2 charts to check Fed pulse ahead of May 3 rate policy meeting

Howard Schneider at Reuters offers a pulse check ahead of the Fed’s next rate policy meeting May 2-3, and 2 charts are worth calling out.

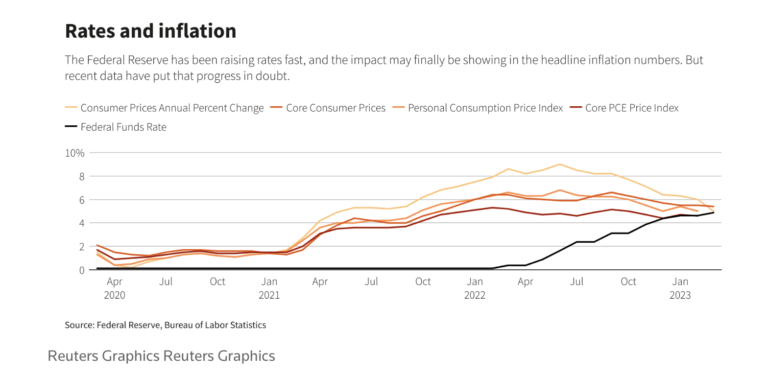

Above is a chart with CPI and PCE inflation — both overall and core which excludes volatile food and energy prices — compared to the Fed’s overnight bank-to-bank lending rates.

The chart says it all: inflation is generally cooling as Fed hikes rise.

This may not be enough for the Fed to pause May 3, but we do get one more PCE and Core PCE reading on Friday, April 28.

When this PCE inflation report came out last month, we provided 12 months of PCE inflation to show when inflation peaked:

Inflation Peaked When Rapper Ice-T’s Gas Station Robbery Went Viral

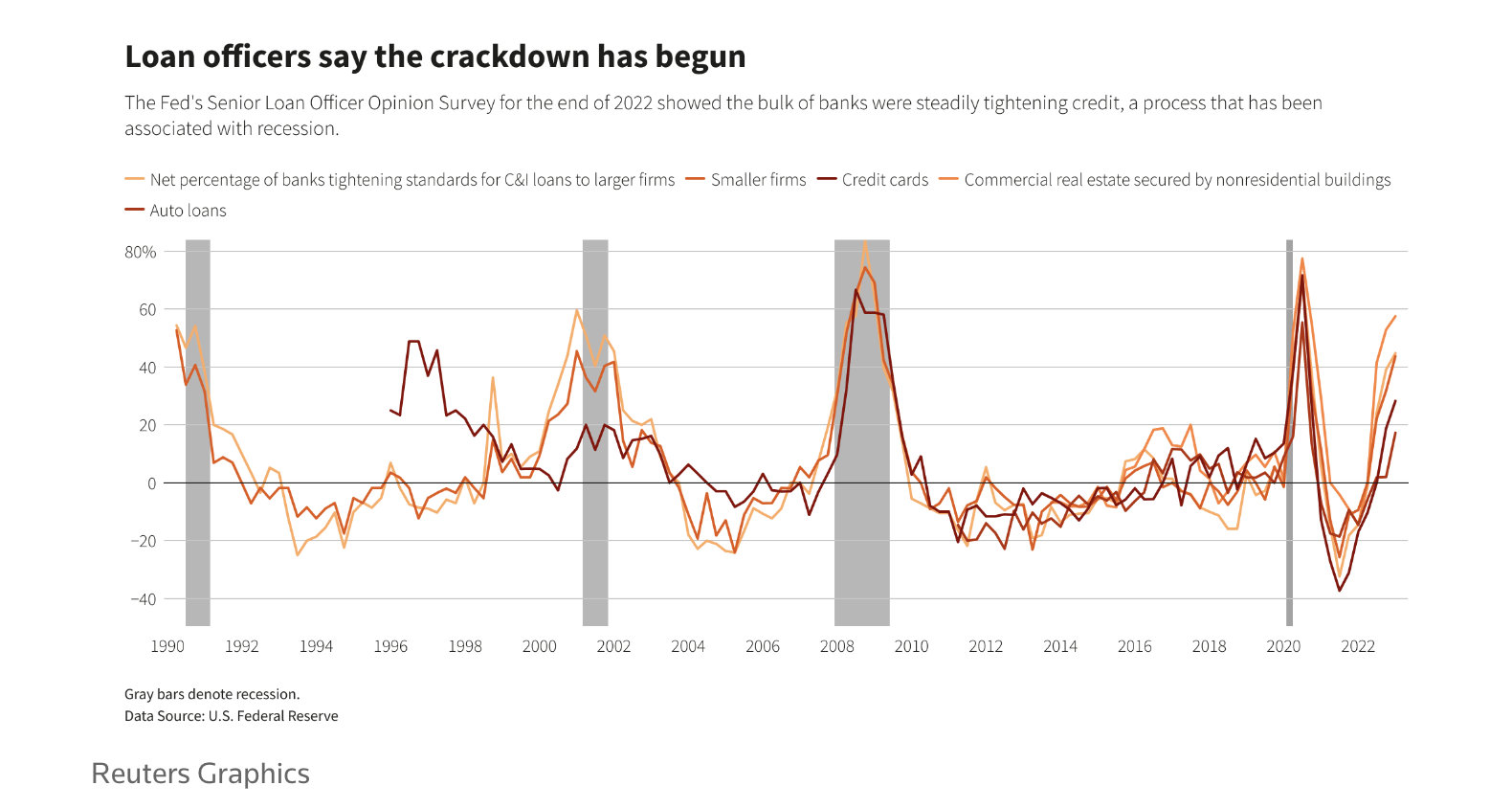

Howard also notes that the Fed’s Senior Loan Officer Opinion (SLOOS) survey for 4Q22 (released February 6) showed banks tightening credit.

Here’s that chart:

This was before the March bank crisis, so the Fed and markets will watch very closely on the next SLOOS report to see what impact the bank crisis and overall recession outlook the banks may have.

This report may come out about a week after the Fed’s May 3 meeting, but they’ll likely have it by then to inform their views.

Below is Howard’s full post previewing the Fed’s May 3 meeting.

The takeaway: Fed likely to hike 25 basis points May 3, then pause.

But as the Fed itself would say, they’re data dependent.

Check back next Friday for our update on Core PCE, the Fed’s preferred inflation measure.

The gas station robberies are over.

___

Reference:

– Fed tilts toward rate hike, with a possible pause in view as lending slows