Who wins & loses in FDIC’s First Republic seizure, sale to 1 of 5 big banks?

First Republic is loved by customers and competing banks. Eleven top banks don’t just deposit $30 billion to help if they don’t see future potential. For now 4 of these banks — PNC, US Bank, BofA, JP Morgan (plus Citizens) — may bid to buy First Republic in an auction the FDIC is conducting now. But will the FDIC insurance fund lose most? And who wins most with a First Republic sale? Let’s take a look.

FDIC SEIZING FIRST REPUBLIC

Reuters first reported FDIC seizure of First Republic was imminent, then that the FDIC was running the auction.

If this happens to the $232 billion asset bank, it would be the second biggest bank failure in U.S. history.

By comparison, Silicon Valley Bank (SVB), a firm that banked similarly sophisticated consumers and businesses, had $209 billion in assets when it failed.

This resulted in a $20 billion hit to FDIC’s deposit insurance fund. Per FT, this made…

“…SVB the most costly failure in the history of the U.S. insurance deposit fund, which was started 1933, eclipsing the $12 billion loss it took on the failure of IndyMac at the start of the financial crisis.”

Bloomberg reports the FDIC “is already planning to impose a special assessment on the industry to cover the cost of SVB and Signature Bank’s failures.”

Bloomberg also reports that the FDIC has asked banks including PNC, US Bank, Citizens, BofA, and JP Morgan for bids to buy First Republic as soon as Sunday.

These bids must come with estimated hits to the FDIC insurance fund.

This comes after weeks of talks about First Republic rescue scenarios.

These talks between regulators and banks have been happening since a First Republic bank run began in March — and resulted in $102 billion of deposit outflows as of March 31.

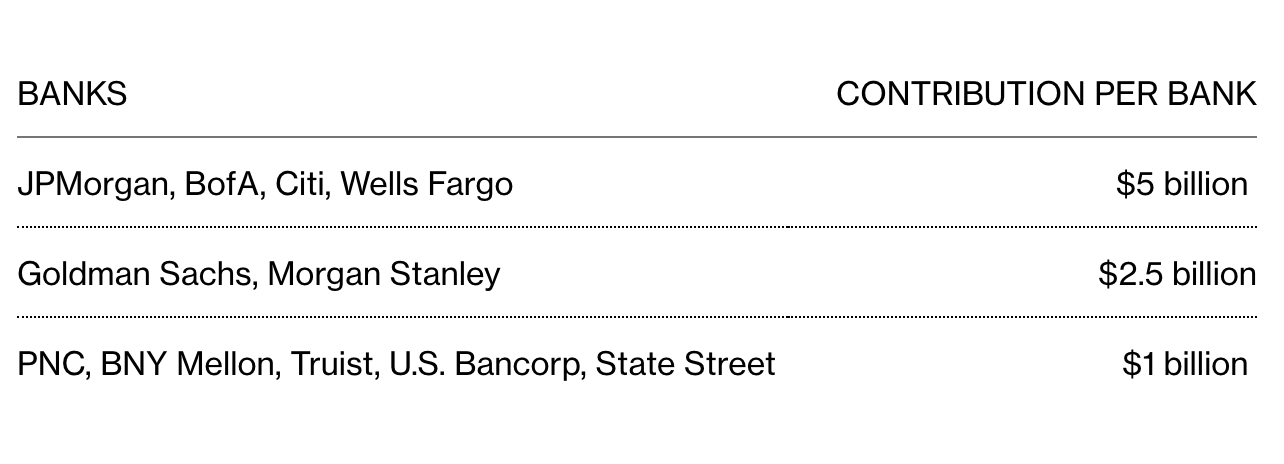

On March 16, 4 of today’s bidding banks were among 11 big banks that deposited $30 billion to help replenish the bank run.

