Buffett, Shiller, Ritholtz, McBride on Housing

Here are a few current thoughts on housing that are useful. I’ve added in some links to reference data being discussed.

ROBERT SHILLER: CASE SHILLER HOME PRICE INDEX CO-CREATOR

-These comments paraphrased from full Bloomberg video below.

-Homebuyers in wait-and-see mode. Buyers are optimistic over the long run. But they’re not optimistic just yet, they don’t see any urgency.

-[Can increase in home sales stop home prices from falling?] I’m not a very good forecaster. I don’t do that any more. But momentum matters in the market. Momentum is down for five years now. There are signs of recovery but we don’t see them in home prices yet. We may see a pick up in the coming months, but I wouldn’t bet on it.

-The homebuilders confidence index is showing nice improvement but it’s still low.

-[Will a foreclosure-to-rental program help?] When houses become rentals, that increases housing supply, so demand goes down as potential buyers rent instead. On the other hand, it may improve overall confidence, stabilize neighborhoods.

BARRY RITHOLTZ: CEO of FUSION IQ and THE BIG PICTURE BLOG AUTHOR

-BNN TV interview comments below, full video here

-The countrysides are just littered with the bodies of economists who’ve called housing bottoms.

-If everything goes just right, we could hope to scrape along the bottom for a couple more years. If things go bad, if we tip into another recession, if we see an uptick in unemployment, another leg down in housing over the next two to three years is not unthinkable.

-We’re fairly close to fair value—off about 33-35% from the peak. The problem is when you have these big booms/bubbles, you tend to over-correct to the downside. This might actually be the very first case where a bubble pops in credit, and the asset vehicle of choice merely reverts to fair value. It’s not the bet I want to make.

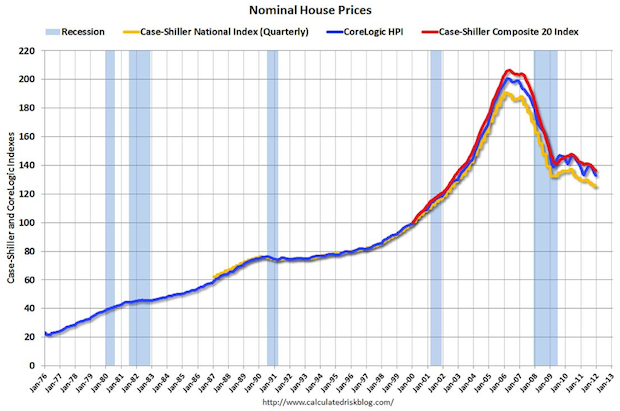

BILL MCBRIDE: CALCULATED RISK BLOG AUTHOR

-Comment/chart below from full post here which has good price-to-rent analysis too

-In nominal terms [meaning not adjusted for inflation], the Case-Shiller National index (seasonally-adjusted) is back to Q3 2002 levels, the Case-Shiller Composite 20 Index (seasonally adjusted) is back to January 2003 levels, and the CoreLogic index is back to February 2003.

WARREN BUFFET: CEO BERKSHIRE HATHAWAY

-Comment below from annual shareholder letter 2/25/2011

-Housing will come back – you can be sure of that… Every day, we are creating more households than housing units. People may postpone hitching up during uncertain times, but eventually hormones take over… Fortunately, demographics and our market system will restore the needed balance…

___

And Here’s My Comments:

Looking For Housing Deals? Then Look Past Case Shiller Data.