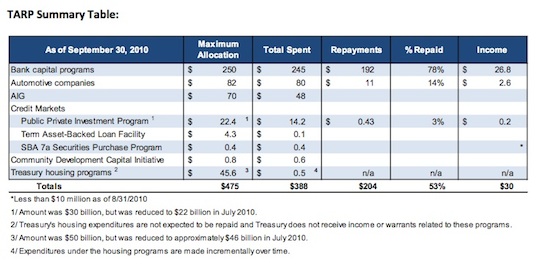

Below is a Treasury chart of TARP payoffs from their 3Q2010 TARP update. Also the FT reports that according to Treasury officials, 122 TARP recipients have now repaid all or a portion of their government aid. The FT story also said: “Bank of America has told US regulators that it has sold enough assets this year to meet the final condition that was set on its landmark plan to repay $45 billion in government bail-out funding. BofA was given until the end of this year to record the gains. US regulators believe the move will help build the bank’s equity as it regains its footing after leaving the government’s troubled asset relief program (TARP) in 2009.” Apparently cutting back its stake in BlackRock and interest in China Construction Bank has BofA close to $3 billion.

The unemployment data from Friday morning gave the press something to talk about for the remainder of the weekend. Mortgages better by about .125 on volume that was a shade less than normal. One would expect volumes to drop off a little, as anyone who locked on Thursday regretted it and anyone who didn’t hoped for further improvement Monday. Basically, the Non-farm Payroll number was disappointing, regardless of the spin government officials put on it. Private payrolls are the weakest since January. After that we learned that Factory Orders fell .9% in October, worse than expected, but the ISM Non-manufacturing Index rose in November. At least the mortgage markets “caught a bid” after the employment data. Treasuries were quickly off to the races but we still have the overseas issues with which to grapple, along with this week’s 3-yr, 10-yr, and 30-yr supply and very little in the way of scheduled US economic news. Fed Chairman Bernanke was on “60 Minutes” last night, saying that the Fed is prepared to do more if need be.

Some folks may be happy to find out that there is no scheduled economic news today or tomorrow. And even on Wednesday the only pseudo-economic release is the MBA’s application index; Thursday is Initial Jobless Claims. Friday we’ll see some trade figures, and a Michigan Consumer Sentiment number. Overseas, a report from Reuters on the IMF suggests that, “The euro zone should have a bigger rescue fund and the European Central Bank should boost its bond buying to prevent the sovereign debt crisis from derailing economic recovery.” And this week we have central banks meeting in Australia, Canada, New Zealand and the UK which might arouse some interest. We find the 10-yr at 2.96% and mortgage prices are better by .250 or more.