8 Things You Need To Know About How Banks & Lenders Sell To You

Nobody wants to be sold to, but everybody wants to buy. This is true whether reminding a store employee you’re “just looking” or buying a home in the largest transaction of your life.

To win, you must know when and how you’re being sold to, especially when it comes to finance. Last week we were ground zero at HousingWire’s 2019 Engage.Marketing conference, one of the banking and real estate industry’s top marketing summits, and below are 8 key takeaways about how banks and lenders sell the American Dream of homeownership to you.

+++

1. Banks will use one product to win you for life.

Lenders and realtors are realizing the one product model doesn’t serve you properly over your financial life. It costs them too much to find new customers all the time, so they want to win you once then keep you happy for life. After a smart lender does your mortgage, they’ll optimize your budget with refis when rates drop, talk to you about student loan consolidation, and offer investing and saving ideas so maybe your kids don’t have to get student loans.

“Organizations crave mass customer acquisition, but the most lifetime value a customer adds is AFTER the initial transaction. My grandmother has had the same checking account since 1942. Think of that lifetime value add,” said Joe Welu, CEO of Total Expert, a startup that helps lenders market to you in ways that actually matter to you.

Remember this: whatever financial product you’re shopping for right now, see if the bank or lender also offers other products you might need later.

+++

2. Winning you means making you a “super-fan.”

Brittany Hodak shared a story about how someone turned her into a super-fan. Her husband is a rabid University of Michigan football fan, and he wanted Michigan coach Jim Harbaugh to come to Hodak’s gender reveal party when she was pregnant. Harbaugh couldn’t come, but wrote the Hodaks a handwritten note offering the baby a scholarship 18 years from now.

A quick note from one of the busiest people in the world turned Hodak into a super-fan for life.

“The best marketing doesn’t cost money,” Hodak said. “You can’t buy superfans. You can’t pay someone to love you.”

The best lenders and realtors are getting better at making you a super-fan by adding human touch in this digital era.

+++

3. Lenders want to be Facebook friends, but they have rules to follow.

If any of your friends are loan officers, it’s all over their social media. They must follow strict regulations on what they can say on social media and how they can say it, so if you end up having specific questions, be prepared for them to ask to engage with you directly. They can’t get too specific on social.

Also you should look out for proper disclosures on your banker and lender’s social accounts. If they talk shop on social, they’re required to put their license numbers on their social account profiles. So look out for NMLS IDs or other indicators on individual’s pages that are posting about business a lot. And of course brand-level social accounts have a different, less personal voice so you know you’re being sold to in these cases.

