Why Holidays Are Best Time To Buy A Home

Of the 150 or so deals my team does each year, my favorites are when appraisals come in higher than purchase prices, or when sellers renegotiate during escrow periods to lower prices or issue credits to buyers.

The favorable appraised value scenarios are more common in a hot market like we’ve had this year in San Francisco. This median price chart tells that story. And it’s worth noting that I’m showing median rather than average price. If you use average price, the higher priced San Francisco homes increase the current $815k data point you see below to $1.1m.

But sellers renegotiating for lower prices or issuing buyer credits are less common scenarios in a seller’s market. I wouldn’t quite call any market in the U.S. a seller’s market just yet, but when inventory is light and distressed sales are dwindling, sellers do have more negotiating power this year than they’ve had since the U.S. home price slide picked up steam in 2007.

That’s why the holidays are the best time to buy a home in markets that are recovering already. Sellers justifiably don’t have full confidence post-crisis, and most buyers pause on their home searches during the holidays.

Case in point: Even in our hot San Francisco market where almost all houses and condos receive multiple offers from competing buyers, my team has already had three buyer clients get into contract to buy homes for less than asking price since the day before Thanksgiving.

Inventory mix and pricing are obviously different in every local market, but the holiday timing does work in buyers’ favor. So talk to your realtor and lender to see if this approach is relevant for conditions in your market. If it’s anything like San Francisco, waiting for the new year or even the so-called ‘Spring homebuying season’ will likely lead to paying a higher price in the new year than you would today.

++++

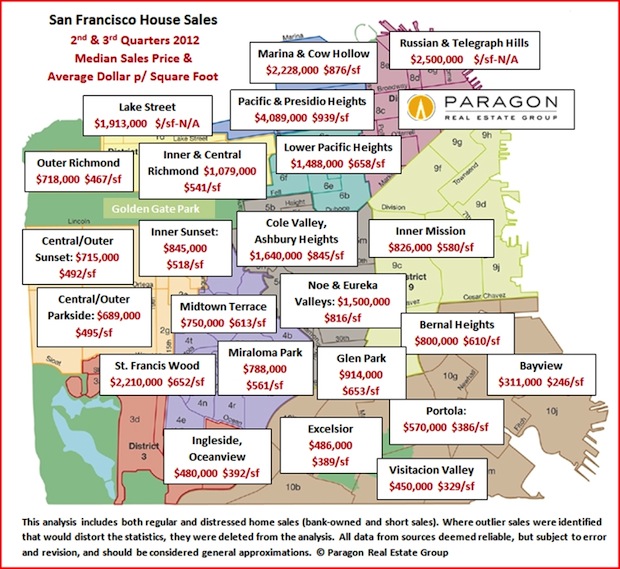

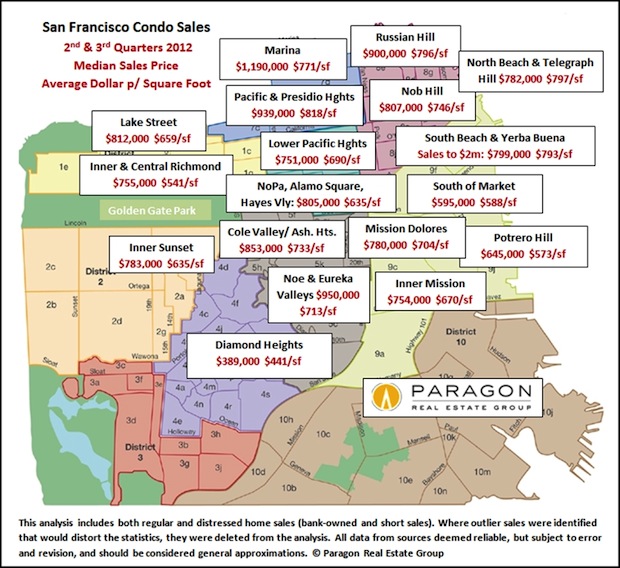

And back to San Francisco for a moment… if you’re home searching in the city, below are some current and useful pricing maps. The link at bottom has more.

___

Data Source, used with permission:

– Paragon Real Estate Group (click here for more charts)