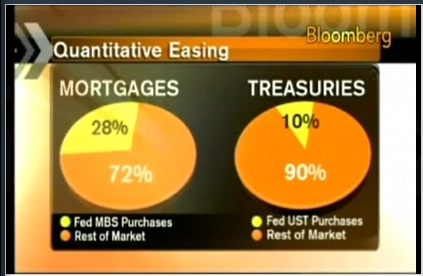

Gov’t Controls 28% of Mortgage Bond Market, 10% of Treasury Market

This is a telling graphic from Bloomberg today. The government (via the Fed) is buying 28% of all mortgage bonds, as which we discuss often on this site, is the reason mortgage rates are so low in 2009. The Fed is also buying 10% of all Treasuries which helps keeps the broader rate complex (beyond mortgages) low. This Fed participation in rate markets is known as ‘quantitative easing’. It’s different from controlling overnight Fed Funds and Discount Rates, which is the traditional method of rate manipulation on the Fed’s behalf.

This is a telling graphic from Bloomberg today. The government (via the Fed) is buying 28% of all mortgage bonds, as which we discuss often on this site, is the reason mortgage rates are so low in 2009. The Fed is also buying 10% of all Treasuries which helps keeps the broader rate complex (beyond mortgages) low. This Fed participation in rate markets is known as ‘quantitative easing’. It’s different from controlling overnight Fed Funds and Discount Rates, which is the traditional method of rate manipulation on the Fed’s behalf.