Housing & Lender Market Share Stats: Bay Area, California

Below is a highlight of some key Bay Area home market stats for September from Dataquick. My firm, RPM Mortgage, is in the number two lender market share slot behind Wells Fargo and ahead of Bank of America for the Bay Area.

Full Bay Area and California reports also linked below.

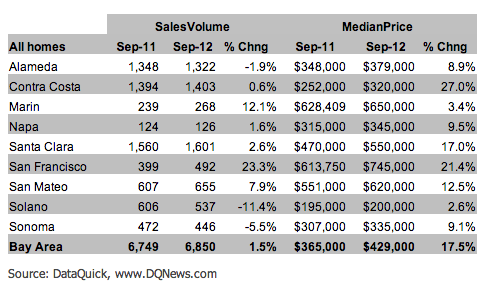

– September median price rose to $429,000, up 4.6% percent from August and up 17.5% from $365,000 September 2010. This was the highest since August 2008 when it was $447,000.

– The low point of this cycle was $290,000 in March 2009, and the peak was $665,000 in June/July 2007.

– Foreclosure resales are at half the level of a year ago.

– The number of homes that sold last month for less than $500,000 fell by 12.4% percent year-over-year, and sales above that threshold increased 20.7 percent.

– 6,850 new and resale homes were sold, down 20.2% from 8,579 in August, up 1.5% from 6,749 for September 2011.

-Jumbo loans above $417,000 accounted for 37.1% percent of last month’s purchase lending, down from a revised 38.8% in August, up from 32.1% a year ago.

– Jumbo usage dropped to 17.1% in January 2009. Before the credit crunch struck in August 2007, jumbos accounted for nearly 60% of the Bay Area purchase loan market.

– The most active lenders to Bay Area home buyers last month were Wells Fargo with 14.7% of the market, RPM Mortgage with 3.7% and Bank of America with 3.4%.

___

Reference:

– September Bay Area Median Highest In Four Years

– California Home Sales Stats for September