Gig economy incomes and jobs slowing. Will April job growth slow too?

The Fed cited still-too-hot inflation and job market as main rationale for hiking rates a 10th straight time this week. Here are those numbers:

– Headline CPI peaked 9% in June 2022, latest CPI 4.9% for March 2023.

– Core PCE peaked 5.2% in March 2022, latest Core PCE 4.6% for March 2023.

– Unemployment 3.5% in March 2023, near 50-year low.

On May 5 (tomorrow), we’ll get April jobs.

On May 10 (next Wednesday), we’ll get April CPI.

On May 26, we’ll get April Core PCE.

Ahead of tomorrow’s jobs report, there are two items worth noting.

First, ADP reports private employers added 296k new jobs in April.

Bill McBride at CalculatedRisk notes this is way above consensus estimates of 135k.

The consensus estimate for Friday’s April BLS jobs report is 178k.

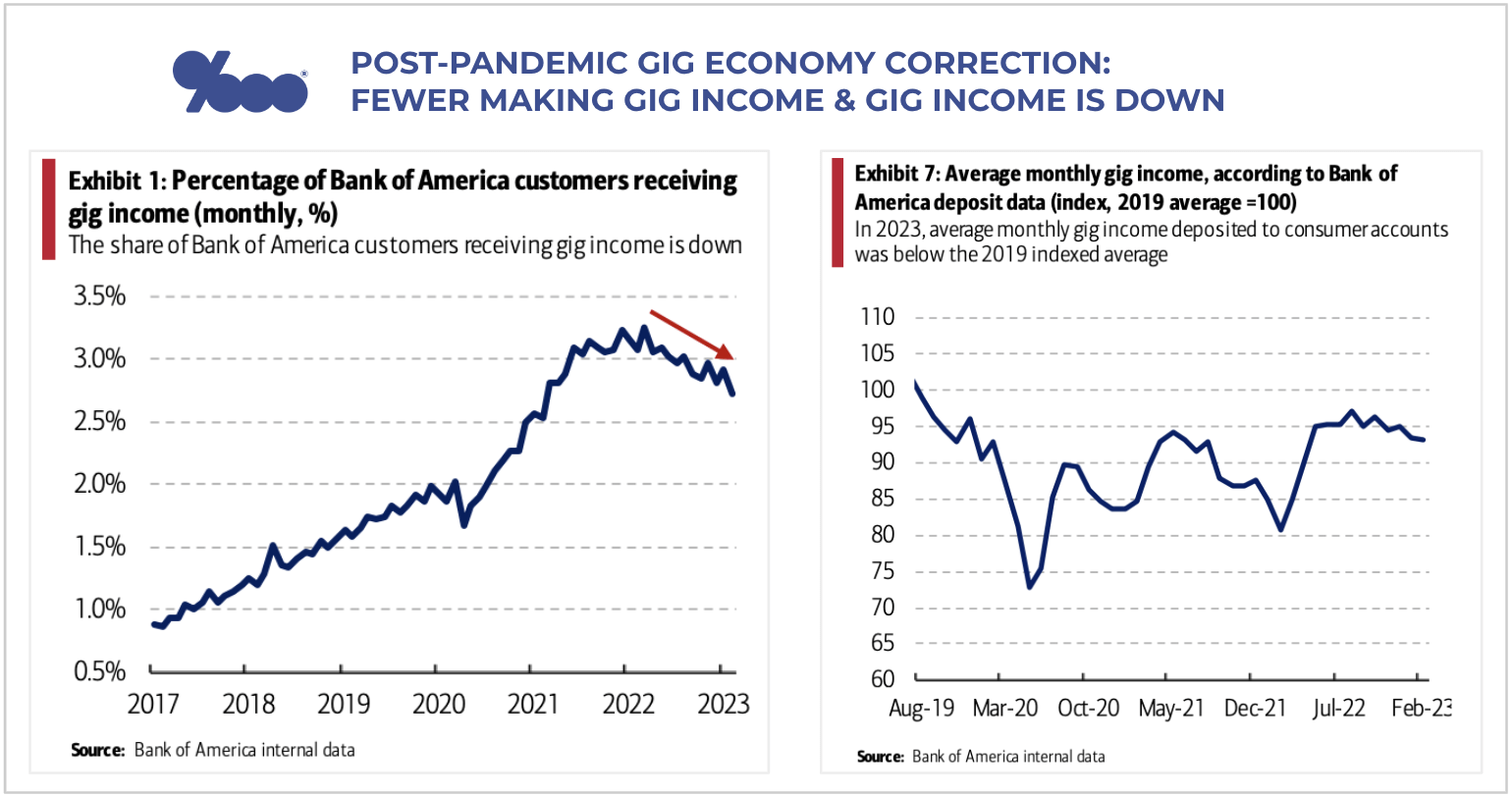

Second, here’s an interesting Bank of America report on gig workers seeing a slowdown.

These two charts show gig economy income is down and fewer people are making gig income in this post-pandemic period.

Will a slowing gig economy impact the April jobs report?

Likely not, but does impact people’s incomes, which are dropping for gig workers.

This hits affordability more subtly than loud reports like Friday’s jobs report.

The full BofA report and other reference links are below.

___

Reference:

– BofA research shows gig economy may have peaked

– Are we within 3 months of CPI dropping enough for Fed to chill out?

– Inflation peak & Fed hike recap. Worst is over.

– Recap of 10 straight Fed hikes totaling 5%