Bernanke’s Options

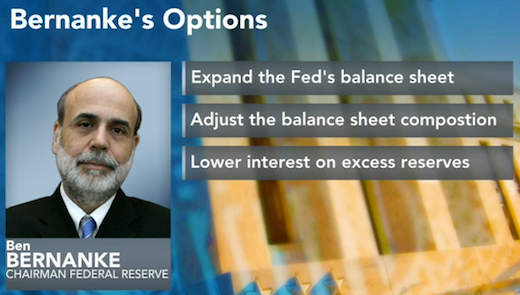

Brace yourselves for a wild rate day tomorrow: hurricane Irene, 2QGDP round 2, Bernanke’s justification for the last FOMC statement. Rates subsequently dropped as though QE3 was here, but it’s not.

Everyone’s looking for clues from The Fed King’s Speech tomorrow, so I’ll throw my hat into the ring: The last FOMC statement said the Fed would “review the size and composition of securities holdings and is prepared to adjust those holdings,” so I’m listening for whether this will be expanded to include explicit mention of mortgage bonds. QE1 was mortgage bonds, QE2 was Treasuries, and refinancing activity this year has lowered the Fed’s MBS positions, which leaves the MBS QE door ajar.