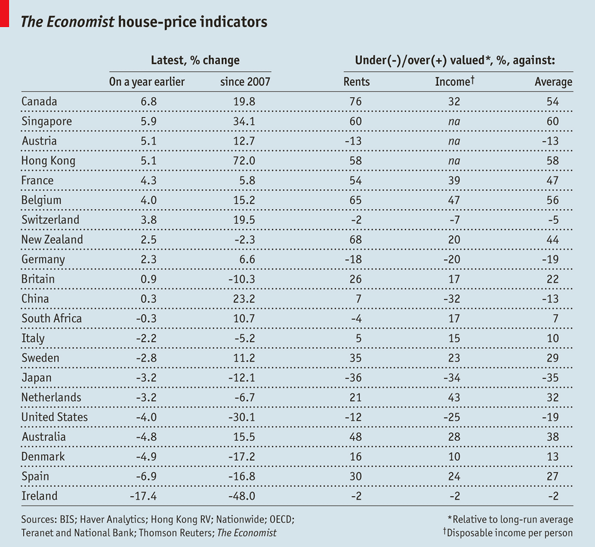

U.S. Home Prices 19% Below Fair Value

The Economist defines fair value of housing as the long-run average of two measures:

the price-to-income ratio, a gauge of affordability, and the price-to-rents ratio, an analogue of the price-to-earnings ratio used to judge the equity value of listed firms.

By these measures, here’s their table on key undervalued/overvalued countries.

Note the U.S. is 19% below fair value.

That said, the U.S. is an absurdly large sample size, as I discussed last week.

That piece was the latest in my series on how to price a home locally. It’s a must-read on methodology of national home pricing, and why lacks local relevance.

___

Source:

–Downdraft: Global House Prices (Economist)

–Interactive Tool: Global Home Prices & Rents (Economist)