S&P: Sept Home Prices Down 1.5% vs 2009. Prices At Mid-2003 Levels. (20 CITY TABLE)

The S&P Case Shiller September 2010 report of existing home sales showed average U.S. home prices declined 1.5% from 3Q2009 to 3Q2010. This is the fourth consecutive month of weaker data, which reflects sustained foreclosure volumes, high unemployment, and the drop off in activity following the federal homebuyer tax credit expiration. While housing prices are still above their spring 2009 lows, average home prices across the U.S. are at similar levels to what they were in the middle of 2003. Full press release below.

Case Shiller September 2010 Home Price Results

The index tracks existing single family homes, and is a credible pricing barometer for broad market analysis because it excludes condos and new construction. Condos can have more volatile pricing, and new construction pricing can be artificially set by builders, especially in times of distress when discounts an incentives can skew pricing. S&P refers to 10 and 20 “City” Composites, but these are actually metropolitan regional areas, not just cities. For example, where the city says San Francisco, this isn’t just San Francisco, but rather 5 counties in the Bay Area region (see page 9 of this PDF): Alameda, Contra Costa, Marin, San Francisco, San Mateo.

FULL TEXT FROM PRESS RELEASE

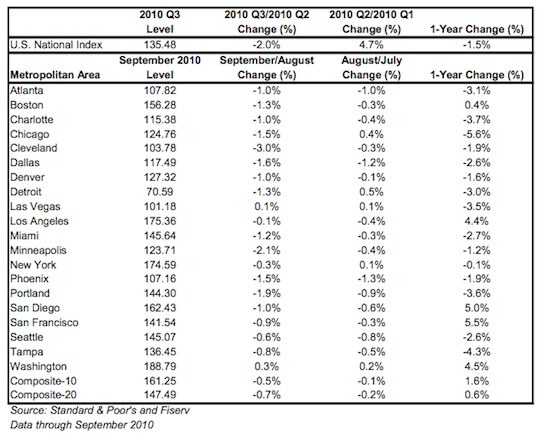

Data through September 2010, released today by Standard & Poor’s for its S&P/Case-Shiller Home Price Indices, the leading measure of U.S. home prices, show that the U.S. National Home Price Index declined 2.0% in the third quarter of 2010, after having risen 4.7% in the second quarter. Nationally, home prices are 1.5% below their year-earlier levels. In September, 18 of the 20 MSAs covered by S&P/Case-Shiller Home Price Indices and both monthly composites were down; and only the two composites and five MSAs showed year-over-year gains. While housing prices are still above their spring 2009 lows, the end of the tax incentives and still active foreclosures appear to be weighing down the market.

The chart above depicts the annual returns of the U.S. National, the 10-City Composite and the 20-City Composite Home Price Indices. The S&P/Case-Shiller U.S. National Home Price Index, which covers all nine U.S. census divisions, recorded a 1.5% decline in the third quarter of 2010 over the third quarter of 2009. In September, the 10-City and 20-City Composites recorded annual returns of +1.6% and +0.6%, respectively. These two indices are reported at a monthly frequency and September was the fourth consecutive month where the annual growth rates moderated from their prior month’s pace, confirming a clear deceleration in home price returns. The 10-City Composite posted a +1.6% annual growth rate in September, versus the +5.4% reported four months prior in May, and the 20-City Composite was up 0.6%, versus its +4.6% May print.

“Another weak report; weaker than last month. The national index is down 1.5% from the third quarter of last year and 15 of 20 cities are down over the last 12 months. Other than Tampa, FL, there are no new lows this month but many analysts will argue that a double dip will be confirmed before Spring. While some of the bad numbers may reflect the end of the government’s tax incentive for first time home- buyers, there are other problems weighing on the housing market.” says David M. Blitzer, Chairman of the Index Committee at Standard & Poor’s. “The national economy is certainly the number one issue for housing. Additionally, there is a large supply of houses on the market and further, hidden, supply due to delinquent mortgages, pending foreclosures or vacant homes. New construction is running at less than half the pace needed to meet normal demand, so a sustained recovery could be a ways off.”

“Looking deeper into the data, in the monthly indices, 18 MSAs and both Composites were down in September over August. This is worse than August when 15 were down month-to-month. The only two which weren’t down in September were Las Vegas, which managed to stay a touch above the low set in July, and Washington DC. Overall, there are few, if any, good numbers in this month’s data.”

The chart above shows the index levels for the U.S. National Home Price Index, as well as its annual returns. As of the third quarter of 2010, average home prices across the United States are at similar levels to what they were in the middle of 2003. The 2010 third quarter values fell by 2.0% over the second quarter, with a corresponding annual rate of return of -1.5%. Since its 2009 Q1 trough, nationally home prices have only grown by +4.9%.

From their peak in June/July of 2006 through the trough in April 2009, the 10-City Composite is down 33.5% and the 20-City Composite is down 32.6%. Through September, they have recovered by +7.2% and +5.9%, respectively. The peak-to-date figures through September 2010 are -28.7% and -28.6%, respectively.

Both the 10-City and 20-City Composites saw slower annual growth. The 10-City Composite was up 1.6% in September, versus +2.5% in August, and the 20-City Composite was up 0.6% in September, versus August’s +1.7%.

Looking at the monthly statistics, both the 10-City and 20-City Composite were down in September over August, by -0.5% and -0.7%, respectively. Eighteen of the 20 metro areas declined in September compared to August – Las Vegas was up 0.1% and Washington DC was up 0.3%. Washington has shown the most resilience against the recent contraction. It has been up for six consecutive months, beginning in April. Thirteen of the MSAs were down by 1.0% or more in September, with Cleveland posting the largest decline of 3.0%.