Here’s who contributed and how much:

– $5b, JP Morgan

– $5b, Bank of America

– $5b, Citibank

– $5b, Wells Fargo

– $2.5b, Goldman Sachs

– $2.5b, Morgan Stanley

– $1b, PNC Financial

– $1b, Bank of New York Mellon

– $1b, Truist

– $1b, U.S. Bank

– $1b, State Street

– $30b, TOTAL

This was to stem broader contagion, which was spreading at the time.

It was also because other banks appreciate First Republic almost as much as customers do, and they saw long-term value if First Republic couldn’t weather short-term strain.

FDIC WOULD SELL FIRST REPUBLIC ANYWAY

As of now, short-term strain prevails.

First Republic had $176 billion in deposits as of December 31. This dropped $102 billion to $74 billion as of March 31, which they reported April 24.

The $74b in First Republic deposits doesn’t include $30 billion that 11 big banks deposited in a coordinated March relief effort with regulators.

Until the decisive auction this weekend, it’s been a game of chicken between regulators and potential acquiring banks.

Even though JP Morgan is a potential buyer, they already have 10% of all U.S. deposits. This makes them too big and ineligible unless regulators made an exception.

But PNC, Citizens, US Bank, and BofA are all strong bidders.

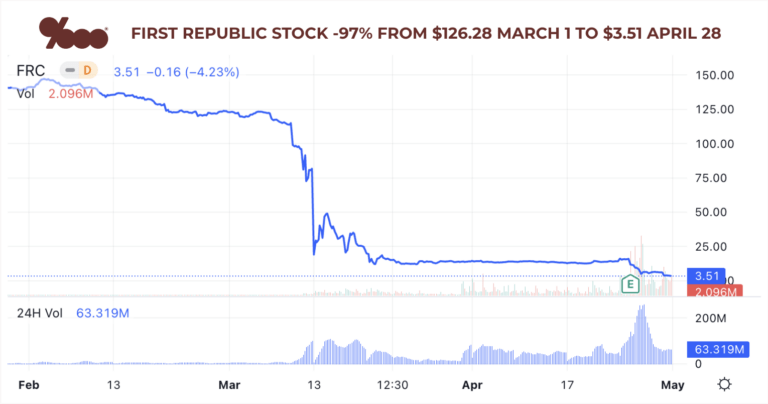

After First Republic stock dropped 97% to $3.51, their market cap is $653 million.

So part of acquiring banks’ hesitation until now is their obligation to their own shareholders to wait for the best deal.

And the deal happens now: a concurrent seizure and sale may be done before Asian markets open Monday.

For 2 huge March bank failures, the FDIC sold SVB to First Citizens and sold Signature to NYCB’s Flagstar unit.

FIRST REPUBLIC SALE WINNERS & LOSERS

By waiting, PNC, US Bank, Citizens, BofA, JP Morgan, or another acquiring bank gets a better deal.

With FDIC seizure, existing First Republic shareholders will likely be wiped out.

Also, when the FDIC markets a seized bank, they’ll typically concede to taking downside risk.

On the flip side, the FDIC can get equity and other benefits in the acquiring institution.

As noted above, bank failures this big hit the FDIC insurance fund hard, but it’s funded by the banks.

The bigger the bank, the bigger the contributions they have to make to the FDIC insurance fund.

So, from an acquiring bank’s perspective (especially if it’s 1 of the bidders noted above), they’re going to pay one way or another.

Their calculus all along may have been: wait until it’s seized, then buy it.

That’s the harshness of open markets and short-term liquidity issues in this real-time bank run era.

But I hope an acquirer would run First Republic as a separate brand.

It’s a loved brand in a typically unloved sector.

That’s rare and special, and I hope the First Republic brand lives on.

___

Reference:

– Bloomberg, WSJ, Reuters on bids from 5 big banks

– First Republic 1Q23 Earnings Report

– How much of $30b did each of 11 big banks deposit into First Republic

– What FDIC got & conceded to when selling SVB and Signature Bank

– Some First Republic long-game strengths before crisis hit

– First Republic has sold before: key dates & details