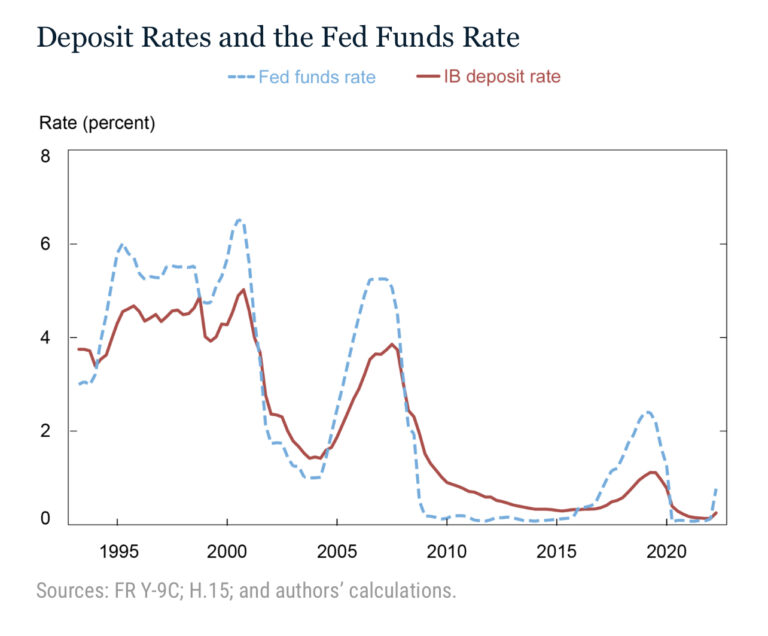

How slow or fast do banks pay more interest on $18 trillion in deposits as Fed hikes rates?

There are $18 trillion in U.S. bank deposits, and this is how banks get funded. But paying decent interest is also one way banks keep customers. When the Fed hikes overnight rates to slow inflation, this should help depositors see better rates paid to them on their deposits.

But the New York Fed notes that bank deposits are so high right now that banks might not be as keen on keeping deposit customers. Or at least might not be that impacted if customers seek out higher deposit rates elsewhere.

Here’s a briefing on how deposit rates have moved during this Fed cycle and how it might play out.

At $18t, U.S. bank deposits are critical for people’s savings and for bank funding. How do banks decide how much interest to pay?

___

Check It Out:

– How slow or fast do banks pay more interest on $18 trillion in deposits as Fed hikes rates?