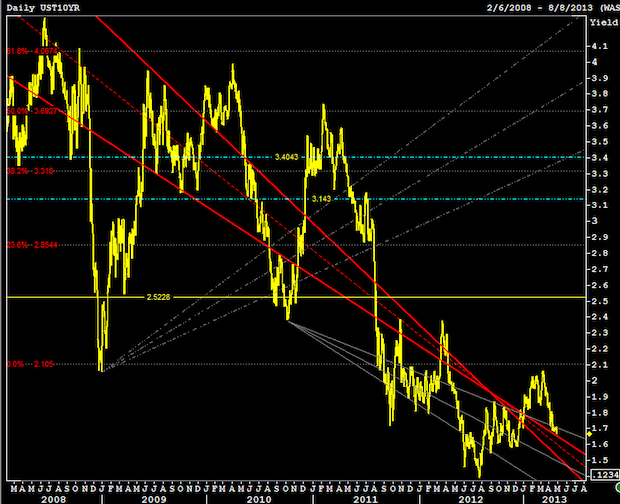

False Start for 10yr Note?

Important notes from Adam Quinones at Reuters on whether this month’s rally in the 10yr Note (and corresponding rate dip) is real. Follow him at @AQ_MND…

Two months ago benchmark yields were teetering on a duration ledge. Now rates have rallied to 2013 lows and production TBAs are back in 2012 territory? How quickly things change. The market has seen this behavior before though. Remember 2009, 2010, 2011 and 2012? I describe it as a “false start”. Stocks on steroids come together with a streak of better than expected economic data. Government initiatives pad consumer balance sheets. Inflation starts to heat up and everyone speculates on an early Fed exit. Rates jump. Then an unexpected headline triggers chaos. We soon realize inflation was entirely cost-push (Fed needs demand-pull) and economic growth proves unsustainable. Stagnate outlooks eventually resurface and the Fed extends QE. Rates drop. Kick the can. Chase the can. Kick the can. Chase the can. Sound familiar? History is beginning to repeat itself. AGAIN! Talk of an early Fed exit is already evolving back toward “long road ahead” reality. All eyes on Ben Bernanke ‘til Wednesday then focus shifts to monthly jobs data on Friday. Waiting for confirmation of another “false start”. Energy has been stored. Positions have flattened out. Everyone is bored. Perfect recipe for a directional run.

Call me cynical. Have been looking at this chart for almost 4 years now…