Rates near records as ADP Jobs and ISM Manufacturing disappoint (CHARTS)

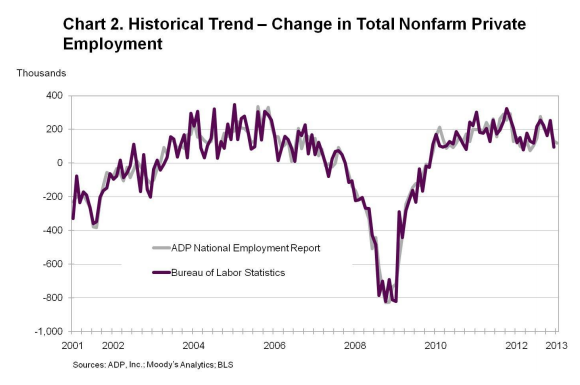

Below is a summary of today’s jobs and manufacturing data. Generally weaker. Rates holding near record lows ahead of Fed meeting.

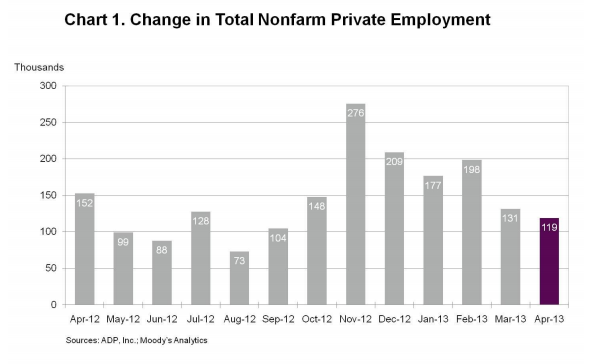

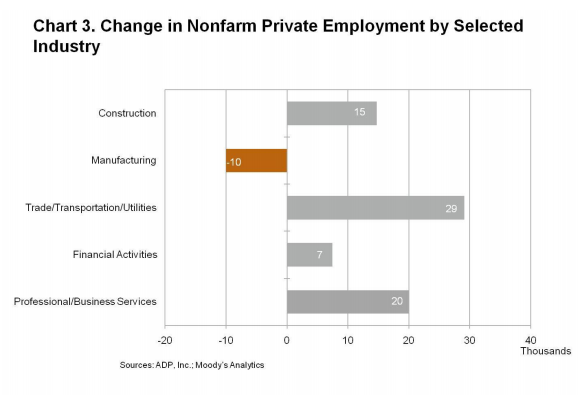

ADP Private Jobs (April 2013)

– ADP Employment +119,000. Previous revised from 158,000 to 131,000.

– With the revision to March private jobs were really +92,000. This is weak and a bad omen for Friday’s BLS Employment Situation Report which was weak last month. With the revision to March private jobs are really +92,000. From the reaction of the markets (equity and Treasury) this would indicate that participants expected an improvement in jobs and got the opposite.

– Full Report with more charts/tables (beyond the ones below)

MBA Mortgage Applications (week ended 4/26/2013)

– Purchase Index Week/Week -1.4%. Previous was +0.3%.

-Refinance Index Week/Week +3.0%. Previous was +0.3%.

-Composite Index Week/Week +1.8%. Previous was +0.2%.

– The Refinance Index rises when rates drop. The Purchase Index is a better macroeconomic indicator and could indicate a slowing in home buying. I would not read too much into any one week.

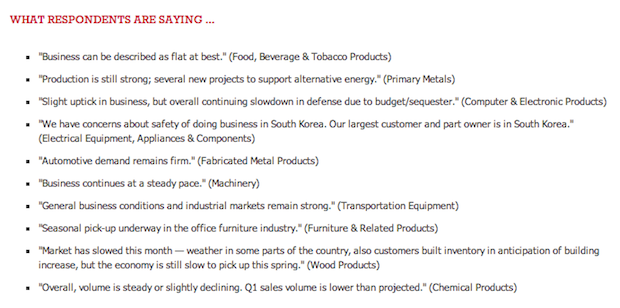

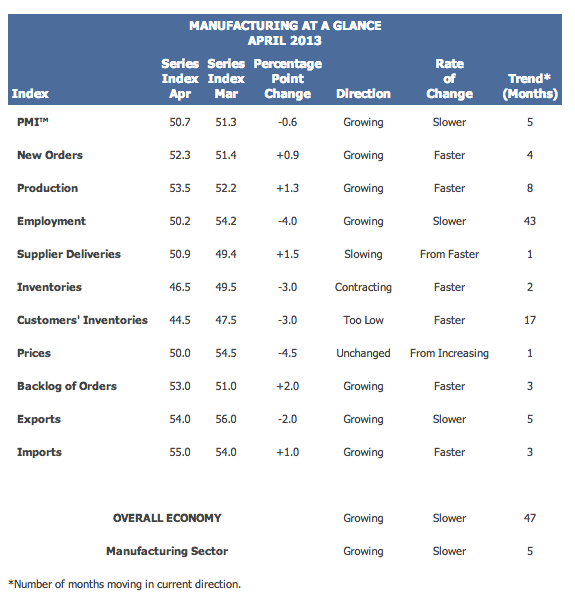

ISM Manufacturing Index (April 2013)

– Index Level 50.7. Previous was 51.3.

– This shows slow growth at best. 50 is dividing line between expansion and contraction.

– This is a survey index, below are some responses and a full data summary

– And here’s the full report