+++

4. Video now rules social. Which videos resonate with you?

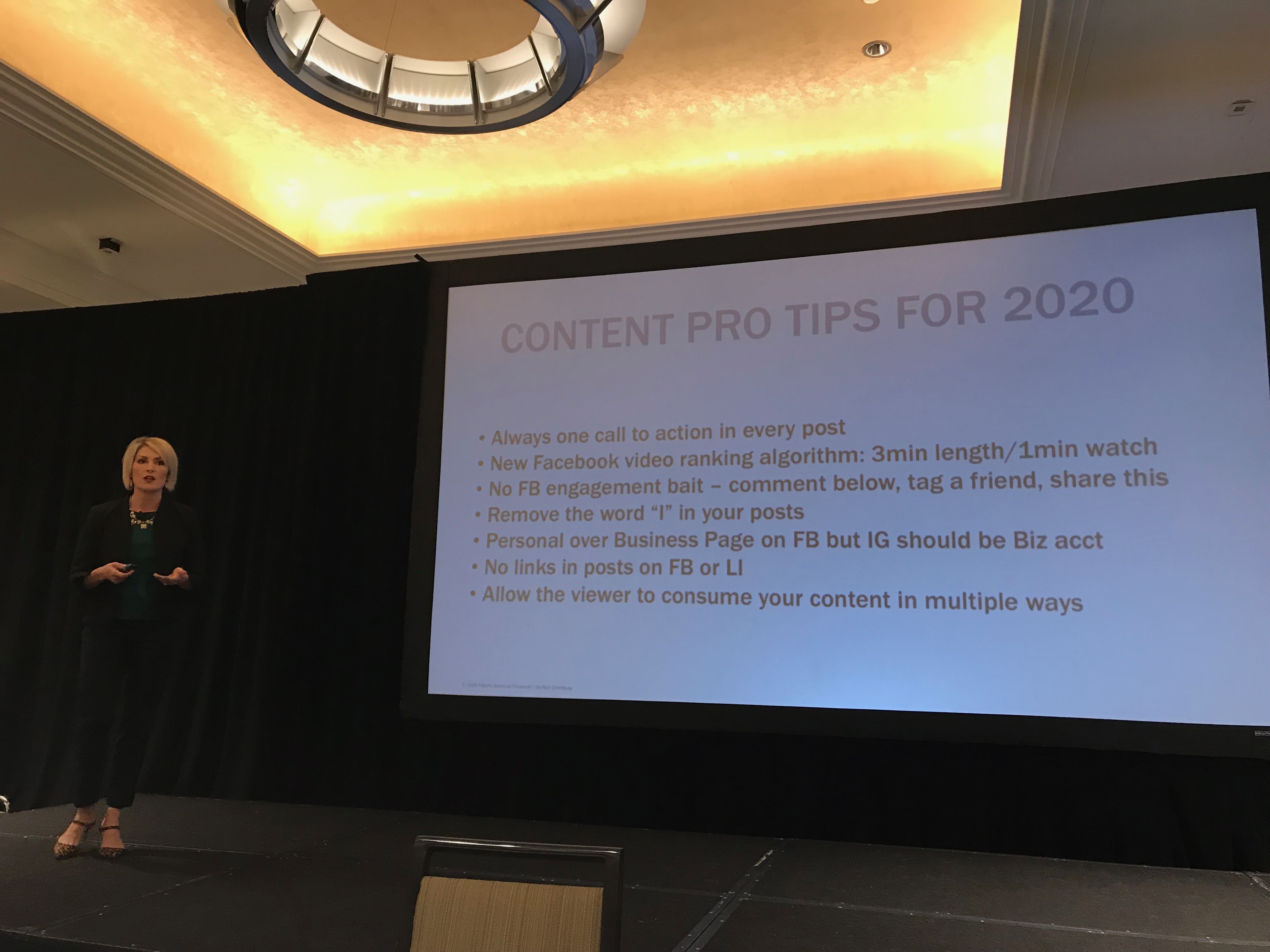

The current Facebook algorithm loves long videos. Expect to see more 3+ minute videos by every brand and individual banker/lender under the sun. Will banks and realtors find their voice?

Most industry folks think individual loan officers and real estate agents will win the video game over big brands. We think it’ll be a mix—big brands can be more creative than some give them credit for.

What type of videos are resonating with you on social right now? Let us know!

+++

5. Loan officers & real estate agents will be your most active social friends.

Facebook’s algorithm loves engagement. When posters chime in on others’ content with insightful commentary, Facebook starts to think you’re friends. So you’ll see your local loan officers and real estate agents start commenting more and more on your posts, and then Facebook will start to show you their content in your feed.

This is good because when it’s finally time for you to start mortgage hunting, that friendly neighborhood lender or realtor will be right in your Facebook feed. If they’re good, their content will make you want to engage with them when you’re ready for serious questions about your situation.

+++

6. Bank marketing will get more relevant. No, seriously!

Just yesterday, Spencer got an email from his bank saying he should take out student loans with them. Yes, this is the same bank who’s been sending his monthly student loan statements to him for years. This is absurd and happens to all of us still to this day.

Alex Kutsishin, CEO of Sales Boomerang, talks to lenders about thinking like a farmer and you the customer are the corn. He joked: “Yes, I just called your borrowers corn.”

But he’s right. Banks and lenders need to know how you’re growing and how your needs are changing so they can deliver the right message to you based on your needs at a specific time. Financial marketers call this nuturing.

They have a lot of data on you and your life and your family that you consent to give them when you apply for a loan or a bank or investment account. If you also consent for them to use this data for the future, they are getting better at reaching out to you exactly when you need it:

– If rates drop they’ll lower your existing mortgage rate.

– If you have a kid they’ll offer you a cheap loan to remodel a room, or show you listings for a bigger home you can afford in your neighborhood, or talk to you about college savings plans.

Total Expert is all over this, and will lead the way in helping banks hit you with relevant offers.

+++

7. Marketers finally get that not every homebuyer is a straight white man.

Homebuyers are increasingly diverse, but a lot of mortgage advertising sells the lily-white suburbs and minivan.

“Single women are buying homes like crazy, but if all your marketing is a husband and wife and golden retriever buying homes, that’s not connecting with that audience,” said Keosha Burns, a marketer at Chase.

She’s right and it’s great to see one of the biggest banks in the U.S. understand this.

+++

8. Education is equally important as a good deal.

Home buying, selling, and financing is complicated, and the best lenders and realtors are finally getting good at making this simple for you.

“Millennial homebuyers are looking for education. There are so many acronyms in this industry,” said Jim Anderson, CMO of Stearns Lending. “You need to have the educational material. The top search terms are how much home you can afford and how a home fits into financial plans.”

The good part about social media is that lenders must be more human (instead of technical) when talking about home buying, selling, and financing concepts, and you’ll start to see this more from your bankers soon (per #6 above).

The technology is getting smarter at educating you, but in finance, most of you still need and want human advice, and the best technology being deployed within financial firms helps them super-power their human advisors to deliver education to you more easily.

+++

More to come on these topics, and below is more reading. Please hit us with questions.

___

Reference:

– The Basis Point’s HousingWire Engage Liveblog 2019 – Day 1

– The Basis Point’s HousingWire Engage Liveblog 2019 – Day 2

– More posts on Money and Homes.