TIMELINE: The Rise of iPhone & Twitter And The Fall Of Finance & Mortgage Rates

As financial markets froze this very week in 2007, the real-time media market was catching fire. So instead of summarizing it all with a 140 character Tweet, below we offer some broader perspective by bringing everyone’s favorite obsessions together: mortgage rates, Twitter, and iPhones. Stat-filled timeline and rate chart are included.

Home prices started falling in 2006 but it wasn’t until 2007 that the full impact of loose credit was felt. Loans made to unqualified (mostly U.S.) borrowers underpinned bond funds around the globe and countless derivatives were created from those bonds. Because of this, Nouriel Roubini was one of the first economists to note that “we have a subprime financial system, not a subprime mortgage market.”

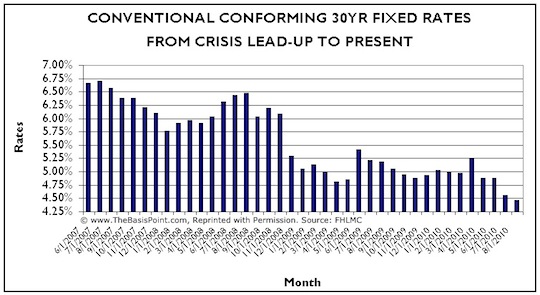

Below are key rate milestones of the financial crisis along with key milestones in real-time media development—the correlations are coincidental but show that, as the crisis escalated, so did the chatter. Also below is a chart to show rates along this timeline (click chart for full size).

April 2, 2007: Credit crunch apparent when New Century, one of the largest U.S. subprime mortgage lenders, failed. Twitter’s tipping point was two weeks prior, March 14-18, when Twitter went from 20,000 to 60,000 tweets per day at the South By Southwest music festival. Average 30yr fixed conforming rates were 6.18%.

June 22, 2007: Two Bear Stearns subprime hedge funds collapsed. Apple’s iPhone, widely considered the catalyst of real-time media, released seven days later on June 29. 30yr fixed rates were 6.66%.

August 6, 2007: American Home Mortgage, the 10th largest U.S. mortgage lender, failed, triggering a global credit market freeze and a series of overnight Fed rate cuts from 5.25% in September 2007 to 1% in November 2008. 30yr fixed rates were 6.57%.

November 24, 2008: Realizing that drastic overnight rate cuts throughout 2008 weren’t helping long-term mortgage rates, Fed announced $500b mortgage bond buying program. 30yr fixed rates were 6.09%.

January 1, 2009: Fed’s mortgage bond buying program began. Twitter stats reported 100 million tweets per quarter in 2008. 30yr fixed rates were 5.05%.

March 18, 2009: Fed increased mortgage bond buying program to $1.25t. Two weeks later (and again in November 2009), 30yr fixed rates hit 4.78%, the lowest since official records started in 1971.

March 31, 2010: Fed mortgage bond buying program ended. Rates moved up .25% in two days. Varying reports showed 25-35 million iPhones sold in 2009. Twitter stats showed 4 billion tweets in the first quarter of 2010. 30yr fixed rates were 5.125%.

June 7, 2010: iPhone mania reached new peak when Apple (fresh off surpassing Microsoft in market cap on May 26 to become the world’s most valuable tech company) announced iPhone 4 with two cameras, video calling, and multitasking to run several apps simultaneously. After May 6 Greece bailout triggered European debt crisis, global investors flocked to U.S. mortgage and Treasury bonds four straight weeks. The rally again drove 30yr fixed rates down to record lows of 4.78%.

August 12, 2010: Up to this day, U.S. economy posted two months of weaker jobs, GDP, home prices, and consumer sentiment. Mortgage and Treasury bond rally continued full steam. Twitter said it has 65 million tweets per day (which is 23.7 billion annualized). 30yr fixed rates set a new all-time record low of 4.44%.

Which brings us to today: Some say the U.S. is bankrupt. But for now U.S. Treasury and mortgage bonds remain the safe haven of choice for global investors. As such, consumers who qualify for home loans are enjoying the low rates that result from this unprecedented mortgage bond rally.

Rates will rise from here, it’s just a matter of when. And the volume of chatter is certain to rise as technology continues to improve. So as you scroll headlines on your iPhone while sitting at a stoplight, remember to actually stop at some point to make sure you understand rate and property markets before making important decisions. Following TheBasisPoint on Twitter can help … now look up … green light!