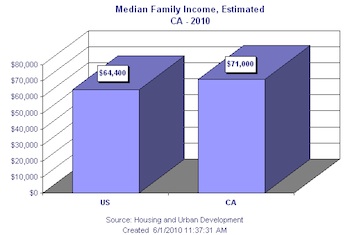

Will Former Countrywide Head Get Away Clean?, CHART: Median Income CA vs US, Market Roundup

Median Income for CA vs. US

The FDIC does more than shut down banks on Fridays. It produces the Regional Economic Conditions (RECON) report that details economic information at the state, MSA (Metropolitan Statistical Area), and county levels. It is helpful to analyze risks facing banks and also for consumers to get a basic look at core stats in their area. For example, here’s a chart on the median income in California and the U.S. You can get this or tons of other stats for every state.

The FDIC does more than shut down banks on Fridays. It produces the Regional Economic Conditions (RECON) report that details economic information at the state, MSA (Metropolitan Statistical Area), and county levels. It is helpful to analyze risks facing banks and also for consumers to get a basic look at core stats in their area. For example, here’s a chart on the median income in California and the U.S. You can get this or tons of other stats for every state.

Will Former Countrywide Head Get Away Clean?

Angelo Mozilo’s civil fraud case is scheduled to go to trial on Tuesday, but according to the WSJ, he and the SEC are in discussions to settle the case. The case focuses on Mozilo, former Countrywide President David Sambol and former Chief Financial Officer Eric Sieracki failing to disclose the true state of Countrywide’s deteriorating mortgage portfolio. [UPDATE: Mozilo settled for a $67.5 million fine, the highest ever for an executive of a public company.]

Foreclosure Mess Summarized

The delay in foreclosures is not a good thing. Yes, foreclosures are a bad thing, but delaying it is even worse. This weekend, when you’re at the Halloween craft fair (or “faire” if you live in a high income area), and someone asks you, “What’s the big deal?” you can explain it like this. Those servicing companies who have put a moratorium on foreclosing on the property often times still owe the ultimate investor the scheduled monthly interest, based on their contract. And if the loan is possibly subject to a buyback situation, the originator of the loan (whoever sold it to Chase, for example) is certainly going to argue that it is not “on the hook” for interest charges that Chase voluntarily stopped making and thus owed.

The current foreclosure issues certainly increase uncertainty – and markets don’t like uncertainty. Bank stocks are down, and they continue to hold on to trillions of “lendable” money because of nervousness about the future. Chase announced that it would now be reviewing 115,000 foreclosure cases in 41 states. PHH’s president and CEO stated, “PHH Mortgage is actively cooperating with its regulators, is responding to such inquiries and has completed a comprehensive review of its foreclosure procedures. Based on this review, PHH Mortgage has not halted foreclosures in any states and has no plans to initiate a foreclosure moratorium.”

On the title company side of things, to secure title insurance on foreclosure sales, Bank of America has agreed to indemnify Fidelity National Financial if the title is challenged due to robo-signings and other improper foreclosure processing practices. So going forward, Fidelity will provide title insurance on the sale of foreclosed properties. Fidelity will defend the new homeowner in court if a foreclosed owner challenges the title, and BofA will cover the costs and any damages awarded to the previous owner.

Rates Up This Week

Thursday was not a good day for stocks or bonds. The primary impetus for the sell off was a poor 30-yr auction, which is somewhat unusual. Are investors growing weary/wary of owning a large amount of US debt? This was a poor week for UST supply as each auction saw “below average indirect/direct bidding, pushing dealers to buy a larger portion of each auction than they had planned. Yesterday the 10-year note lost about .5 in price, and has lost about a point in price this week with the yield hitting 2.49%. Mortgages worsened about .125 in price, and supply from mortgage bankers picked up.

We have already had a lot of economic news. The Consumer Price Index came out +.1%, and ex-food and energy it was unchanged. Retail Sales came out +.6%, ex-autos it was up .4%. (Apparently my Sky Mall purchases of the “Glow in the Dark Cat Litter Box” and “Eavesdrop on Your Office Mate Listening Device” helped.) These numbers were pretty close to expected. Ahead of us we have the Empire State Manufacturing and preliminary October Michigan Sentiment numbers, along with Business Inventories.

All of this, however, doesn’t seem quite as important as Fed Chairman Bernanke’s comments on monetary policy at a Boston Fed conference. The timing of this speech is critical, because markets are largely discounting some form of QE2 at the November FOMC meeting. The text of Bernanke’s speech was released already, making the actual speech more of a ceremony. The text could shift markets for the rest of the day as folks pick it apart, but the basic sentence could be, “Additional monetary stimulus may be warranted because inflation is too low and unemployment is too high.” So far, since the speech, stocks have rallied, and fixed-income securities (like mortgage prices) are roughly unchanged but volatile with the 10-yr at 2.50%.