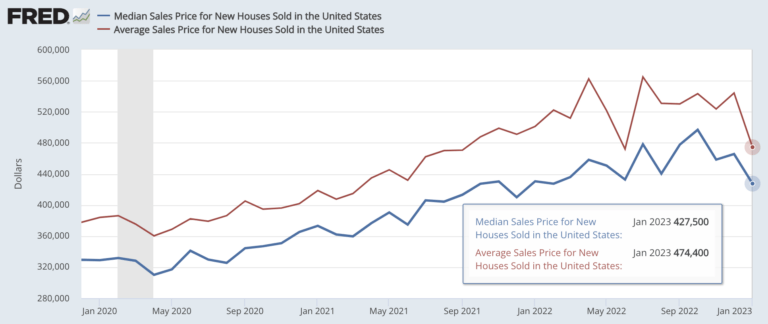

Feb 2023 prices on newly built homes down 14% to $427,500. Can you afford this?

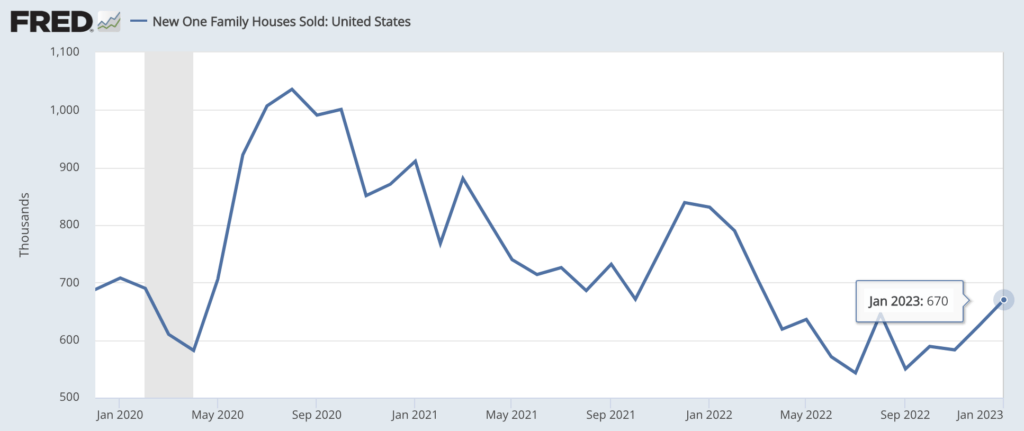

The latest Census/HUD report shows 670,000 new homes sold in January, up 7.2% from December but down 19.4% from January 2022. More important to you as a buyer is that median new home prices (blue line in first chart above) are $427,500, down 14% from the October peak of $496,800.

BUILDERS CATERING TO BUYERS NOW

The other critical thing for you to note as a homebuyer is that builders want to make deals right now. As National Association of Homebuilders (NAHB) chief economist Robert Dietz noted earlier this month:

– 31% of builders reduced home prices in February

– The average price drop in February was 6%

– 57% of builders offered some kind of incentive in February

These incentives can be things like seller credits at closing and home upgrades.

It’s a good time for buyers to make deals with builders, but it’s also critical to note that these February homebuilder price cuts and incentives have decreased from December and November levels.

Builder confidence (as measured by NAHB) has grown the last 2 months, and the more confident builders get, the less incentives you’ll see.

NEW HOME PRICES 2023 & AFFORDABILITY

– New home sales account for about 13% of total home sales, and existing home sales are 87%.

– So what’s the difference in qualifying for a new home vs. an existing home?

– Let’s first look at new home affordability using the median new home price of $427,500.

– Monthly all-in cost on a $427,500 home purchase with 5% down and today’s worst case 7.125% rate would be $3544 (mortgage payment, insurance, taxes, mortgage insurance).

– If you had no other monthly debt, you’d need to make $99k* per year to qualify for this.

– If you had $600 in credit card, auto, and other monthly debt, you’d need to make $116k* per year to qualify.

– This is still reasonably affordable, especially if there are two household incomes qualifying.

– The median existing home price of an existing home right now is $359,000.

– The all-in monthly cost for a 5% down purchase at today’s worst case 7.125% rate on this price is $2993.

– To see what you need to make to qualify for this, see my other post that also covers why rates are suddenly 7% again.

– And remember: builders are entities who need to sell what they’ve built so they’re fully open to negotiation.

– So while existing homes from private sellers might show lower list prices, don’t shy away from newly built homes on price alone.

– Negotiate!

I’m putting links below with more on these topics.

Hit me with questions on new home prices and affordability.

___

Reference:

– Inflation fuels mortgage rate spike from 6% to 7% in Feb. What can you afford?

– New home sales rose to 670k in Jan, up 7.2% MoM but down 19.4% YoY

– *To arrive at these qualifying income numbers, I’m using 43% deb-to-income ratio that Federal regs allow for all mortgages of this size in America.