Rates Benefit Slightly From Weaker Jobs, Manufacturing

Today’s weaker U.S. jobs and manufacturing data is helping rates just a bit today—key MBS coupons that lenders use as benchmarks to price consumer rates are even to up slightly. Rates move inverse of MBS prices.

Jobless Claims (week ended 4/13/2013)

– New Claims (seasonally adjusted) 352,000. Previous was revised from 346,000 to 348,000.

– 4-week Moving Average 361,250. Previous was 358,500.

– New Claims (unadjusted) 354,973 down 1,269 from the previous week.

– Data approximating 350,000 is indicative of almost no growth in real (population adjusted) jobs

The underlying fact is that jobs have been offshored or automated are those are not coming back. The economic and social ramifications of this are significant.

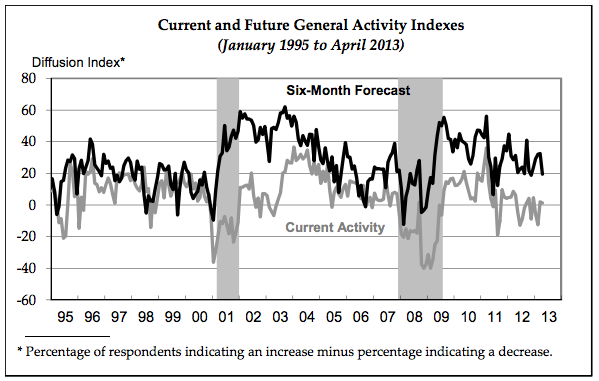

Philadelphia Fed Survey (April 2013)

– General Business Conditions Index 1.3. Previous was 2.0.

– Outlook is just barely positive: 0 is dividing line between expansion and contraction.

– This measures manufacturing activity in Eastern Pennsylvania, Southern New Jersey, Delaware

– Full report and chart below

Leading Indicators (March 2013)

– Leading Indicators Month/Month -0.1 %. February was +0.5%. January was -1.1%

LEI is a rehash of 10 data sets. Details here.

Economic fundamental today are flat. “Flat” will not support the continued runup in equity prices. Worse yet we are not adding jobs apart from what is needed to keep pace with population growth.