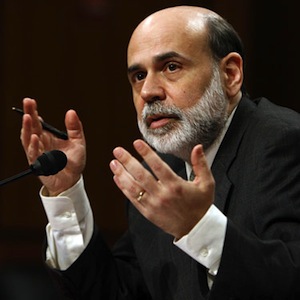

What Bernanke Should Say

Today’s FOMC statement wasn’t much of a change from the last one: economic growth is slightly better but questionable, and the Fed will keep overnight bank-to-bank rates near zero for at least another year.

Today’s FOMC statement wasn’t much of a change from the last one: economic growth is slightly better but questionable, and the Fed will keep overnight bank-to-bank rates near zero for at least another year.

At his 11:15 PT press conference today, it would be great if Bernanke simply said “What the hell do you want me to do when the fiscal side of the economy is running $1.4 trillion deficits for the past three years” and walked off the podium.

The fact is that the Fed has interest rates near zero and is monetizing about 60% of the deficit. This takes away the Fed’s discretion to manage the money supply.

After the FOMC announcement, mortgage bonds are down slightly which add to yesterday’s losses and push rates up slightly.

Here’s a rundown of today’s stats.

Mortgage Applications (week ended 4/20/2012)

-Composite Index, Week/Week -3.8%

-Purchase Index, Week/Week +2.7%

-Refinance Index, Week/Week -5.6%

Durable Goods Orders (March 2012)

-New Orders, Month/Month -4.2%, biggest decline in 2yrs

-Ex-transportation, Month/Month -1.1%

-This was a broad based decline and most certainly is not indicative of economic growth.